1991 Twin Turbo Nissan 300zx..mint..only 40k Miles..t-tops..5 Speed... on 2040-cars

Saint James, New York, United States

Engine:3.0L 2960CC V6 GAS DOHC Turbocharged

Body Type:Coupe

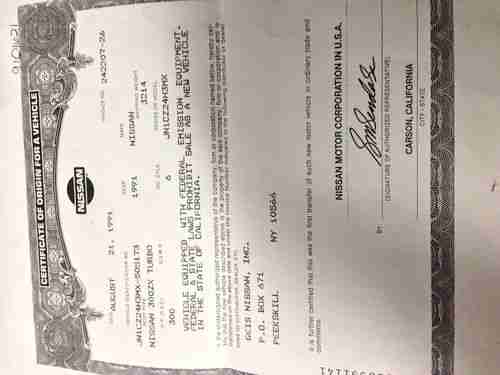

Vehicle Title:Clear

For Sale By:Private Seller

Exterior Color: Red

Make: Nissan

Interior Color: Black

Model: 300ZX

Number of Cylinders: 6

Trim: Turbo Coupe 2-Door

Drive Type: RWD

Mileage: 43,515

Sub Model: TWIN TURBO

Warranty: Vehicle does NOT have an existing warranty

Nissan 300ZX for Sale

1995 nissan 300zx base coupe 2-door 3.0l

1995 nissan 300zx base coupe 2-door 3.0l 91 nissan 300zx twin turbo - original owner!!!!!!

91 nissan 300zx twin turbo - original owner!!!!!! 1991 nissan 300zx base coupe 2-door 3.0l

1991 nissan 300zx base coupe 2-door 3.0l 1984 nissan 300zx turbo 50th anniversary edition

1984 nissan 300zx turbo 50th anniversary edition California rust free nissan 300zx twin turbo 5 speed $8000,00 in upgrades fast(US $9,450.00)

California rust free nissan 300zx twin turbo 5 speed $8000,00 in upgrades fast(US $9,450.00) 1987 nissan 300zx 2+2 t-tops(US $2,800.00)

1987 nissan 300zx 2+2 t-tops(US $2,800.00)

Auto Services in New York

Witchcraft Body & Paint ★★★★★

Will`s Wheels ★★★★★

West Herr Chevrolet Of Williamsville ★★★★★

Wayne`s Radiator ★★★★★

Valley Cadillac Corp ★★★★★

Tydings Automotive Svc Station ★★★★★

Auto blog

Nissan will build just 45 examples of this 45th Anniversary GT-R

Thu, Nov 27 2014It's been 45 years since the release of the original Nissan Skyline GT-R, so to celebrate, the Japanese automaker has announced this special commemorative edition. Based on the newly updated 2015 Nissan GT-R in Premium trim, the 45th Anniversary edition is done up in a unique shade called Silica Brass – the same color as the legendary R34-gen 2001 Skyline GT-R M-Spec. It also comes with the requisite special badging inside and under the hood, but unfortunately, that's about the extent of the special touches applied to this celebratory model. Nissan will only make 45 highly symbolic examples of this special edition, each to be sold on a strictly first-come, first-served basis. And unfortunately they'll be restricted to the Japanese market, where they'll each command a sticker price of 10,787,040 yen – equivalent to about $91,700 at today's rates, which is already a good ten grand less than what you'd pay for a standard GT-R in the US, anyway. Nissan Releases the Limited-Edition "45th Anniversary" GT-R – Production will be limited to 45 vehicles – YOKOHAMA, Japan (November 25, 2014) - Nissan Motor Co., Ltd. today announced that the Limited-Edition "45th Anniversary" Nissan GT-R will go on sale in early February throughout Japan, in conjunction with the release of the 2015 model year GT-R. Since its release in 2007, the Nissan GT-R has been recognized as the world's foremost high performance super sports car, which embodies Nissan's commitment to "innovation that excites" like no other. The GT-R's legacy continues as the ultimate "GT" (Grand Tourer), armed with a comfortable ride, a high level of refinement and benchmark fit and finish; while its world-class high performance embodies the "R" in its name (Racing technology). Thus, its "multi performance" character allows the driver to enjoy the full depths of the GT-R's capabilities, whether navigating corners of a winding mountain road, simply cruising on the open highway or even running errands on neighborhood streets. Based on the 2015 Nissan GT-R, which features ride quality that has been specially tuned to exhibit a more mature, better refined feel than its predecessors, the "45th Anniversary" will come with a special paint color, "Silica Brass" – the same trademark color as the Skyline GT-R M-Spec (R34 Type), which was touted as the "a GT-R that satisfies the mature driver" when it was released in 2001.

Nissan, Fisker in advanced talks on investment, partnership

Sat, Mar 2 2024Nissan is in advanced talks to invest in electric vehicle maker Fisker in a deal that could provide the Japanese automaker with access to an electric pickup truck while giving the struggling startup a financial lifeline, according to two people familiar with the negotiations. The deal could close this month, said the sources, who asked not to be identified because the talks are ongoing and have not been finalized. Terms being discussed include Nissan investing more than $400 million in Fisker's truck platform and building Fisker's planned Alaska pickup starting in 2026 at one of its U.S. assembly plants, one of the sources said. Nissan would build its own electric pickup on the same platform, the source said. Nissan has U.S. assembly plants in Mississippi and Tennessee. Fisker said on Thursday, when it announced it might not be able to continue as a going concern and would cut 15% of its workforce, that it was in talks with a large automaker for a potential investment and joint development partnership. It did not name the automaker. A Fisker spokesman said the company does not comment on speculation, while Nissan officials were not immediately available to comment. Fisker shares had been down about 45% before the Reuters report but pared those losses and were trading down about 25% with a market capitalization of more than $295 million. The term sheet is ready and the deal is going through due diligence, one of the sources said. Nissan was an EV pioneer with its fully battery powered Leaf hatchback in 2010 but has since struggled in the face of nimbler new entrants. A deal with Fisker would help it move into the growing U.S. electric pickup market. Nissan's talks with Fisker comes in the wake of the former's “rebalanced” relationship with its long-time alliance partner Renault. Last year, Nissan and Renault finalised terms of a restructured alliance after months of negotiations. They aim to have cross-shareholdings of 15% as part of the deal. The more limited alliance removes certain restrictions and has opened the door for Nissan to develop growth plans in areas such as EVs and software independent of Renault, said one of the sources, who is familiar with Nissan's thinking. The Yokohama-headquartered automaker is scouring “many, many opportunities,” the person said.

The next steps automakers could take after sales drop again in April

Tue, May 2 2017DETROIT (Reuters) - Major automakers on Tuesday posted declines in U.S. new vehicle sales for April in a sign the long boom cycle that lifted the American auto industry to record sales last year is losing steam, sending carmaker stocks down. The drop in sales versus April 2016 came on the heels of a disappointing March, which automakers had shrugged off as just a bad month. But two straight weak months has heightened Wall Street worries the cyclical industry is on a downward swing after a nearly uninterrupted boom since the Great Recession's end in 2010. Auto sales were a drag on U.S. first-quarter gross domestic product, with the economy growing at an annual rate of just 0.7 percent according to an advance estimate published by the Commerce Department last Friday. Excluding the auto sector the GDP growth rate would have been 1.2 percent. Industry consultant Autodata put the industry's seasonally adjusted annualized rate of sales at 16.88 million units for April, below the average of 17.2 million units predicted by analysts polled by Reuters. General Motors Co shares fell 2.9 percent while Ford Motor Co slid 4.3 percent and Fiat Chrysler Automobiles NV's U.S.-traded shares tumbled 4.2 percent. The U.S. auto industry faces multiple challenges. Sales are slipping and vehicle inventory levels have risen even as carmakers have hiked discounts to lure customers. A flood of used vehicles from the boom cycle are increasingly competing with new cars. The question for automakers: How much and for how long to curtail production this summer, which will result in worker layoffs? To bring down stocks of unsold vehicles, the Detroit automakers need to cut production, and offer more discounts without creating "an incentives war," said Mark Wakefield, head of the North American automotive practice for AlixPartners in Southfield, Michigan. "We see multiple weeks (of production) being taken out on the car side," he said, "and some softness on the truck side." Rival automakers will be watching each other to see if one is cutting prices to gain market share from another, he said, instead of just clearing inventory. INVESTORS DIGEST BAD NEWS Just last week GM reported a record first-quarter profit, but that had almost zero impact on the automaker's stock. The iconic carmaker, whose own interest was once conflated with that of America's, has slipped behind luxury carmaker Tesla Inc in terms of valuation.