1998 Mitsubishi Eclipse on 2040-cars

Waretown, New Jersey, United States

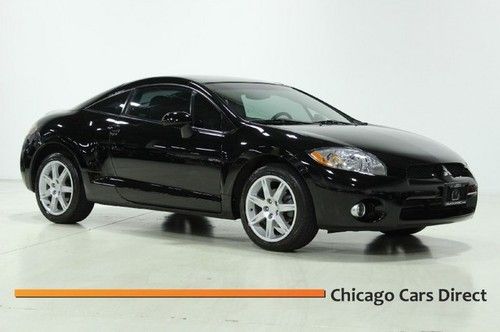

Body Type:Coupe

Engine:doc 2.01 16 valve

Vehicle Title:Clear

Fuel Type:Gasoline

For Sale By:Private Seller

Number of Cylinders: 4

Make: Mitsubishi

Model: Eclipse

Trim: base 2 dr coupe

Warranty: Vehicle does NOT have an existing warranty

Drive Type: FWD

Options: CD Player

Mileage: 144,401

Safety Features: Driver Airbag, Passenger Airbag

Sub Model: RS

Power Options: Air Conditioning

Exterior Color: Red

Interior Color: Tan

Up for sale is a 1998 Mitsubishi Eclipse RS .... car has some dents as shown in pics .. the car is an automatic..has a CD player..has AC..the car needs a headliner..the car does run good dependable..my daughter used car to go back and forth to school..Car is being Sold As Is Where Is..Buyer is responsible for pick up of vehicle..Car is also being listed locally.. Seller reserves right to end auction early..Thank you and God Bless

Mitsubishi Eclipse for Sale

2006 red gs!(US $8,977.00)

2006 red gs!(US $8,977.00) We finance 03 rs 2.4l clean carfax low miles cd stereo cloth bucket seats(US $6,000.00)

We finance 03 rs 2.4l clean carfax low miles cd stereo cloth bucket seats(US $6,000.00) 1991 mitsubishi eclipse gsx turbo awd super rare!! never modified! 5-speed(US $5,900.00)

1991 mitsubishi eclipse gsx turbo awd super rare!! never modified! 5-speed(US $5,900.00) 07 eclipse se coupe 2.4l leather moonroof auto 56k low miles one owner rare(US $12,995.00)

07 eclipse se coupe 2.4l leather moonroof auto 56k low miles one owner rare(US $12,995.00) 2006 mitsubishi eclipse gs hatchback 2-door 2.4l

2006 mitsubishi eclipse gs hatchback 2-door 2.4l 1997 mitsubishi eclipse gst hatchback 2-door 2.0l

1997 mitsubishi eclipse gst hatchback 2-door 2.0l

Auto Services in New Jersey

Vip Honda ★★★★★

Totowa Auto Works ★★★★★

Taylors Auto And Collision ★★★★★

Sunoco Auto Care ★★★★★

SR Recycling Inc ★★★★★

Robertiello`s Auto Body Works ★★★★★

Auto blog

FCA-Renault merger faces tall odds delivering on cost-cutting promises

Thu, May 30 2019FRANKFURT/DETROIT — Fiat Chrysler Automobiles and Renault promise huge savings from a mega-merger, but such combinations face tall odds because of the industry's long product cycles and problems translating deal blueprints into real world success, industry veterans told Reuters. BMW's 1994 purchase of Rover, and Daimler's 1998 merger with Chrysler both made sense on paper. The companies promised to hike profits by combining vehicle platforms and engine families. Both combinations proved unworkable in reality, and were unwound. Renault and Nissan, which have been in an alliance since 1999 designed to share vehicle components, have only managed to use common vehicle platforms in 35% of Nissan's products despite an original target of 70%, according to Morgan Stanley. FCA and Renault have raised the stakes for themselves by ruling out plant closures. That increases the pressure to achieve more than $5 billion in promised annual savings from pooling procurement and research investments. The two companies have yet to fill in many of the blanks in the merger plan put forward by Fiat Chrysler. Renault's board is expected to act soon to accept the proposal, but that would lead only to a memorandum of understanding to pursue detailed operational and financial plans. A final deal and the legal combination of the two companies could take months to complete if all goes well. Pressure to cut automotive pollution is driving the latest round of consolidation. Automakers are looking at multibillion-dollar bills to develop electric and hybrid cars and cleaner internal combustion engines. Fiat Chrysler and Renault are betting they can design common electric vehicle systems, then sell more of them through their respective brands and dealer networks, cutting the cost per car. Developing all-new electric vehicles can bring more opportunities to share costs from the outset, industry experts said. "With the emergence of connected, autonomous, electric and shared vehicles, carmakers face immediate investments, so new opportunities for sharing costs have emerged," said Elmar Kades, managing director at Alix Partners. However, most electric vehicles lose money. This is a challenge for city car brands in Europe in particular. Both Renault and Fiat rely heavily on this segment for sales.

