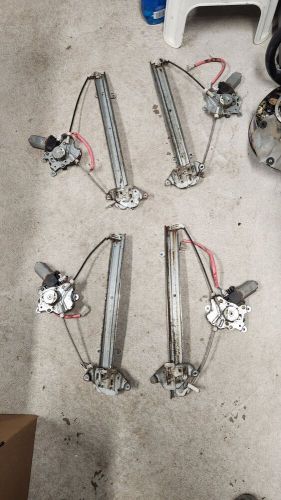

Mitsubishi Lancer 2003 Es Window Motor on 2040-cars

Laurier-Station, Quebec, Canada

Body Type:Sedan

Fuel Type:Gasoline

Year: 2003

Mileage: 200000

Model: Lancer

Exterior Color: Gray

Car Type: Passenger Vehicles

Make: Mitsubishi

Mitsubishi Lancer for Sale

2010 mitsubishi lancer(US $22,000.00)

2010 mitsubishi lancer(US $22,000.00) 2015 mitsubishi lancer evolution gsr(US $34,500.00)

2015 mitsubishi lancer evolution gsr(US $34,500.00) 2006 mitsubishi lancer mr edition awd 4dr sedan(US $46,999.00)

2006 mitsubishi lancer mr edition awd 4dr sedan(US $46,999.00) 2014 mitsubishi lancer evolution gsr(US $22,396.50)

2014 mitsubishi lancer evolution gsr(US $22,396.50) 2011 mitsubishi lancer evolution gsr(US $28,500.00)

2011 mitsubishi lancer evolution gsr(US $28,500.00) 2008 mitsubishi lancer evolution gsr(US $30,000.00)

2008 mitsubishi lancer evolution gsr(US $30,000.00)

Auto blog

Mitsubishi Motors posts surprise loss as car sales slide

Fri, Jan 31 2020TOKYO — Mitsubishi Motors on Friday posted a surprise operating loss in the third quarter, its worst quarterly performance in more than three years, hurt by falling sales in China, Japan and Southeast Asia, as well as a stronger yen. The carmaker posted an operating loss of 6.6 billion yen ($60.2 million) for the October-December quarter, widely missing an average forecast for a profit of 11.6 billion yen, based on analyst estimates compiled by Refinitiv. It was the firm's biggest loss since the July-September 2016 quarter, when a mileage cheating scandal sapped profits. However, Mitsubishi stuck to an earlier forecast for a 73% drop in full-year operating profit to 30 billion yen in the fiscal year ending in March. The automaker's net loss for the quarter just ended came in at 14.4 billion yen. The fall in quarterly sales was worst in China and at home, while sales also slipped in ASEAN countries, traditionally a stronghold, leading to a 16% fall in global vehicle sales to 320,000 units. The automaker also said it would keep some of its offices in China closed through Feb. 9, as a new coronavirus spreads throughout the country and beyond. The automaking alliance of Mitsubishi, Renault and Nissan on Thursday said they had "no other option" but to drastically improve their joint operations to remain competitive in the fast-changing global auto industry. Related Video: Â Â Â Â Â (Reporting by Naomi Tajitsu; editing by Richard Pullin) Earnings/Financials Mitsubishi

2018 Mitsubishi Outlander PHEV First Drive | Nailing the sweet spot

Mon, Oct 2 2017SANTA CATALINA ISLAND, Calif. — For years now, while the Mitsubishi brand has languished here in the U.S., other parts of the world have been enjoying the Outlander PHEV. It's Europe's best-selling plug-in hybrid, and Mitsubishi has been improving on it over the years, testing it, refining the technology and punishing the vehicle in competitions like the Baja Portalegre 500 and the Asia Cross Country Rally. Now, as electric vehicles begin to gain greater acceptance, and as Mitsu turns its brand around, it will finally offer the Outlander PHEV in America at the end of this year. As Mitsubishi prepares to launch the Outlander PHEV stateside, we had the rare opportunity to drive it across the interior of Santa Catalina Island, off the coast of Los Angeles, to test it out on some rugged, scenic roads. Sitting inside the Outlander PHEV, we were actually pleased with the interior. It was simple and clean, and the plastics didn't feel especially cheap. Sure, it wasn't the thoughtful design or plush touch points of the other available plug-in crossovers on the market, but the Outlander PHEV also doesn't share the same price tag. We definitely found it to be more attractive and appealing than the inside of, say, a Chevrolet Equinox. If you were expecting a pile of hot garbage from Mitsubishi, you're way off. When we popped open the rear liftgate to take a look, we found our near-ideal tailgating vehicle. In the rear cargo area was a ton of space, a large speaker, cupholders and a standard three-prong outlet, perfect for plugging in a slow cooker, blender, or any other appliance you could find useful at a football game or campsite. Later, when we would take a break from our drive at Catalina Island's Shark Harbor, we'd be treated to a smoothie prepared in a blender plugged into that AC outlet. If you happen to use all 12 kWh of energy, the gas engine will fire up to serve as a generator. The Toyota 4Runner may have had the "Party Mode" button, but the Outlander PHEV would be our pick for the stadium parking lot. As we passed through a gate at the edge of the town of Avalon and headed up a dirt road across the interior of Catalina Island, we were quickly impressed with the way the Outlander PHEV handled the rocky, dusty trails from which most drivers are normally prohibited. The steering feel was light but communicative, and we were really able to tell what was going on between the front wheels and the rugged surface beneath them.

Mitsubishi North America distances itself from mileage scandal

Thu, Apr 28 2016Mitsubishi's US operations are keen to distance themselves from the falsified fuel mileage scandal that has brought the whole of Mitsubishi Motors under scrutiny. In a statement released Thursday, MMNA announced that the internal audit of US market vehicles dating back to 2013 has uncovered no wrongdoings. Mitsubishi Motors R&D North America has verified the data previously submitted to EPA, and no vehicles sold in the US from 2013 to 2017 are affected with the fuel data irregularities. According to Mitsubishi, the testing data for the US market vehicles complies with EPA procedures and a different method is used in the United States than Japan to gather fuel mileage figures – something the EPA calls "Road Load Coefficient," and the data is independently verified before submitting. So far, the scandal seems to center on Japanese market cars, even if the findings date back to 1991. Related Video: Mitsubishi Motors North America Statement Regarding Fuel Consumption Testing Data April 27, 2016 Mitsubishi Motors Corporation in Tokyo recently announced irregularities concerning fuel consumption testing data. To confirm that U.S. market vehicles are not affected by this issue, Mitsubishi Motors R&D America, Inc., working together with Mitsubishi Motors Corporation, proactively conducted an internal audit of U.S. market vehicles going back several model years to check previously submitted data to the EPA. After a thorough review of all 2013MY – 2017MY vehicles sold in the United States, we have determined that none of these vehicles are affected. Our findings confirm that fuel economy testing data for these U.S. market vehicles is accurate and complies with established EPA procedures. An entirely different system is used for the United States market to determine what the EPA calls Road Load Coefficient, strictly adhering to EPA procedures. The data generated is then independently verified for its accuracy before being submitted to the EPA for their fuel economy testing. MMNA has shared this information with EPA, California Air Resources Board and DOT. Mitsubishi Motors Corporation has acted quickly to address this issue and is putting in place a committee of external experts to thoroughly and objectively continue this investigation. The results of the investigation, once completed, will be made public.