1993 - Mitsubishi-3000gt Vr-4 on 2040-cars

Rochester, New York, United States

|

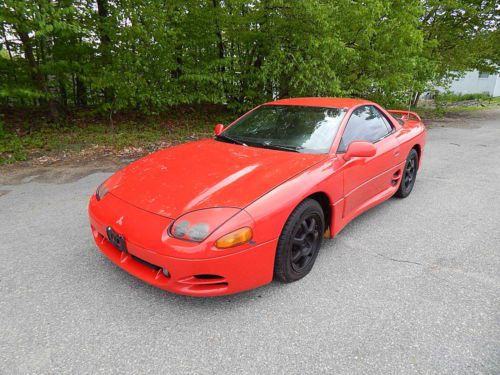

Up for auction is beautiful 1993 Mitsubishi 3000 GT VR4 Twin Turbo All-wheel drive , All Wheel St erring , 2-door coupe sports car. Truly one of a kind rare 3000 gt VR4 Twin Turbo in excellent looking,and running condition,with 77,200 miles only.VIN # . ja3bn74k1py029189.This car is very strong,and very fast.Runs,and drive perfect.Tires 255/40/18 Michelin Pilot with 70% trade.Tinning belt service by Mitsubishi dealer on 72 K.New wires,and laser iridium spark plugs,and gaskets,new front calipers.KN filter,and valve cover.New driver,and passenger window regulator's.A/C on this car was change to R-134,from R-12.Silver tinted windows with front and back logo,Viper alarm,with kyles entry.Drilled,and slotted rotors,with new brake pads.Custom floor mats.New short 5 speed shifter,and knob.Front,and rears seats,with front and rear panels from 99 3000gt,and also rear spoiler.ECM was rebuild .This car is All Stock. Must see it .Every thing was done on this car was done three year ago,and cast me over $6,000.00 to made this car like you see,in EXCELLENT almost new condition.I have for most upgrade's and services receipt's.ATTENTION: Also the full amount for this car have to be made ONLY BY CASH,or USPS Money Order's PS:Please no emails,only phone calls (585)387-9914. Kris

|

Mitsubishi 3000GT for Sale

1992 - mitsubishi-3000gt vr-4

1992 - mitsubishi-3000gt vr-4 1995 mitsubishi: 3000gt(US $6,900.00)

1995 mitsubishi: 3000gt(US $6,900.00) 1993 mitsubishi 3000gt base coupe 2-door 3.0l(US $3,500.00)

1993 mitsubishi 3000gt base coupe 2-door 3.0l(US $3,500.00) 1992 mitsubishi 3000gt vr-4 coupe 2-door 3.0l(US $6,500.00)

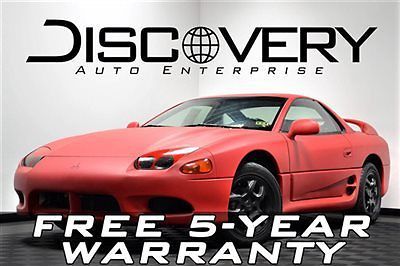

1992 mitsubishi 3000gt vr-4 coupe 2-door 3.0l(US $6,500.00) *3000gt* free 5-yr warranty / shipping! v6 auto alloys must see!(US $8,995.00)

*3000gt* free 5-yr warranty / shipping! v6 auto alloys must see!(US $8,995.00) 1995 mitsubishi 3000gt base coupe 2-door 3.0l

1995 mitsubishi 3000gt base coupe 2-door 3.0l

Auto Services in New York

Willowdale Body & Fender Repair ★★★★★

Vision Automotive Group ★★★★★

Vern`s Auto Body & Sales Inc ★★★★★

Valvoline Instant Oil Change ★★★★★

Valanca Auto Concepts ★★★★★

V & F Auto Body Of Keyport ★★★★★

Auto blog

NHTSA releases updated Takata airbag recalled cars list, but it still has errors

Wed, 22 Oct 2014

Unfortunately, the government's list still contains errors.

