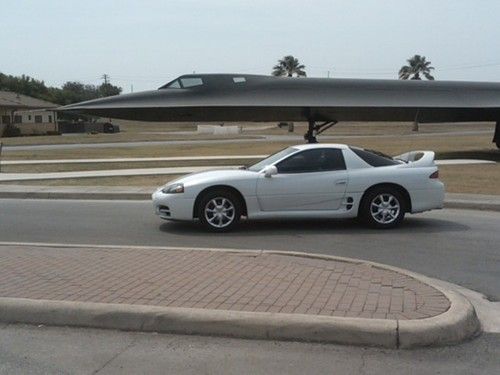

1997 Mitsubishi 3000gt Base Coupe 2-door 3.0l on 2040-cars

Fountain Valley, California, United States

Fuel Type:GAS

Transmission:Automatic

Vehicle Title:Clear

Engine:3.0L 2972CC 181Cu. In. V6 GAS SOHC Naturally Aspirated

For Sale By:Dealer

Exterior Color: White

Interior Color: Tan

Number of Doors: 2

Year: 1997

Options: Cassette Player, Leather Seats, CD Player

Model: 3000GT

Safety Features: Driver Airbag, Passenger Airbag

Trim: Base Coupe 2-Door

Power Options: Air Conditioning, Cruise Control, Power Locks, Power Windows

Drive Type: FWD

Warranty: Vehicle does NOT have an existing warranty

Mileage: 142,368

Nice and clean vehicle. Very rare. Original miles. A beautiful California car. Surprise your gf or bf with this hotty!

Mitsubishi 3000GT for Sale

1994 ferrari like mitsubishi 3000gt sl coupe 2-door 3.0l(US $1,700.00)

1994 ferrari like mitsubishi 3000gt sl coupe 2-door 3.0l(US $1,700.00) 1998 mitsubishi 3000 gt sl(US $8,700.00)

1998 mitsubishi 3000 gt sl(US $8,700.00) 1994 mitsubishi 3000gt vr-4 *rolling shell, chassis*(US $4,100.00)

1994 mitsubishi 3000gt vr-4 *rolling shell, chassis*(US $4,100.00) 1993 mitsubishi 3000 gt vr4(US $6,900.00)

1993 mitsubishi 3000 gt vr4(US $6,900.00) 1995 mitsubishi 3000gt spyder vr-4 convertible 2-door 3.0l(US $18,500.00)

1995 mitsubishi 3000gt spyder vr-4 convertible 2-door 3.0l(US $18,500.00) 1999 mitsubishi 3000 gt pearl white less than 66,000 excellant shape

1999 mitsubishi 3000 gt pearl white less than 66,000 excellant shape

Auto Services in California

Young`s Automotive ★★★★★

Yas` Automotive ★★★★★

Wise Tire & Brake Co. Inc. ★★★★★

Wilson Motorsports ★★★★★

White Automotive ★★★★★

Wheeler`s Auto Service ★★★★★

Auto blog

Junkyard Gem: 1989 Mitsubishi Galant Sedan

Tue, Apr 21 2020The history of the Mitsubishi Galant in North America goes all the way back to the 1971 model year, when Chrysler imported the first-generation Galant and badged it as the Dodge Colt. Later in the 1970s, we got Galant coupes badged as Dodge Challengers and Plymouth Sapporos, and Mitsubishi began selling Galants (now with front-wheel-drive) with the company's own badging starting in the 1985 model year. The sixth-generation Galant arrived here for the 1989 model year, as a stylish and technology-packed competitor to the Taurus, Camry, and Accord, and it made a fair-sized splash in the automotive world. You'd have a tough time finding one of these cars today, but this '89 appeared in a self-service yard in Phoenix a couple of months back and I was there to document it. 159,385 miles is a respectable total for a 1980s car, and this one looks clean enough to indicate that it had conscientious owners for most of its 31-year life. Check out the dual analog trip counters, the sort of cool little feature Mitsubishi did so well during this era. One of this car's owners (probably its final owner) applied glue-on bling to many locations inside the car. A fairly typical Japanese sedan interior for the late 1980s and early 1990s, though a bit flashier than what Toyota and Honda were doing at the time. The base Galant sedan listed at $10,971 in 1989, versus $12,400 for a Ford Taurus L sedan, $12,105 for a base Chevrolet Celebrity sedan, $11,488 for a base Toyota Camry sedan, and $11,770 for a Honda Accord DX sedan. That was a good price for a competent and fuel-efficient sedan with a modicum of sportiness. Power came from a 2.0-liter 4G63 Sirius four-cylinder rated at 102 horsepower. This engine went into a list of vehicles longer than a Mitsubishi HIIB rocket, everything from the Eclipse to the Great Wall Coolbear, and you can buy a brand-new BAW BJ2022 Brave Warrior with 4G63 power to this day. Protected by the Nassau County PBA and Radio Shack. This car must have begun its career in New York, then moved to Arizona. Some Americans still bought midsize sedans with manual transmissions during this era, but their numbers were in steep decline (Ford stopped selling three-pedal Tauruses, other than the SHO after 1988). This car has an automatic, though I have found a bullet-riddled '91 Galant with a 5-speed during my junkyard travels. This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings.

