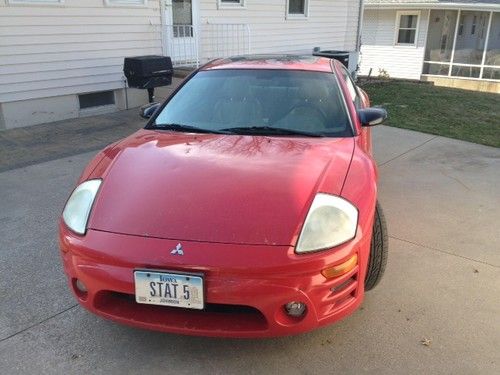

1998 Mitsubishi Eclipse Gst Hatchback 2-door 2.0l on 2040-cars

Cuba, New York, United States

Engine:2.0L 1997CC 122Cu. In. l4 GAS DOHC Turbocharged

Vehicle Title:Clear

Body Type:Hatchback

Fuel Type:GAS

For Sale By:Private Seller

Sub Model: GST

Make: Mitsubishi

Exterior Color: Black

Model: Eclipse

Interior Color: Gray

Trim: GST Hatchback 2-Door

Warranty: Vehicle does NOT have an existing warranty

Drive Type: FWD

Number of Cylinders: 4

Options: Sunroof, Cassette Player, Leather Seats, CD Player

Safety Features: Anti-Lock Brakes, Driver Airbag, Passenger Airbag

Power Options: Cruise Control, Power Locks, Power Windows

Number of Doors: 2

Mileage: 141,000

I have for sale a 1998 Mitsubishi Eclipse GsT with automatic trans...To start out I bought the car with the knowledge it could possible need a motor, after pulling the first motor I confirmed the issue. The oil pump locked up, it broke the timing belt and through a rod through the back. With what I was told the car sat for quite awhile before I bought it. I then bought a motor with 66k miles on it, I replaced the head gasket, timing belt, lifters, cams, bearings, just common things that would eventually go wrong. After putting the motor back in it ran great and instead of leaving it alone I relocated the battery to the trunk, it started again and stalled and since then it hasn't been getting fuel or spark. Could be something as simple as the engine fuse or a ground. I completely lost interest in working on it. It does have a big 16g turbo, front mount intercooler that needs piping to finish. The car also needs the passenger strut tower fixed(common on these cars, salt traps) The wheels in the picture are now gone because they were rotted so now I have junk steel rims on it to make it a roller....I am selling the car AS IS and is also for sale locally, so I have the right to end the auction at any time. If you have any questions, feel free to message me. Also I am not just gonna give this car away because I know what I have in it now and what the motor alone is worth.

Mitsubishi Eclipse for Sale

Mitsubishi eclipse gs(US $3,500.00)

Mitsubishi eclipse gs(US $3,500.00) 3dr cpe auto 3.8l cd 4-wheel abs 4-wheel disc brakes 5-speed a/t a/c cloth seats

3dr cpe auto 3.8l cd 4-wheel abs 4-wheel disc brakes 5-speed a/t a/c cloth seats 2007 mitsubishi eclipse se, black, one owner

2007 mitsubishi eclipse se, black, one owner We finance 2000 mitsubishi eclipse gt auto cleancarfax mroof cd pwrlcks/wndws v6(US $4,800.00)

We finance 2000 mitsubishi eclipse gt auto cleancarfax mroof cd pwrlcks/wndws v6(US $4,800.00) 2003 mitsubishi eclipse gts coupe 2-door 3.0l

2003 mitsubishi eclipse gts coupe 2-door 3.0l 2004 mitsubishi eclipse gts

2004 mitsubishi eclipse gts

Auto Services in New York

Whitesboro Frame & Body Svc ★★★★★

Used-Car Outlet ★★★★★

US Petroleum ★★★★★

Transitowne Misibushi ★★★★★

Transitowne Hyundai ★★★★★

Tirri Motor Cars ★★★★★

Auto blog

Mitsubishi Outlander PHEV faces longer delays, might not arrive until 2016

Thu, 22 May 2014It seems every time the Mitsubishi Outlander PHEV makes the news the information concerns a delay, and the reason always centers on its batteries. Four months ago the culprit was restricted battery supply from Lithium Energy Japan, pushing the arrival to 2015. This time it's no different, with Automotive News reporting that a battery-related request made by California state regulators will push the Outlander PHEV arrival back to "late 2015 or early 2016."

CA authorities want all plug-in hybrids to be fitted with a monitor for the lithium-ion batteries that will be on the lookout for degradation, the concern being that diminished batteries could change the vehicle's emissions. Getting the technology fitted and tested means something like a 16- to 22-month delay.

The extra time, however, should let Mitsubishi figure out what it's going to do about its battery supply since the current level of 4,000 per month isn't enough to support a US launch; the Automotive News article says Mitsubishi expects a volume of 63,000 plug-ins for 2016. The company hasn't said how it plans to make up the balance.

Japan calls Ghosn's escape inexcusable and vows tighter immigration checks

Sun, Jan 5 2020TOKYO ó Japan's justice minister on Sunday called the flight of former Nissan Chairman Carlos Ghosn as he awaited trial on financial misconduct charges inexcusable and vowed to beef up immigration checks. Justice Minister Masako Mori said she had ordered an investigation after Ghosn issued a statement a few days ago saying he was in Lebanon. She said there were no records of Ghosn's departure from Tokyo. She said his bail has been revoked, and Interpol had issued a wanted notice. Departure checks needed to be strengthened to prevent a recurrence, Mori said. While expressing deep regret over what had happened, Mori stopped short of outlining any specific action Japan might take to get Ghosn back. Japan does not have an extradition treaty with Lebanon. ¬ďOur nation¬ís criminal justice system protects the basic human rights of an individual and properly carries out appropriate procedures to disclose the truth of various cases, and the flight of a suspect while out on bail is never justified,¬Ē she said in a statement. Mori¬ís statement was the first public comment by a Japanese government official after the stunning escape of Ghosn, once a superstar of the auto industry. Tokyo prosecutors issued a similar statement Sunday. They had opposed Ghosn's release on bail, arguing he was a flight risk. First arrested in November 2018, Ghosn was out on bail over the last several months, and more recently had moved into a home in an upscale part of Tokyo. He has repeatedly said he was innocent. His statement from Beirut said he was escaping injustice. Japan's justice system has come under fire from human rights advocates for its long detentions, the reliance on confessions and prolonged trials. The conviction rate is higher than 99%. Even if Ghosn had been found innocent, the prosecutors could have appealed, and the appeals process could have lasted years. Ghosn's trial was not expected to start until April at the earliest. During that time, he had been prohibited from seeing his wife, and was only allowed a couple of video calls in the presence of a lawyer. Ghosn had been charged with underreporting his future compensation and breach of trust in diverting Nissan money for his personal gain. Although the details of his escape are not yet clear, Turkish airline company MNG Jet has said two of its planes were used illegally, first flying him from Osaka, Japan, to Istanbul, and then on to Beirut, where he arrived Monday and has not been seen since.

Mitsubishi drops two more teasers of new Outlander

Mon, Mar 23 2015Mitsubishi just keeps teasing the debut of the refreshed 2016 Outlander at the 2015 New York Auto Show on April 2. The Japanese brand already hinted at the updated CUV's look on the company's invitation to the event in the Big Apple. Now, it released an even clearer view of the front and the first official look at the crossover's rear. Debuting Mitsubishi's new design language, a shot of an Outlander waiting at port already revealed its new nose completely undisguised. The brand's latest teaser provides yet another glimpse at it and further confirms the X-shaped front end that's outlined in chrome. As with the rest of the updated styling, the rear also adapts the look of last year's Concept-S. The taillights are still separated into three bars, but here they stop at the tailgate in the center, rather than running all the way across like on the show car. Beyond just the refreshed styling, the 2016 Outlander has over 100 improvements, according to Mitsubishi, including NHV refinements, better handling and improved throttle response. We will get the full details about all of the tweaks in New York in just a few days. Related Video: MITSUBISHI MOTORS TO CONDUCT WORLD PREMIERE OF 2016 OUTLANDER AT THE NEW YORK INTERNATIONAL AUTO SHOW Mitsubishi Motors North America, Inc. (MMNA) is pleased to announce that it will make the world premiere of the 2016 Outlander during its press conference at the 2015 New York International Auto Show in the North Hall (booth 260) on Thursday, April 2, 2015 at 11:30a.m. ET. The 2016 Outlander will be the first Mitsubishi vehicle to debut the brand's new design language. The 2016 Outlander is a refined crossover utility vehicle that features over 100 engineering and design improvements including a new, powerful and dynamic appearance, enhanced road performance as the result of improvements to noise levels, ride, handling and throttle response, and a more eloquent yet functional interior space. The new 2016 Outlander demonstrates the brand's renewed emphasis on style, refinement and overall driving experience. For those who are unable to join Mitsubishi Motors in New York, the press conference will be internationally broadcast live. For details about the webcast please check media.mitsubishicars.com. Full 2016 Outlander details will be released at 11:30a.m. ET on April 2, 2015. About Mitsubishi Motors North America, Inc.