We Finance!!! 2011 Nissan 370z Nismo 6-speed Rev Match Xenon 12k Mi Texas Auto on 2040-cars

Webster, Texas, United States

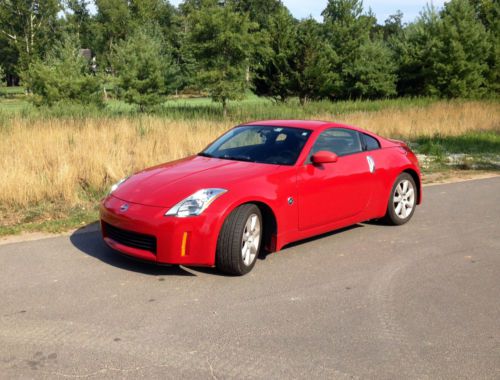

Nissan 350Z for Sale

2004 nissan 350z touring convertible 2-door 3.5l low miles z car

2004 nissan 350z touring convertible 2-door 3.5l low miles z car 350 z - sunset lemans orange(US $16,000.00)

350 z - sunset lemans orange(US $16,000.00) 2004 nissan 350z base coupe 2-door 3.5l(US $12,900.00)

2004 nissan 350z base coupe 2-door 3.5l(US $12,900.00) Nissan 350z salvage rebuildable repairable wrecked project damaged project fixer(US $3,595.00)

Nissan 350z salvage rebuildable repairable wrecked project damaged project fixer(US $3,595.00) 2004 nissan 350z touring low miles! leather, 6-speed, bose, rare! all original!(US $18,991.00)

2004 nissan 350z touring low miles! leather, 6-speed, bose, rare! all original!(US $18,991.00) 2004 nissan 350z roadster touring model(US $12,900.00)

2004 nissan 350z roadster touring model(US $12,900.00)

Auto Services in Texas

Zoil Lube ★★★★★

Young Chevrolet ★★★★★

Yhs Automotive Service Center ★★★★★

Woodlake Motors ★★★★★

Winwood Motor Co ★★★★★

Wayne`s Car Care Inc ★★★★★

Auto blog

Nissan unveils ZEOD RC at Nismo HQ in Japan [w/videos]

Thu, 17 Oct 2013At Le Mans this past summer, Nissan unveiled the first prototype for the ZEOD RC, a new hybrid racecar which it intends to field at the famous French endurance race next year. Four months have passed since then, totaling eight month of development, and now Nissan has revealed the final form at the headquarters of its Nismo racing division.

The updated Nissan ZEOD RC benefits from a more streamlined shape with optimized cooling and improved aerodynamics. Although billed as an electric vehicle and not a hybrid, the ZEOD RC pairs a 1.6-liter turbo four with a pair of electric motors. Its regenerative braking system is derived from the Leaf RC, and after 11 laps, it's said to be capable of taking another around the Circuit de la Sarthe under electric power alone, making it the first racecar capable of doing so. Nissan has further stated that it hopes the lessons it garners from this project will help in its development of a new LMP1 to challenge for overall victory at Le Mans in the near future.

The ZEOD RC will be on display at Fuji Speedway this weekend during the six-hour FIA World Endurance Championship race there, after which it will continue its development at the hands of former GT1 champion Michael Krumm and gamer-turned-racer Lucas Ordonez, who will be getting it ready for (and possibly drive it at) next year's 24 Hours of Le Mans. There it will compete - faster than most GTE sportscars, says Nissan - in the Garage 56 spot that once was awarded to the DeltaWing, which Nissan sponsored and to which the ZEOD RC looks conspicuously similar.

Porsche Taycan is here, Lamborghini Sian is near | Autoblog Podcast #594

Fri, Sep 6 2019In this week's Autoblog Podcast, Editor-in-Chief Greg Migliore is joined by Senior Editor Alex Kierstein and Senior Editor, Green, John Beltz Snyder. They start the conversation with the cars they've been driving, including the Subaru Forester, Lincoln Navigator, Mercedes-AMG C 43 and Subaru Crosstrek Hybrid. Then they talk about the biggest news of the week: the reveal of the all-electric Porsche Taycan. After that, they sweep up other news, like the Lamborghini Sian, new Nissan Juke and the Aston Martin Vanquish 25 by Ian Callum. Next, Autoblog's Erik Meier, who both produces this very podcast and also hosts our Twitch livestream, joins the chat with his impressions of the latest racing game, "WRC 8." Finally, our editors try to provide some helpful guidance in the "Spend My Money" segment. Autoblog Podcast #594 Get The Podcast iTunes – Subscribe to the Autoblog Podcast in iTunes RSS – Add the Autoblog Podcast feed to your RSS aggregator MP3 – Download the MP3 directly Rundown Cars we're driving 2019 Subaru Forester 2019 Lincoln Navigator 2019 Mercedes-AMG C 43 Coupe 2019 Subaru Crosstrek Hybrid Porsche unveils 2020 Taycan Turbo and Turbo S 2020 Lamborghini Sian Next-generation Nissan Juke Aston Martin Vanquish 25 by Ian Callum Autoblog plays "WRC 8" Spend My Money Feedback Email – Podcast@Autoblog.com Review the show on iTunes Related Video:   Green Podcasts Toys/Games Aston Martin Lamborghini Lincoln Mercedes-Benz Nissan Porsche Subaru Used Car Buying Coupe Crossover SUV Electric Hybrid Performance

Nissan reviving Pulsar name for Euro market

Mon, 19 May 2014The Nissan Pulsar doesn't have what we'd consider a rich history in the US, other than on some models decades ago. However, the nameplate has been part of the Nissan lineup globally since 1978 and has proven popular in Asia and Australia. Now, the brand is teasing a five-door hatch to revive the name and hit European showrooms this fall.

The new Pulsar will be built at the company's recently renovated factory in Barcelona, Spain. It's not clear from the teaser whether this is the same model that is already sold in other parts of the world or a brand new vehicle. Although, Nissan says in the announcement that the car "has been designed to meet the specific demands of European car buyers."

With competitors like the Volkswagen Golf and Ford Focus, the European five-door hatch market is seriously competitive. It will be interesting to see if Nissan will have something special to bring to the table. Scroll down to read Nissan's full teaser about its latest hatchback in Europe.