2021 Nissan Armada Sl on 2040-cars

Engine:5.6L V8 DOHC 32V LEV3-ULEV125 400hp

Fuel Type:Gasoline

Body Type:4D Sport Utility

Transmission:Automatic

For Sale By:Dealer

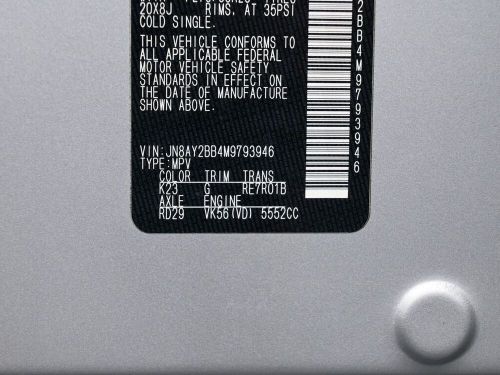

VIN (Vehicle Identification Number): JN8AY2BB4M9793946

Mileage: 75017

Make: Nissan

Trim: SL

Features: --

Power Options: --

Exterior Color: Silver

Interior Color: Charcoal

Warranty: Unspecified

Model: Armada

Nissan Armada for Sale

2022 nissan armada sl(US $45,634.00)

2022 nissan armada sl(US $45,634.00) 2018 nissan armada sl 4x4 4dr suv(US $22,995.00)

2018 nissan armada sl 4x4 4dr suv(US $22,995.00) 2020 nissan armada sl(US $22,044.00)

2020 nissan armada sl(US $22,044.00) 2023 nissan armada s(US $42,300.00)

2023 nissan armada s(US $42,300.00) 2009 nissan armada le 4wd(US $1,971.00)

2009 nissan armada le 4wd(US $1,971.00) 2023 armada sl 4dr suv 4x4(US $47,995.00)

2023 armada sl 4dr suv 4x4(US $47,995.00)

Auto blog

2013 Nissan Frontier gets substantial price drop, better fuel economy

Mon, 04 Mar 2013With the competition dwindling (or dying) among compact trucks, Nissan is looking to make some minor changes to the 2013 Frontier to snag a few extra sales for its aging pickup. Pricing and fuel economy are probably two of the most important vehicle stats among new-car buyers, and the 2013 Nissan Frontier has made vast improvements in both areas over the 2012 model.

First things first: The MSRP of both the King Cab and Crew Cab models have dropped by $1,270 with new starting prices of $17,990 and $22,030 (*not including the $845 destination charge), respectively. The biggest price drop is seen on the SV Crew Cab 4x2, which dropped $1,450 to its new price of $23,990. The important thing here is that the 2013 Frontier King Cab is now priced just a few hundred dollars more than a regular cab version of the Toyota Tacoma. Nissan is also offering a new SV Value Truck Package that includes all the equipment of the previous SV Premium Utility Package (spray-on bedliner, Utili-Track in-bed cargo system with four adjustable cleats and Bluetooth) and adds in a rearview monitor and dual-zone air conditioning.

Another key change made for 2013 was to the Frontier's fuel economy. Except for the base-model truck (King Cab, inline-four, manual transmission, two-wheel drive), all other configurations have seen increases in city and/or highway fuel economy to the tune of one or two miles per gallon; the biggest improvement was to the V6 models with the automatic transmission, which saw an improvement of one mpg city and two mpg highway. Nissan accomplished this with better aerodynamics and updated internal engine components to reduce friction. Aero changes include a seal between the cab and bed, a tailgate spoiler and a new front chin spoiler. For more details on the 2013 Frontier - including a full pricing breakdown - scroll down for the official press release.

2020 Ford Escape hybrids vs other crossover fuel sippers: How they compare on paper

Wed, Apr 3 2019Along with a new generation of Escape, Ford also reintroduced the world to the 2020 Ford Escape Hybrid. And if that weren't enough, Ford is adding a plug-in hybrid version. This is a sign of the times: people are more crossover crazy than ever, but are also seeking ways to use less fuel, whether it's for environmental or purely money-motivated reasons. The Ford hybrids aren't the only fuel-efficient compact crossovers on the market. They will be going head-to-head with conventional hybrids including the 2019 Kia Niro, 2019 Nissan Rogue Hybrid and 2019 Toyota RAV4 Hybrid. There are other plug-in hybrids including the 2019 Subaru Crosstrek PHEV, 2019 Mitsubishi Outlander PHEV and the plug-in version of the 2019 Kia Niro. There are even a couple diesels in the form of the 2019 Chevy Equinox and 2019 GMC Terrain. So we've rounded up the details on all these crossovers to see who leads and lags in criteria such as power, fuel efficiency, space and price. Check out all their details below. 2019 Subaru Crosstrek Hybrid View 68 Photos How do their engines and fuel economy compare? Conventional Hybrids and Diesels Let's face it, if you're buying one of these crossovers, one of the things that matters most to you is just how frugal with fuel they are. We'll start off with the conventional hybrids and diesels, and the clear victor is the Kia Niro, which in base FE trim, manages to hit 50 mpg combined. This is thanks to it sharing its powertrain with the Hyundai Ioniq, the Hyundai equivalent of the Toyota Prius. Buyers should take note that only the FE returns such high fuel economy. The LX and EX drop to 49 mpg, and the S Touring and Touring get 43. Even then, the least efficient Niro is the most efficient of the normal hybrids and diesels. It is nearly the least powerful, though, with 139 horsepower. Just behind it is the Toyota RAV4 Hybrid. It delivers 40 mpg combined, and it has an ace up its sleeve: it comes standard with all-wheel drive. Every other vehicle in this powertrain group has front drive standard, and the Niro isn't available with all-wheel drive at all. If that weren't enough, the RAV4 Hybrid also boasts the most power at 219 horses. While we can't say anything about Escape Hybrid fuel economy, we do know that it will make 198 horsepower, which is close to the class-leading RAV4. The least powerful of these is the Equinox and Terrain, and they return the worst fuel economy at 32 mpg.

Sebastien Vettel testing Infiniti's production Etherea?

Thu, 30 May 2013It sounds like Sebastian Vettel has had his hands full recently, juggling his Formula One racing career while moonlighting as the newly appointed director of performance at Infiniti. On that latter note, Autocar is reporting that Vettel has been testing a production version of the Etherea Concept at France's Circuit Paul Ricard.

There is still no word as to when we could see this car go into production or what it will be called (possibly the Q30), but it will likely share a platform with the Mercedes-Benz A-Class as a part of the Daimler/Renault-Nissan collaboration. The article also said that this future entry-level Infiniti would be produced at Nissan's Sunderland, UK plant.