The National Highway Traffic Safety Administration has issued an updated list of vehicle models that it's urging owners to repair under the mushrooming Takata airbag inflator recall. The latest version adds vehicles from new automakers like Subaru and Ford that are missing from the original announcement, and it also removes erroneous entries from General Motors, leaving only the 2005 Saab 9-2X (a reskinned Subaru WRX), and the 2003-2005 Pontiac Vibe, a joint project with Toyota.

Mitsubishi's first US chairman since 2007 charged with revitalizing brand

Fri, 02 Nov 2012Have a look at Mitsubishi North America's vehicle page and you'll find seven cars in four model lines: i-MiEV electric hatch, Lancer sedan, Lancer Evolution and Sportback, Outlander and Outlander Sport, and Galant sedan. The Galant has 3.9 tires in the automotive grave, and the only hope for mainstream excitement, the Eclipse coupe and Spyder, had hemlock poured down their crankcases last year. Increasing the quotient of bleak, the Lancer isn't due for a refresh until 2014, the coming Outlander PHEV will sell in miniscule numbers when it does arrive, a little sports car has been nixed and the only other Mitsu being considered for our landmass is the Colt, which, for its stellar fuel economy numbers, looks like a car designed by Pikachu. There's also that matter of declining NA market share in a rising overall market, Mitsubishi's piece of the total pie currently hovering around the 0.4-percent mark according to Automotive News.

The company has decided to do more about it, reassigning Executive Vice President and Head Officer of the Headquarters Product Projects & Strategy Group Gayu Uesugi to be the new chairman of Mitsubishi Motors North America. It will be the first time in five years that someone has filled the chairman position at MMNA.

The hope is that with Uesugi's 35 years with the company, his experience in the company's global product plan and his success in emerging market strategy, he's the man to "[develop] a product plan and growth strategy for the US market" that will put things right. Or at least better. He will work with Yoichi Yokozawa, who has been CEO of MMNA since last year. There are more details on the move in the press release below.

Small 3-row crossover SUVs specifications compared on paper

Thu, May 10 2018There's no shortage of three-row vehicles on the market for carrying seven or more people and their stuff wherever they all need to go. Just about every car company has at least one large crossover or traditional SUV with three rows of seats, and there are still plenty of minivans to pick from. But most of these vehicles are large, pricey, and frequently thirsty. Fortunately, there are still a handful of smaller crossovers that deliver 7-passenger capability in a smaller, cheaper package. We've gathered four of the small three-row set here to compare them based on space, power, fuel economy, pricing, and more. They include the very old Dodge Journey, the slightly less old Mitsubishi Outlander and Kia Sorento, and the relatively new Volkswagen Tiguan. You can see the raw numbers in the chart below, followed by a more detailed breakdown and some notes on how we like each of these vehicles. For in-depth opinions on the vehicles, be sure to check out our full reviews, and if you want to compare these with other vehicles, try out our comparison tools. Engines, transmissions and performance Interestingly, three of the four crossovers here utilize similar engines for their four-cylinder offerings. The Dodge, Kia and Mitsubishi all feature naturally aspirated 2.4-liter four-cylinder engines. Only the Volkswagen Tiguan chooses turbocharging and a smaller 2.0-liter displacement. But because of its turbocharger, the Tiguan's four-cylinder is easily the most potent, making a healthy 221 pound-feet of torque, which is more than 40 more than the Sorento, the crossover with the next most torque. The VW is also second-most powerful, just one horse behind the Sorento. The Outlander is the least powerful in the four-cylinder class. The Journey is only barely better, but it will probably feel as slow or worse thanks to its ancient 4-speed automatic. The four-cylinder Sorento and Outlander each have 6-speed automatic transmissions, and the VW has an 8-speed. The Sorento with a V6 has an 8-speed, too. View 17 Photos Moving up to the V6 class, the Outlander is once again at the bottom. It actually makes less torque than the turbo VW Tiguan. The Journey and Sorento are almost perfectly matched. The Journey makes a bit more torque; the Sorento makes a bit more power. The Journey also gets upgraded to a 6-speed automatic. Another powertrain consideration to bare in mind is whether all-wheel-drive is necessary.