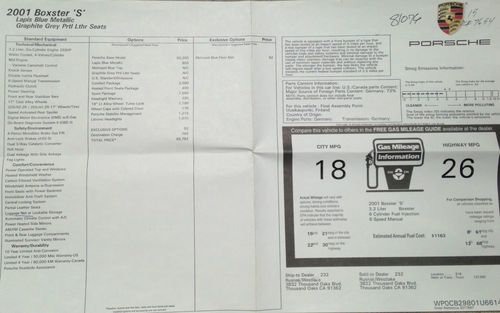

2001 Porsche Boxster Roadster S Convertible 2-door 3.2l on 2040-cars

Simi Valley, California, United States

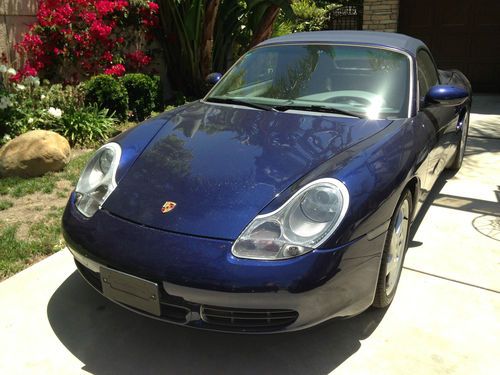

Body Type:Convertible

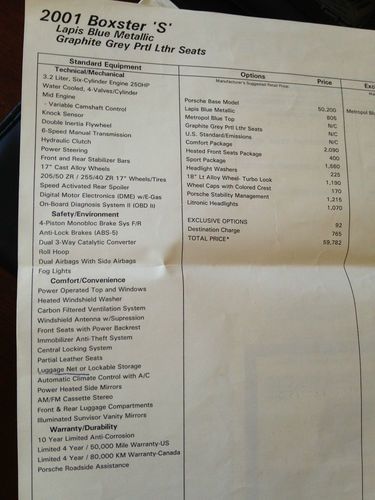

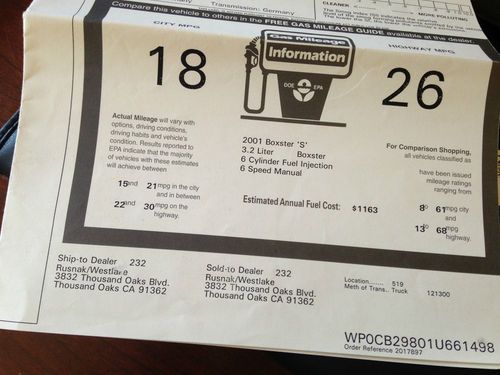

Engine:3.2L 3179CC H6 GAS DOHC Naturally Aspirated

Vehicle Title:Clear

Fuel Type:GAS

For Sale By:Private Seller

Interior Color: Graphite Grey

Make: Porsche

Number of Cylinders: 6

Model: Boxster

Trim: Roadster S Convertible 2-Door

Drive Type: RWD

Mileage: 31,714

Exterior Color: Blue Metallic

Number of Doors: 2

In great condition with REALLY low miles. Little wear and tear with no dents and only minor scratches. Clean title. Car has been garaged its whole life and in near immaculate condition. It will be hard to find another similar year Porsche in this condition and well maintained.

Porsche Boxster for Sale

Silver porsche boxter s 2010(US $56,600.00)

Silver porsche boxter s 2010(US $56,600.00) 2002 porsche boxster 33,000 miles/all oem/no damage history

2002 porsche boxster 33,000 miles/all oem/no damage history 2001 porsche boxster super low miles!! no reserve

2001 porsche boxster super low miles!! no reserve 2000 porsche boxster roadster convertible 2-door 2.7l(US $12,500.00)

2000 porsche boxster roadster convertible 2-door 2.7l(US $12,500.00) 2000 guards red porsche boxster roadster s 986 convertible roadster 77k miles!(US $15,000.00)

2000 guards red porsche boxster roadster s 986 convertible roadster 77k miles!(US $15,000.00) Boxster s, rad sport design wheels, sport pkg, nice car(US $18,888.00)

Boxster s, rad sport design wheels, sport pkg, nice car(US $18,888.00)

Auto Services in California

Z & H Autobody And Paint ★★★★★

Yanez RV ★★★★★

Yamaha Golf Cars Of Palm Spring ★★★★★

Wilma`s Collision Repair ★★★★★

Will`s Automotive ★★★★★

Will`s Auto Body Shop ★★★★★

Auto blog

Volkswagen Group's Vision 2030 strategy could bring revolution to the brands

Sat, May 11 2019One would expect a corporate plan called "Vision 2030," looking 11 years ahead through wildly tumultuous times, to involve great change and numerous forks in numerous roads. According to Automobile's breakdown of Volkswagen's path forward, though, the plans contain some lurid potential surprises. The ultimate aim is return on investment, and that means ruthless reorganization of a conglomerate with eight primary car brands, two car sub-brands, and Ducati motorcycles. The first two Vision 2030 cornerstones Automobile mentions are near boilerplate: Production network restructuring, and "streamlining of key technologies." The latter two are the ones that could upend what we know as the Volkswagen Group: focusing on the Group's core brands — meaning Audi, Porsche, and VW — and transitioning to EVs, autonomy, and other mobility solutions. Based on the report, a quote from Audi's CTO referring to the Audi brand could cover how the Group plans to handle all of its brands: "We need to find a sustainable solution for the indefinite transition period until EVs eventually take over." The boutique divisions adjacent to carmaking, Ducati and Italdesign, look likely to be spun off. For the halo car brands — Bentley, Bugatti, and Lamborghini — apparently shareholders want double-digit returns on investment, and the trio doesn't have long to hit the target. One eyebrow raiser is when the report states, "Bugatti is tipped to be gifted to [ex-VW Group Chairman] Ferdinand Piech." Piech fathered the Veyron during his tenure at VW, and it was thought he commissioned the La Voiture Noire, but he's lately stepped so far back from VW that he sold all his shares in the Group. Automobile quoted a senior strategist as saying of money-losing Bentley, "Why invest on a backward-looking enterprise when you can support a trendsetter? A proud history and excellent craftmanship alone don't cut it anymore." We guess no one at Ferrari, McLaren, or even Porsche got that memo. Bentley is reportedly close to being put in time out, and if brand CEO Adrian Hallmark can't right the Crewe ship, the hush-hush Plan B is to prop the Flying B up enough to lure a buyer. As for Lamborghini, caught between two masters at Audi and Porsche, even record-breaking numbers at the Italian supercar maker barely staved off sacrilege. It's said that VW brand CEO Herbert Diess considered putting a 5.0-liter Porsche V8 into the Aventador successor.

Auto journalist ordered to pay big money for blowing up Porsche 917 engine [UPDATE]

Tue, 22 Jan 2013Racecars blow engines all the time, but a Porsche 917 isn't just a run-of-the-mill racecar. British automotive writer Mark Hales reportedly borrowed a 917 from 82-year-old former Formula One racer David Piper for a magazine article, and mechanical tragedy ensued. Nobody is arguing that the engine failed after being spun to 8,200 rpm. However, Hales was warned not to exceed 7,000 rpm, says owner Piper, and the affair landed in English courts with Piper seeking £50,000 - over $79,000 US - in reimbursement funds for an engine rebuild and loss of use of the car while it was being repaired. Judge Simon Brown ruled in favor of car owner Piper, putting Hales on the hook for £110,000 ($174,000) including legal fees - a whole lot of money in any language.

Hales says the Porsche suffered a mechanical fault while lapping that allowed it to slip out of gear and over-rev. Piper wasn't convinced, and sought to have the repair paid for by the guy who broke the racer, saying "If you bend it, you mend it." It's not like Hales is a novice driver, having seat time in both professional and amateur races over 30 years, notching about 150 wins, but even the best drivers sometimes miss a shift, and that's what Piper contended happened to his car.

According to reports, Hales has had to sell most of his valuables to pay his lawyers and is now facing bankruptcy with the ruling against him. Members of the Pistonheads website are trying to coordinate a collection to help him out, as well.

Porsche's former CEO Wiedeking to stand trial over VW-share manipulation

Wed, 27 Aug 2014Former Porsche CEO Wendelin Wiedeking (left in the above photo) could potentially be facing some time in the slammer after all. The last we had heard, he and former Chief Financial Officer Holger Haerter (right) had avoided a trial in April due to a lack of evidence. However, an appeals court in Stuttgart has looked at the case again and overruled the earlier decision, finding that the executives should be tried for share manipulation during Porsche's failed attempt to take over Volkswagen in 2008, Bloomberg reports.

The judges in the appeal "list numerous indications that could suggest that there was a hidden decision to increase the stake as they could suggest the opposite evaluation by the lower court," said Stefan Schueler, a spokesperson for the court, in a statement cited by Bloomberg. Wiedeking and Haerter put out their own releases saying that there was no merit to the charges.

The prosecutors allege that Wiedeking and Haerter had a plan to buy up VW stock options in 2008 to take the automotive giant over but hid it from investors. The whole thing was a massive failure and eventually allowed VW the chance to acquire Porsche and forced the two execs to step down. In addition to the criminal investigation, hedge funds have attempted to sue the company multiple times in civil court for the same reason, but they have repeatedly failed.