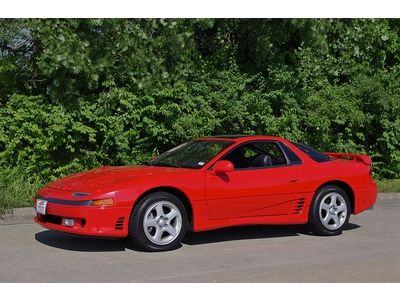

1992 Mitsubishi 3000gt Vr-4 Coupe 2-door 3.0l on 2040-cars

Toms River, New Jersey, United States

Mitsubishi 3000GT for Sale

18 thousand original mile 1 owner mitsubishi 3000gt vr4 leather & roof awd

18 thousand original mile 1 owner mitsubishi 3000gt vr4 leather & roof awd 1994 mitsubishi 3000gt vr4(US $6,000.00)

1994 mitsubishi 3000gt vr4(US $6,000.00) 1994 mitsubishi 3000gt base coupe 2-door 3.0l, manual trans, green(US $3,150.00)

1994 mitsubishi 3000gt base coupe 2-door 3.0l, manual trans, green(US $3,150.00) 1994 mitsubushi 3000 gt

1994 mitsubushi 3000 gt 1995 mitsubishi 3000gt(US $2,200.00)

1995 mitsubishi 3000gt(US $2,200.00) Low original mileage - vr-4 twin turbo - extremely clean

Low original mileage - vr-4 twin turbo - extremely clean

Auto Services in New Jersey

Vip Honda ★★★★★

Totowa Auto Works ★★★★★

Taylors Auto And Collision ★★★★★

Sunoco Auto Care ★★★★★

SR Recycling Inc ★★★★★

Robertiello`s Auto Body Works ★★★★★

Auto blog

A car writer's year in new vehicles [w/video]

Thu, Dec 18 2014Christmas is only a week away. The New Year is just around the corner. As 2014 draws to a close, I'm not the only one taking stock of the year that's we're almost shut of. Depending on who you are or what you do, the end of the year can bring to mind tax bills, school semesters or scheduling dental appointments. For me, for the last eight or nine years, at least a small part of this transitory time is occupied with recalling the cars I've driven over the preceding 12 months. Since I started writing about and reviewing cars in 2006, I've done an uneven job of tracking every vehicle I've been in, each year. Last year I made a resolution to be better about it, and the result is a spreadsheet with model names, dates, notes and some basic facts and figures. Armed with this basic data and a yen for year-end stories, I figured it would be interesting to parse the figures and quantify my year in cars in a way I'd never done before. The results are, well, they're a little bizarre, honestly. And I think they'll affect how I approach this gig in 2015. {C} My tally for the year is 68 cars, as of this writing. Before the calendar flips to 2015 it'll be as high as 73. Let me give you a tiny bit of background about how automotive journalists typically get cars to test. There are basically two pools of vehicles I drive on a regular basis: media fleet vehicles and those available on "first drive" programs. The latter group is pretty self-explanatory. Journalists are gathered in one location (sometimes local, sometimes far-flung) with a new model(s), there's usually a day of driving, then we report back to you with our impressions. Media fleet vehicles are different. These are distributed to publications and individual journalists far and wide, and the test period goes from a few days to a week or more. Whereas first drives almost always result in a piece of review content, fleet loans only sometimes do. Other times they serve to give context about brands, segments, technology and the like, to editors and writers. So, adding up the loans I've had out of the press fleet and things I've driven at events, my tally for the year is 68 cars, as of this writing. Before the calendar flips to 2015, it'll be as high as 73. At one of the buff books like Car and Driver or Motor Trend, reviewers might rotate through five cars a week, or more. I know that number sounds high, but as best I can tell, it's pretty average for the full-time professionals in this business.

Nissan ex-chief Carlos Ghosn cancels hastily arranged Tokyo press conference

Fri, Jun 28 2019TOKYO — Former Nissan boss Carlos Ghosn on Friday abruptly canceled plans for what would have been his first press conference since his arrest in November, after journalists had been notified about a briefing just two hours earlier. Ghosn's lawyers called to cancel the event that was to be held at the Foreign Correspondents' Club of Japan (FCCJ), but did not immediately give a reason for the abrupt change, an official at the FCCJ told Reuters.Automotive News cited a source as saying his family and media team staged a "last-minute intervention" to get him to call off plans to make his case at the press conference, fearing he would be faced with questions he couldn't answer without tipping his legal team's strategy, or that Japanese prosecutors would take a dim view of him publicly criticizing their actions and attempt to revoke his bail. A spokesman for the Ghosn family in Tokyo did not answer his mobile phone and did not immediately respond to an emailed request for comment. If the conference had not been canceled, Ghosn would have spoken as Japanese Prime Minister Shinzo Abe hosts national leaders at the G20 leaders gathering in Osaka, including U.S. President Donald Trump and French President Emmanuel Macron, who Ghosn's wife Carole have called on to raise the issue of her husband's treatment by Japan's courts. In May a Japanese court dismissed an appeal by Ghosn to ease a bail restriction that bans him from contacting his wife and rejected a subsequent request to allow him a one-off monitored meeting with Carole. His lawyers have argued that that condition violates Japan's constitution and international law on family separations. Ghosn's movements are also monitored and he is only allowed internet access from a computer at his lawyer's office that records the activity for the court. Once among the world's most feted auto executives, Ghosn is awaiting trial in Japan over charges including enriching himself at a cost of $5 million to Nissan, in a scandal which has rocked the industry and exposed tensions in the automaking partnership between Nissan and Renault SA. Since his initial arrest in November last year, Ghosn has been charged four times for crimes which also include underreporting his Nissan salary and temporarily transferring personal financial losses to his employer's books during his time at the helm of Japan's No. 2 automaker.

Japan plans real-world diesel emissions test after companies fail

Fri, Mar 4 2016Japan's transport ministry plans to start real-world diesel emissions tests after an experiment found four models from Toyota, Nissan, and Mitsubishi that produced more nitrogen oxide (NOx) emissions than the nation's rules allow, according to The Japan Times. Regulators there usually only perform emissions checks in the lab. The VW diesel scandal has everyone double-checking their figures. Diesel versions of the Toyota Hiace van, Land Cruiser Prado, and Nissan X-Trail produced up to 10 times more NOx than allowed. The Mitsubishi Delica D:5 was up to five times over the limit, The Wall Street Journal reports. There was no evidence of defeat devices in the vehicles. Mazda performed well in the experiment, though. The CX-5 passed with nearly the same results on the road and in the lab. The Demio, better known as the Mazda2, did nearly as well with only slighter higher figures in the real world than in the controlled setting. The experimenters theorized the reason for the excessive emissions was that cold weather caused the engines' software to shut off the exhaust gas recirculation to prevent damage, according to the WSJ. However, this behavior also increased NOx production. Toyota, Nissan, and Mitsubishi don't have to worry about punishment from the transport ministry because this check was just an experiment. Their models already passed the mandated lab tests, which was the only requirement, according to The Japan Times. As governments begin greater real-world emissions tests, the results suggests diesels aren't very clean. A recent check in France found models from Ford, Renault, and Mercedes-Benz that didn't perform up to the standards. Regulators in India conducted similar evaluations and ordered VW to recall over 300,000 vehicles. Related Video: