2000 Nissan Maxima Gle on 2040-cars

826 Reading Rd, Mason, Ohio, United States

Engine:3.0L V6 24V MPFI DOHC

Transmission:4-Speed Automatic

VIN (Vehicle Identification Number): JN1CA31A1YT214785

Stock Num: S214785

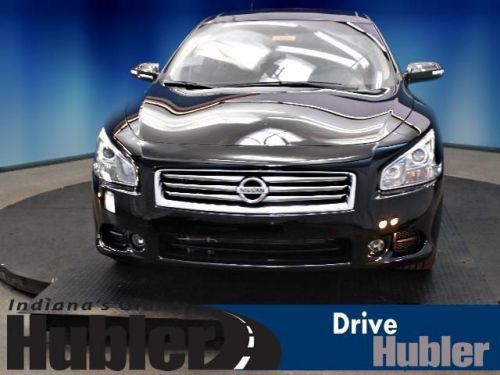

Make: Nissan

Model: Maxima GLE

Year: 2000

Exterior Color: Silver

Interior Color: Black

Options: Drive Type: FWD

Number of Doors: 4 Doors

Mileage: 118595

UP FOR SALE IS A 2007 NISSAN MAXIMA GLE, AUTOMATIC, POWER WINDOWS, POWER DOOR LOCKS, POWER SUNROOF, ALLOY WHEELS, POWER HEATED LEATHER SEATS, CRUISE CONTROL, AM,/FM/CD PLAYER, TILT STEERING, POWER STEERING, VERY CLEAN INSIDE AND OUT, RUNS AND DRIVES GREAT, PLEASE VISIT WWW.KGMOTORS.COM FOR MORE INFORMATION, PICTURES, AND A FREE CARFAX, OR CALL US TODAY AT 877-875-4240 !!! WE SELL ALL OF OUR CARS AT ALMOST WHOLESALE PRICES, SO PLEASE CALL US AND CONFIRM THAT THE CAR IS STILL AVAILABLE. PRICES ARE SUBJECT TO CHANGE. Visit KG Motors online at www.kgmotors.com to see more pictures of this vehicle or call us at 877-875-4240 today to schedule your test drive. VERY CLEAN INSIDE AND OUT, DRIVES AND LOOKS EXCELLENT, WARRANTY IS AVAILABLE, TRADES ARE ALWAYS WELCOME, PLEASE VISIT OUR WEBSITE AT WWW.KGMOTORS.COM FOR MORE PICTURES AND INFO.

Nissan Maxima for Sale

2004 nissan maxima se(US $5,995.00)

2004 nissan maxima se(US $5,995.00) 2007 nissan maxima se(US $8,995.00)

2007 nissan maxima se(US $8,995.00) 2007 nissan maxima sl(US $7,995.00)

2007 nissan maxima sl(US $7,995.00) 2001 nissan maxima gxe(US $4,995.00)

2001 nissan maxima gxe(US $4,995.00) 2014 nissan maxima sv(US $39,285.00)

2014 nissan maxima sv(US $39,285.00) 2014 nissan maxima sv(US $36,449.00)

2014 nissan maxima sv(US $36,449.00)

Auto Services in Ohio

Yonkers Auto Body ★★★★★

Western Reserve Battery Corp ★★★★★

Walt`s Auto Inc ★★★★★

Valvoline Instant Oil Change ★★★★★

Valvoline Instant Oil Change ★★★★★

Tritex Corporation ★★★★★

Auto blog

Nissan didn't have much say in merger talks, but it had what FCA wanted

Fri, Jun 7 2019TOKYO — Nissan wasn't consulted on the proposed merger between its alliance partner Renault and Fiat Chrysler, but the Japanese automaker's reluctance to go along may have helped bring about the surprise collapse of the talks. While Nissan Motor Co. had a weaker bargaining position from the start, with its financial performance crumbling after the arrest last year of its star executive Carlos Ghosn, it still had as its crown jewel the technology of electric vehicles and hybrids that Fiat Chrysler wanted. The board of Renault, meeting Thursday, didn't get as far as voting on the proposal, announced last week, which would have created the world's third biggest automaker, trailing only Volkswagen AG of Germany and Japan's Toyota Motor Corp. When the French government, Renault's top shareholder with a 15% stake, asked for more time to convince Nissan, Fiat Chrysler Chairman John Elkann abruptly withdrew the offer. Although analysts say reviving the talks isn't out of the question, they say trust among the players appears to have been broken. "The other companies made the mistake of underestimating Nissan's determination to say, 'No,' " said Katsuya Takeuchi, senior analyst at Mitsubishi UFJ Morgan Stanley Securities in Tokyo. The Note, an electric car with a small gas engine to charge its battery, was Japan's No. 1 selling car, the first time in 50 years that a Nissan beat Toyota and Honda. Renault and Fiat Chrysler highlighted possible synergies that come from sharing parts and research costs as the benefits of the merger. But what Fiat Chrysler lacks and really wanted was what's called in the industry "electrification technology," Takeuchi said. With emissions regulations getting stricter around the world, having such technology is crucial. Yokohama-based Nissan makes the world's best-selling electric car Leaf. Its Note, an electric car equipped with a small gas engine to charge its battery, was Japan's No. 1 selling car for the fiscal year through March, the first time in 50 years that a Nissan model beat Toyota and Honda Motor Co. for that title. Nissan is also a leader in autonomous-driving technology, another area all the automakers are trying to innovate. "Although Nissan had no say, its cautionary stance on the merger ended up being very meaningful," Takeuchi said.

PSA shares rise following FCA's breakup with Renault

Thu, Jun 6 2019Shares in Groupe PSA, parent company of automakers Peugeot, Citroen and the DS brand, rose on Thursday as analysts considered the possibility that Fiat Chrysler could turn back to PSA after withdrawing its $35 billion merger offer for Renault. "Both parties have acknowledged the need for scale or [mergers and acquisitions] and may pursue other opportunities. If Nissan was an obstacle (to an FCA-Renault deal) PSA-FCA discussions could resume," wrote brokerage Jefferies. Back in March at the Geneva Motor Show, rumors started swirling that PSA was interested in a potential merger with FCA. Mike Manley, who took over at the helm of Fiat Chrysler following the death of Sergio Marchionne, had indicated a willingness to look into potential partnership options. Of course, that was all before FCA proposed a merger with Renault — with that deal now off the table, attention naturally turns back to PSA, which is also based in France. "We expect both shares to react negatively but see FCA having wider strategic options and Renault shares more downside risk near-term," said Jefferies. According to Reuters, PSA shares were up 1.5% at the time this was published, making it the top-performing stock on France's benchmark CAC-40 Index. Renault saw its shares slump 7%. Shares for FCA fell 3% in early trading on the Milan Stock Exchange. Considering that FCA said in its statement confirming the withdraw of its merger offer with Renault that "political conditions in France do not currently exist for such a combination to proceed successfully," we have to wonder how keen the company is to begin negotiations with another French automaker like PSA. Those thoughts were similarly voiced by Bernstein Research analyst Max Warburton, who said (via Forbes), "Expect PSA to rise on unrealistic hopes it may be FCA's next date." Earnings/Financials Chrysler Fiat Mitsubishi Nissan Citroen Peugeot Renault FCA renault-nissan

Chip shortage will hit Nissan, Suzuki and Mitsubishi in June

Sat, May 22 2021TOKYO — A global chip shortage is forcing Nissan and Suzuki to temporarily halt production at some plants in June, sources with direct knowledge of the plans told Reuters on Friday. Nissan will idle its factory in Kyushu, southern Japan, for three days on June 24, 25 and 28, while making production adjustments during the month at its Tochigi and Oppama plants in Japan, three sources said. Nissan will also temporarily halt production of some of its models at its Mexico plant, they said, declining to be identified because the plan is not public. "A global shortage of semiconductors has affected parts procurement in the auto sector. Due to the shortage, Nissan is adjusting production and taking necessary actions to ensure recovery," a Nissan spokeswoman said. Suzuki will idle its three plants in Shizuoka prefecture from three to nine days, two sources said, also declining to be identified because the plan is not public. The plan "has not been confirmed," a Suzuki spokesman said, explaining that while the carmaker gave its provisional production plan to auto part makers, it is still making adjustments to minimize the impact of the chip shortage. Elsewhere, Mitsubishi will reduce production by 30,000 vehicles in total in June at five plants in Japan, Thailand and Indonesia, a spokeswoman said, adding that the impact has already been factored into its earnings outlook for the current fiscal year. Related video: This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings. Plants/Manufacturing Mitsubishi Nissan Suzuki