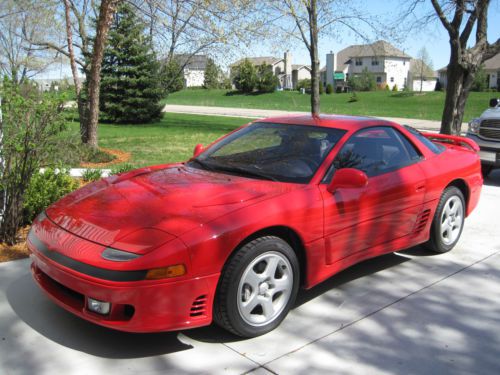

1995 Mitsubishi 3000gt Base Coupe 2-door 3.0l on 2040-cars

San Francisco, California, United States

Mitsubishi 3000GT for Sale

Auto Services in California

Z Auto Sales & Leasing ★★★★★

X-treme Auto Care ★★★★★

Wrona`s Quality Auto Repair ★★★★★

Woody`s Truck & Auto Body ★★★★★

Winter Chevrolet - Honda ★★★★★

Western Towing ★★★★★

Auto blog

Mitsubishi prices 2014 Outlander from $22,995*

Sat, 30 Mar 2013Mitsubishi will gladly sell you a 2014 Outlander ES for $22,995, excluding an $835 destination fee. Buyers can step up to the middle-tier Outlander SE for $23,795, or around $200 less than last year. That stack of cash will net you 18-inch aluminum wheels, a 6.1-inch LCD information display, dual-zone climate control and other goodies. Somewhat more impressively, Mitsubishi has cut the price tag for the Outlander GT by $800. That machine will run you $27,795, and throws in a more potent V6 engine, the company's Super All-Wheel Control system and HID headlamps.

The 2014 Outlander bows with an all-new exterior design, and base models receive a 166-horsepowr 2.4-liter four-cylinder paired with a continuously variable transmission and an all-wheel-drive system. That driveline is good for 24 miles per gallon city and 29 mpg highway. Check out the full pricing press release below and our own Jonathon Ramsey's first drive here.

2017 Mitsubishi Model Year Preview and Updates

Fri, Mar 3 2017This ain't your father's Mitsubishi. And for those focused more on 'economy' than 'Evo', that's probably a good thing. The Evolution is no more, Mitsubishi's truck-tough Montero is no longer sold in the States, and the Mirage sedan and hatch serve as little more than price holders in a constricted lineup. With that, sales are up and Mitsubishi is working hard on a revamp of its entire lineup. The newest addition comes this fall in the form of a small crossover, the 2018 Eclipse Cross, pictured above. MITSUBISHI i-MIEV: The least expensive EV available in the US market obtains an optional navigation package. The nav unit includes a seven-inch touch screen, Fuse hands-free link, USB port, rearview camera and steering wheel controls. LANCER: The Lancer lives, albeit without the mojo intrinsic to the high-performance Evo, now discontinued. For '17 a rear camera is standard on the small four door, along with new wheels and an optional Sun and Sound package. MIRAGE: Mitsu's entry-level hatch and sedan receive an aggressive refresh for 2017, with an enhanced exterior (new front fascia, hood, grille and wheels), a bump in horsepower and improved suspension. Also, two new colors are added: Wine Red and Sunrise Orange. OUTLANDER SPORT: While awaiting an all-new Sport, Mitsubishi's compact crossover adds automatic climate control, upgraded seat fabric and – as announced at this year's Chicago Auto Show – a Limited Edition trim. OUTLANDER: Mitsubishi's large three-row crossover receives a new, entry-level All-Wheel Control 4WD system and enhanced technology.

Mitsubishi showing off 473-hp Lancer Evo X Concept Final at Tokyo Auto Salon

Mon, Dec 29 2014We know from the head of Mitsubishi USA that the special edition Lancer Evo X coming next June will be a five-speed GSR model with more horsepower, a tweaked suspension and some additional fancy "bits and pieces." We didn't expect to be this, the Mitsubishi Lancer Evolution X Final Concept with an ECU tune and new HKS turbo making its 2.0-liter engine good for 473 horsepower. That's 183 more ponies than the stock model. Based on a five-speed GSR, on top of that power boost it gets larger intakes and intercoolers, an upgraded cooling system and exhaust, an adjustable suspension from HKS and 19-inch Rays forged wheels. The finish is a mix of matte and gloss black, and chrome trim. Actually, we still don't expect the special edition we'll get to mimic the Evo X Final Concept; rather, we think this black beauty is a full-fat showcase for the Tokyo Auto Salon, where the Evo X Final Concept will be shown. It's a tantalizing could-have-been, and now that we've seen what Mitsu can do with the Lancer Evo when it cares just a little, we hope our that end-of-series special isn't too disappointing by comparison.

1997 mitsubishi 3000gt vr-4 coupe 2-door 3.0l

1997 mitsubishi 3000gt vr-4 coupe 2-door 3.0l 1992 mitsubishi 3000gt vr-4 coupe 2-door 3.0l

1992 mitsubishi 3000gt vr-4 coupe 2-door 3.0l 1992 mitsubishi 3000gt vr-4 coupe 2-door 3.0l twin turbo awd rear wheel steering

1992 mitsubishi 3000gt vr-4 coupe 2-door 3.0l twin turbo awd rear wheel steering 1993 - mitsubishi-3000gt vr-4

1993 - mitsubishi-3000gt vr-4 1992 - mitsubishi-3000gt vr-4

1992 - mitsubishi-3000gt vr-4 1995 mitsubishi: 3000gt

1995 mitsubishi: 3000gt