Mechanic bagged by red light camera at 3AM driving customer car

Mon, Dec 8 2014This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings. An Oregon woman took her 2001 Mitsubishi Montero to Steve's Imports in Portland to have the emissions system fixed; the business, however, is a repair and body shop that doesn't appear to specialize in emissions. After paying $2,299.05 for the fix she got a call from the shop informing her that a repairman had been caught on camera running a red light, so she should expect a ticket. When the ticket came, the image with it was the one above, taken at 2:59 AM. The shop's owner, Steve Spinnett, said the man in the car is his son, Tommy Spinnett, who is the shop foreman. The woman is a "family friend" that Tommy was picking up from a concert. Steve told KVAL news that his son had the car all weekend to put it through a drive cycle, and that the shop doesn't charge for drive cycles done after hours. Even if all of that is true, drive cycles don't take a whole weekend - a thorough emissions-test drive cycle can be done in a couple of hours. And then there's this: the owner needed to pass the emissions test to get new license plates; the ones on the vehicle that Tommy drove over the weekend were expired. We've written about some egregious instances of customer abuse at the hands of dealership and repair shops, but this isn't one of them. But it looks bad and it's suspicious, and everyone involved might want to be more careful next time. You'll find more details on the incident in the video.

Mitsubishi Engelberg Tourer concept is a 4WD plug-in hybrid

Tue, Mar 5 2019Mitsubishi has finally taken the wraps off its strangely named Engelberg Tourer crossover concept in Geneva, revealing a twin-motor, four-wheel-drive plug-in hybrid with some nifty off-road capabilities and connected-car technology. Named for a Swiss ski resort famous for its unmarked, backcountry terrain, the Engelberg Tourer is a sporty-looking crossover that could preview a new Outlander. It features plenty of side creasing, an upright front end, interesting running lights and that unique roof box cap with integrated fog lamps and highly reflective strips of chrome along the sides. Mitsubishi says the crossover has an all-electric range of more than 70 kilometers, or around 43 miles, at least on the European WLTP cycle, and a combined gasoline-electric range of more than 700 km (435 miles). The Engelberg — users will inevitably make comparisons to the singer Engelbert Humperdinck, as does Google's autofill function — benefits from established and advanced Mitsubishi technologies. It uses the twin-motor PHEV system developed for the Outlander PHEV and improves it, with high-efficiency motors at the front and rear axles and a 2.4-liter gasoline engine in a series hybrid setup, acting as a generator. It uses active yaw control first developed for the Lancer Evolution series to split torque between the front and rear wheels, or between the front wheels alone, and matches it with a super all-wheel control system to improve performance and stability. The concept also features improved anti-lock braking at each wheel and active stability control to reduce wheel slip on snow-covered roads. The onboard navigation system takes the destination entered by the driver and factors in weather, temperature, topography, traffic and road conditions to choose the ideal drive mode and tailor torque split through drive battery management and the super all-wheel control system. Inside, Mitsubishi fashioned a spacious interior bedecked in white panels and seating material and black contrasts. There's also a roof box that houses fog lamps and front and rear bumper under guards. Mitsubishi also is demonstrating the Dendo Drive House, its version of a vehicle-to-home system that allows electric or plug-in hybrid vehicles to generate, store and share energy with a home. Mitsubishi says the service will be offered through dealerships in Japan and Europe later this year. Related Video: