2010 Mitsubishi Lancer Gts on 2040-cars

Engine:2.4L L4 SOHC 16V

Fuel Type:Gasoline

Body Type:SEDAN 4-DR

Transmission:Continuously Variable Transmission

For Sale By:Dealer

VIN (Vehicle Identification Number): JA32U8FW3AU019755

Mileage: 55334

Make: Mitsubishi

Trim: GTS

Drive Type: --

Features: --

Power Options: --

Exterior Color: Blue

Interior Color: Black

Warranty: Unspecified

Model: Lancer

Mitsubishi Lancer for Sale

1993 mitsubishi lancer evolution i(US $30,000.00)

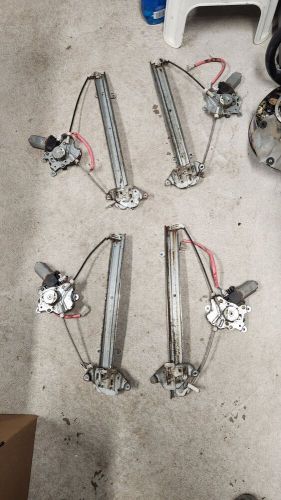

1993 mitsubishi lancer evolution i(US $30,000.00) Mitsubishi lancer 2003 es window motor(C $75.00)

Mitsubishi lancer 2003 es window motor(C $75.00) 2010 mitsubishi lancer(US $22,000.00)

2010 mitsubishi lancer(US $22,000.00) 2015 mitsubishi lancer evolution gsr(US $34,500.00)

2015 mitsubishi lancer evolution gsr(US $34,500.00) 2006 mitsubishi lancer mr edition awd 4dr sedan(US $46,999.00)

2006 mitsubishi lancer mr edition awd 4dr sedan(US $46,999.00) 2014 mitsubishi lancer evolution gsr(US $22,396.50)

2014 mitsubishi lancer evolution gsr(US $22,396.50)

Auto blog

Junkyard Gem: 2012 Mitsubishi Eclipse Spyder

Wed, May 15 2024When Chrysler and Mitsubishi partnered to establish the Diamond-Star Motors plant in Illinois, the first cars built at that facility were 1990 Mitsubishi Eclipses along with their Eagle Talon and Plymouth Laser twins. The Eclipse went through four generations, with 2012 as the final model year. Today's Junkyard Gem is one of the very last Eclipses, found in a Denver car graveyard recently. This generation of Eclipse was built starting with the 2006 model year, and it was based on a platform shared with the Galant and Endeavor. It was substantially larger than the early Eclipses, scaling in at nearly 3,500 pounds. The Spyder convertible version of the fourth-gen Eclipse debuted in the United States as a 2007 model. Sales were never strong and became downright miserable by the end, with fewer than a thousand 2012 Eclipses (both coupes and convertibles) leaving showrooms. This car is a base-grade GS with automatic transmission, and its VIN indicates that it was built for fleet sale. This would have been a fun rental car, at least compared to the Dodge Nitros and Kia Rios that stocked rental fleets in the early 2010s. The engine is a 2.4-liter SOHC straight-four rated at 162 horsepower and 162 pound-feet. The MSRP was $27,999, or about $38,581 in 2024 dollars. 2012 was also the final year for the Galant in the United States, though that was the model year in which the i-MiEV went on sale here. For the 2018 model year, Mitsubishi revived the Eclipse name — sort of — for the Outlander-derived Eclipse Cross compact SUV, which is still being built to this day. Rare? Very. Valuable? No. You could get the Eclipse Spyder with a 650-watt sound system. Driven to thrill.

Carlos Ghosn: What misconduct is he accused of?

Tue, Nov 20 2018TOKYO — Japan was shocked by news that Nissan Motor Co. Chairman Carlos Ghosn, who was widely respected for rescuing the carmaker from near bankruptcy, was arrested on Monday for alleged financial misconduct. Nissan said that Ghosn, who is also chairman and CEO of Renault and chairman of Mitsubishi Motors, would be fired from his post as Nissan chairman on Thursday. What is Carlos Ghosn accused of? Nissan CEO Hiroto Saikawa told a packed press conference on Monday night that the company had found that Ghosn had been using corporate money for personal purposes and under-reporting his income for years in official company filings to the Tokyo Stock Exchange. Another board member, Greg Kelly, was also deeply involved in the misconduct, Nissan said. Saikawa said he couldn't elaborate as the cases are being investigated by prosecutors, who have declined to comment. Prosecutors said that Ghosn and Kelly conspired to understate Ghosn's compensation over five years starting in fiscal 2010 as being about half of the actual 9.998 billion yen ($88.9 million). Public broadcaster NHK said Nissan paid billions of yen to buy and renovate homes for Ghosn in Rio, Beirut, Paris and Amsterdam, citing unnamed sources. The properties had no business purpose and were not listed as benefits in TSE filings, NHK said. Ghosn, 64, has not been formally charged. The Asahi newspaper reported that he and Kelly had submitted to prosecutors' questions after getting off a plane on Monday afternoon at Tokyo's Haneda Airport. Saikawa confirmed they had been arrested. Ghosn and Kelly have not been seen since, and their exact whereabouts are not known. Suspects are typically taken to the Tokyo Detention Center, which is linked to the Tokyo District Public Prosecutors Office. How did this come to light? Nissan's Saikawa said Ghosn's alleged improprieties came to light through a whistleblower, after which the company began an internal investigation and informed prosecutors. Japanese media reports say the informant is a member of Nissan's legal department. The Asahi reported, without citing sources, that the informant gave the prosecutors information in a plea bargain, implying the person may have provided evidence in exchange for a lighter sentence. How much control did Carlos Ghosn have? After becoming CEO of struggling Nissan in 2001, Ghosn was hailed as the automaker's savior by implementing an aggressive cost-cutting plan.

Mitsubishi recalling i-MiEV models for brake problem

Thu, 02 Oct 2014Mitsubishi is issuing a recall for the 2010-2014 i-MiEV that affects 1,810 units of the little electric car, because it's possible for the brake vacuum pump to stop working. If this happens, the result would be longer stopping distances, according to the company. The affected models were built between September 15, 2009, and March 25, 2014.

While this is just a single recall, there are actually two things that can cause this brake problem on the i-MiEV, according to Mitsubishi's filing with the National Highway Traffic Safety Administration. First, bad programming in the EV-ECU could cause the system to "falsely judge that the relay contact point is stuck," according to the full NHTSA defect notice PDF. Second, the vacuum pump exhaust hole could be corroded and blocked due to being splashed with road salt. However, the company says that if either fault happens, the brake warning lamp would illuminate, and there would be an audible alarm.

Depending on which issue is affecting an owner's i-MiEV, Mitsubishi is going to reprogram the software, replace the pump or both. Scroll down to read the recall report from NHTSA.