1991 Mitsubishi 3000gt Vr-4 Coupe 2-door 3.0l on 2040-cars

Layton, Utah, United States

Vehicle Title:Clear

Transmission:Manual

Body Type:Coupe

Fuel Type:GAS

For Sale By:Private Seller

Sub Model: gt vr4

Make: Mitsubishi

Exterior Color: Yellow

Model: 3000GT

Interior Color: Tan

Trim: VR-4 Coupe 2-Door

Warranty: Vehicle does NOT have an existing warranty

Drive Type: AWD

Options: 4-Wheel Drive, Leather Seats, CD Player

Number of Cylinders: 6

Safety Features: Anti-Lock Brakes, Driver Airbag, Passenger Airbag

Power Options: Air Conditioning, Power Locks, Power Windows, Power Seats

Disability Equipped: No

Mileage: 114,000

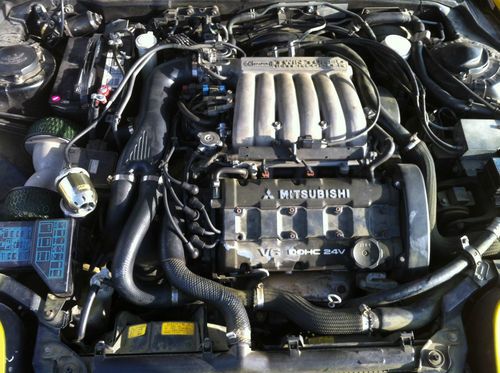

this is a 1991 Mitsubishi 3000gt VR4, twin turbo, dual exhaust, all wheel drive. it has very nice wheels on it, and the tires have a lot of good tread left on them. the car runs, and drives great, it passed safety and emissions last year when my dad registered it. this was my fathers vehicle, and he recently passed away, so I am trying to sell it for my mom. it has leather interior, which is in pretty good condition. we just put in a new stereo with a large display screen, with hands free blue tooth phone syncing capability.

Mitsubishi Evolution for Sale

2010 mitsubishi lancer es, one owner, black rims, mp3, spoiler, automatic(US $14,777.00)

2010 mitsubishi lancer es, one owner, black rims, mp3, spoiler, automatic(US $14,777.00) 08 mitsubishi evolution gsr 356 awhp!!!(US $23,600.00)

08 mitsubishi evolution gsr 356 awhp!!!(US $23,600.00) 1995 mitsubishi mirage, no reserve

1995 mitsubishi mirage, no reserve 2003 mitsubishi lancer es sedan 4-door 2.0l(US $4,700.00)

2003 mitsubishi lancer es sedan 4-door 2.0l(US $4,700.00) 1988 mitsubishi mirage turbo colt turbo

1988 mitsubishi mirage turbo colt turbo We finance!! fwd gt 2.4l cd leather grey(US $18,699.00)

We finance!! fwd gt 2.4l cd leather grey(US $18,699.00)

Auto Services in Utah

Wrenches ★★★★★

Tunex Orem ★★★★★

Terrace Muffler & Auto Repair ★★★★★

Ted`s Express Auto ★★★★★

Rocky Mountain Collision and Auto Painting ★★★★★

Rick Warner Body Shop ★★★★★

Auto blog

2018 Mitsubishi Eclipse Cross Quick Spin Review | Deserving of a clean slate

Wed, Apr 18 2018The 2018 Mitsubishi Eclipse Cross is named after a sport compact coupe, which was iconic to some and a sad reminder of its brand's slide into irrelevance to most others. That "Eclipse" is now attached to a compact SUV will likely cheese off the former and cause the latter to sarcastically mutter, "Yup, that seems about right." Mitsubishi's marketers would say it shares the old Eclipse's "reputation for driving dynamics and technology." Do with that what you will. For now, though, let's put aside what it's called. Well, beyond the fact it's comically long to say and difficult to type (I started calling it the Eagle Talon Cross for those reasons). Because really, the name straps a whole load of baggage to a mostly clean-slate vehicle that in concept is actually a smart move by a brand trying to climb back to relevance. In size, it straddles the line between B- and C-segment compact SUVs. In shape and style, it's set apart from the more utilitarian entries of both. Under the hood, it provides torque-rich turbocharged grunt in contrast to meek naturally aspirated rivals. The ample ground clearance and standard all-wheel drive (on most trims) take a page from the Subaru playbook that's been moving the chains so well. As we discovered when we compared its specs to those of vaguely similar SUVs, the Eclipse Cross is far more intriguing and potentially competitive than originally thought. Perhaps it's unfair to the car itself, but besides all that baggage attached to its name, it's also saddled with the expectations of recent Mitsubishi products that have been uncompetitive, dull or just plain bad. (The i-Miev is the worst and most embarrassing car I've ever driven, and I've driven a Yugo.) In short, the Eclipse Cross warrants a clean-slate appraisal. Sure, it shares its wheelbase with Mitsubishi's two Outlander SUVs and certainly other components as well, but in appearance, touch and driving feel, the Eclipse Cross is profoundly different. This is immediately obvious in the cabin that's far more contemporary in appearance. If you think it looks a bit like the Lexus NX interior, you certainly wouldn't be alone, right down to its touchpad tech interface (more on that later). Materials quality is also strong, and not just in comparison to its brand mates, but to the compact SUV segment as a whole.

Mitsubishi Attrage brochure reveals additional looks, info

Thu, 23 May 2013If you're keen to get a closer look at the upcoming Mitsubishi Attrage global sedan, we've got good news for you. A handful of brochure images have made their way to the web courtesy of IndianAutosBlog.com, complete with driveline details. The compact car looks to have its teeth set on taking a chunk out of the Nissan Versa. The Attrage will launch in Thailand with a 1.2-liter three-cylinder engine good for 76 horsepower coupled to either a five-speed manual transmission or a continuously variable transmission. The combination should yield a range of around 570 miles with an 11 gallon tank. We'll save you the math: that's over 50 miles per gallon, though we wouldn't be surprised to see a more powerful, less efficient engine show up on the US-spec model. Buyers can also enjoy snazzy 15-inch alloy wheels.

Expect to find a rearview camera, push-button start, Bluetooth audio and automatic climate control indoors. This information gives us a pretty good idea of what we can expect from the car once it touches down here in the US, though final details - including powertrain - remain likely to change somewhat.

Mitsubishi exec says Evo 'will be replaced in spirit' by high-po hybrid SUV

Thu, 02 Oct 2014Stop us if you've heard this one: According to Autocar, the current generation will be the last Mitsubishi Evolution we will ever see.

That, while unfortunate for driving enthusiasts, is a reality we've had plenty of time to digest. The days of wanton fuel burning for the sake of speed and power will soon come to an end. But that doesn't mean the days of performance have to die, too. "Green is still fun to drive," said Mitsubishi UK boss Lance Bradley in a conversation with Autocar. "It's a challenge to make it fun, but not a particularly difficult one. Electric vehicle performance is very good."

So, should we expect a new hybrid sedan to take up the mantle left by the Evo? Not so much. The British magazine quotes Kanenori Okamoto of Mitsubishi as saying, "It will be replaced in spirit by an SUV with high performance," which will apparently incorporate lessons learned in the automaker's efforts at Pikes Peak. The Mitsubishi MiEV Evolution III, which handily broke the EV record at the famed mountain course, will donate much of its high-performance, zero-emissions technology to the project, including its Super All Wheel Control four-wheel-drive system.