2021 Ram 1500 Laramie on 2040-cars

Engine:HEMI 5.7L V8 Multi Displacement VVT

Fuel Type:Gasoline

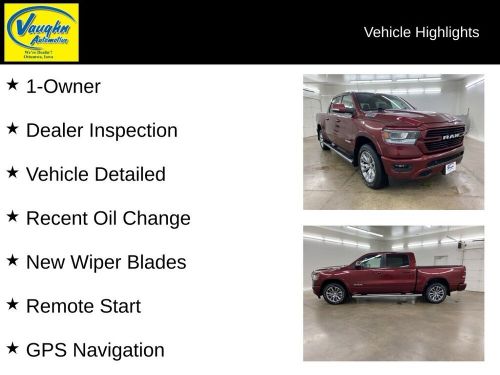

Body Type:4D Crew Cab

Transmission:Automatic

For Sale By:Dealer

VIN (Vehicle Identification Number): 1C6SRFJT6MN651692

Mileage: 21670

Make: Ram

Trim: Laramie

Features: --

Power Options: --

Exterior Color: Red

Interior Color: Black

Warranty: Unspecified

Model: 1500

Ram 1500 for Sale

2022 ram 1500 big horn/lone star(US $37,998.00)

2022 ram 1500 big horn/lone star(US $37,998.00) 2025 ram 1500 laramie(US $72,330.00)

2025 ram 1500 laramie(US $72,330.00) 2022 ram 1500 big horn crew cab 4x4 5'7 box(US $41,987.00)

2022 ram 1500 big horn crew cab 4x4 5'7 box(US $41,987.00) 2024 ram 1500 big horn/lone star(US $46,990.00)

2024 ram 1500 big horn/lone star(US $46,990.00) 2022 ram 1500 big horn quad cab 4x4 6'4" box(US $30,031.00)

2022 ram 1500 big horn quad cab 4x4 6'4" box(US $30,031.00) 2022 ram 1500 laramie crew cab 4x4 5'7" box(US $44,373.00)

2022 ram 1500 laramie crew cab 4x4 5'7" box(US $44,373.00)

Auto blog

Chrysler recalls 2013 Ram pickups, 2014 Jeep Grand Cherokee

Wed, 17 Jul 2013Chrysler's spate of successful products is about to be marred by a trio of recalls. The Pentastar is recalling 51,477 Ram trucks and Jeep SUVs. According to the National Highway Traffic Safety Administration, there have been no reported accidents, injuries or deaths related to the affected vehicles.

The largest action covers the Ram 1500, which is seeing 45,961 trucks being recalled. Models built between June 26, 2012 and February 5, 2013 are being recalled due to a potential software issue in the electronic stability control. Apparently, the system can be randomly deactivated upon vehicle startup.

Chrysler is also recalling 4,458 2014 Jeep Grand Cherokee models. Covering everything but the SRT models, the potentially defective SUVs were built between January 14 and March 20, 2013. This recall focuses on "premium headlights," which means cars equipped with LED running lights. During the switch from the bright daytime running lamp setting to the low-intensity parking light setting, an electrical spike can cause one of the Jeep's computers to go into a safe mode, turning off the LEDs. This violates Federal Motor Vehicle Safety Standards.

Stellantis reports surprising 2020 results, is 'off to a flying start'

Wed, Mar 3 2021MILAN — Low global car inventories and cost cuts should boost Stellantis's profit margins this year, though a shortage of semiconductors and investments in electric vehicles could weigh on results, the newly-formed automaker said on Wednesday. The forecast came as Stellantis, created by the January merger of Peugeot-maker PSA and Fiat Chrysler (FCA), reported better-than-expected results for 2020 that sent its shares up around 3% in morning trading. "Stellantis gets off to a flying start and is fully focused on achieving the full promised synergies (from the merger)," Chief Executive Carlos Tavares said in a statement. Stellantis is the world's fourth largest carmaker, with 14 brands including Fiat, Peugeot, Opel, Jeep, Ram and Maserati. It said 2021 results should be helped by three new high-margin Jeep vehicles in North America and a strong pricing environment there. The U.S. market has driven profits for years at FCA and starts off as the strongest part of Stellantis. The group's guidance assumes no more significant lockdowns caused by the global COVID-19 pandemic, which shuttered auto plants around the world last spring. Stellantis should also get a lift as its starts to implement a plan aimed at delivering over 5 billion euros a year in savings, without closing any plants. Tavares has also pledged not to cut jobs. But a pandemic-related global shortage of semiconductors, used for everything from maximizing engine fuel economy to driver-assistance features, could hurt business. Auto industry executives have said the shortage should ease by the second half of 2021. Stellantis said its "electrification offensive" could also weigh on results this year. Automakers are racing to develop electric vehicles to meet tighter CO2 emissions targets in Europe and this week Volvo joined a growing number of carmakers aiming for a fully-electric line-up by 2030. Stellantis plans to have fully-electric or hybrid versions of all of its vehicles available in Europe by 2025, broadly in line with plans at top rivals such as Volkswagen and Renault-Nissan, although Stellantis has further to go to meet that goal. The carmaker is targeting an adjusted operating profit margin of 5.5%-7.5% this year. That compares with a 5.3% aggregated margin last year: 4.3% at FCA and 7.1% at PSA excluding a controlling stake in parts maker Faurecia, which is set to be spun-off from Stellantis shortly.

Stellantis won't race to split electric vehicles from fossil fuel cars

Fri, May 6 2022MILAN - Stellantis is not considering splitting its electric vehicle (EV) business from its legacy combustion engine operation, its finance chief said on Thursday, as the carmaker presented above-expectation revenue data for the first quarter. Chief Financial Officer Richard Palmer told analysts he did not see huge benefits in the kind of separations pursued by rivals such as France's Renault and U.S. Ford. "We need to manage the company and the assets we have through this transition," he said. "There are benefits to having the cash flow being generated by the internal combustion business for the investments we need to make." Palmer said the group, formed by a merger last year of Fiat Chrysler and Peugeot maker PSA, was not averse to considering adjusting its structure "but we aren't anticipating any big changes." Palmer's comments came after the world's fourth largest carmaker said its net revenue rose 12% to 41.5 billion euros ($44.1 billion) in the January-March period, as strong pricing and the type of vehicles sold helped offset the impact of the semiconductor shortage on volumes. That topped analyst expectations of 36.9 billion euros, according to a Reuters poll. Milan-listed shares were up 0.5% by 1415 GMT, in line with Italy's blue-chip index. The impact of the chip crunch was evident in the decline in shipment figures which fell 12% in the quarter to 1.374 million vehicles. It was a similar story for Germany's BMW which posted higher revenues on Thursday and a decline in car sales. Riding the Recovery Stellantis, whose brands also include Citroen, Jeep and Maserati, confirmed its 2022 forecasts for a double-digit adjusted operating income margin, after 11.8% last year, and a positive cash-flow despite supply and inflationary headwinds. Morgan Stanley analysts said after the results that Stellantis had better management than many peers and benefited from its significant exposure to a stronger U.S. economy and a European recovery from the COVID-19 pandemic. They also said it was less affected by a slowing Chinese economy. Palmer said it was important for the group to maintain double-digit margins and keep delivering positive cash flows. "A 12% increase in revenue with a 12% decrease in volumes indicates a very strong performance on price and mix, which augurs well for our margin performance," he said. He said semiconductor supply problems were expected to ease this year with continued improvements in 2023.