Mitsubishi fuel economy scandal will result in $1.39 billion loss

Wed, Jun 22 2016The fuel economy scandal revealed a couple months ago will cost Mitsubishi Motors a pretty penny. According to The New York Times, the Japanese automaker predicted the fiscal year 2016 will result in a loss of 145 billion yen, or $1.39 billion. We won't know for sure until March rolls around. The prediction is even more striking when compared to Mitsubishi's performance during the last few years. It will be Mitsubishi's first reported loss in eight years. In 2014, Mitsubishi reported a global profit of $1.2 billion, which doubled the profits of the previous year, and in the spring of 2015 the US arm of the manufacturer reported its first profits in seven years – $4.18 million. For a little while there, it seemed like things were looking really good for Mitsubishi, but past flaws caught up with it. Some of the models built have had their fuel economy readings rounded by as much as 15 percent, due to the way running resistance is calculated in laboratory conditions. Nissan swept in to buy one third of Mitsubishi, and under the Renault-Nissan alliance it is likely Mitsubishi will be put on a crash course to clear its name and start turning a profit again. But the bad publicity caused by the scandal will probably mean it'll be far in the future. Related Video:

Nissan files civil suit against Ghosn, seeking $91 million in damages

Wed, Feb 12 2020TOKYO — Nissan filed a civil suit Wednesday seeking 10 billion yen ($91 million) in damages from the Japanese automaker's former Chairman Carlos Ghosn. Nissan filed the case in Yokohama District Court to recoup some of the monetary damages suffered, it said, “as a result of years of misconduct and fraudulent activity" by Ghosn. The claim was calculated by adding the costs from what Nissan called Ghosn's “corrupt practices,” such as rent for overseas property, use of corporate jets and payments to Ghosn's sister, as well as costs for the internal investigation into Ghosn's alleged wrongdoings. Representatives of Ghosn said in a statement they couldn't comment as they had yet to see the legal documents. “Nissan's maneuvers continue,” they said, while noting Nissan had claimed larger damages before. Ghosn, who led Nissan for two decades and saved it from near-bankruptcy, was arrested in Japan in November 2018, and charged with underreporting his future compensation and breach of trust in diverting Nissan money for personal gain. He was awaiting trial but skipped bail and showed up in Lebanon late last year. Japan has no extradition treaty with Lebanon, and he's unlikely to be arrested. A date had not been set for his trial, and Ghosn has said he was worried his ordeal would never end and he would not get a fair hearing. The bail conditions also barred him from seeing his wife. He has repeatedly lashed out at Japan's judicial system, where the conviction rate is higher than 99%. Japanese authorities recently issued an arrest warrant for Ghosn and three Americans, accused of helping his escape. Separately, they issued an arrest warrant for Ghosn's wife on suspicion of perjury. Ghosn has repeatedly said he is innocent, saying that the promised compensation had never been decided, and all the payments were for legitimate services. Wednesday's lawsuit by Nissan comes on top of the civil case Nissan filed against Ghosn in the British Virgin Islands in August last year. It alleged unauthorized payments, sought to regain a luxury yacht and pursued other damages, according to Nissan. Yokohama-based Nissan, which makes the Z sportscar, Leaf electric car and Infiniti luxury models, is also facing trial in Japan as a company in relation to Ghosn's scandal. It has indicated it will agree to any penalties. Nissan's reputation has been sorely tarnished over the Ghosn fiasco, and its sales have dropped. Nissan reports financial results Thursday.