Mitsubishi 3000GT for Sale

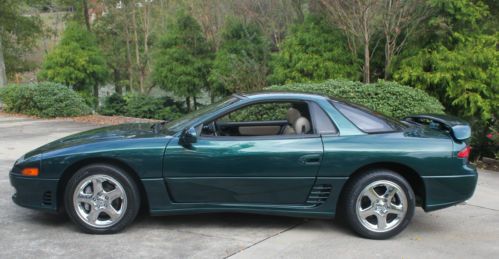

1999 mitsubishi 3000gt sl coupe 2-door 3.0l

1999 mitsubishi 3000gt sl coupe 2-door 3.0l 1993 mitsubishi 3000gt vr-4 ***barter or trade options***(US $6,000.00)

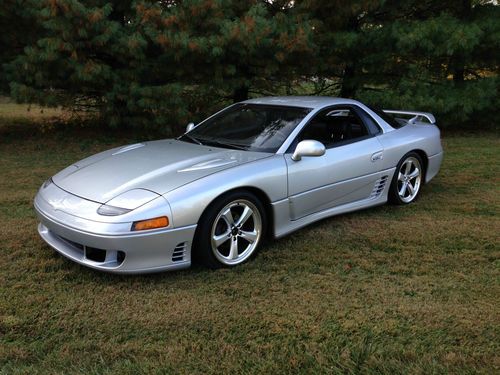

1993 mitsubishi 3000gt vr-4 ***barter or trade options***(US $6,000.00) 1992 mitsubishi 3000 gt adult owned and driven, amazing car!!!!!!!!(US $6,000.00)

1992 mitsubishi 3000 gt adult owned and driven, amazing car!!!!!!!!(US $6,000.00) 1992 mitsubishi 3000gt base coupe 2-door 3.0l

1992 mitsubishi 3000gt base coupe 2-door 3.0l 3000gt vr-4 coupe 2-door(US $2,800.00)

3000gt vr-4 coupe 2-door(US $2,800.00) 1991 mitsubishi 3000gt vr-4 coupe 2-door 3.0l twin turbo 5 speed(US $8,700.00)

1991 mitsubishi 3000gt vr-4 coupe 2-door 3.0l twin turbo 5 speed(US $8,700.00)

Auto blog

Why a Renault-FCA merger could be good news for Nissan, Mitsubishi

Fri, May 31 2019TOKYO — Nissan's advanced technologies including platforms and electric powertrains could give it leverage in a merger involving Renault and Fiat Chrysler, thanks to a royalty system it has with the former, two people with knowledge of the matter said. A merged Renault-Fiat Chrysler could face an extra hurdle each time it uses technology developed by Nissan or Mitsubishi Motors, while the two Japanese automakers stand to gain a client in Fiat Chrysler (FCA), one of the people said. Both sources declined to be identified because of the sensitivity of the matter. Nissan's technology, particularly in electrification and emissions reduction, could give it some sway in the $35 billion potential tie-up between Renault and FCA, even as its stake in the newly formed company would be diluted. Currently Renault SA pays less for technology developed by Nissan than the Japanese automaker pays for French technology, a third person said. This has long been a sticking point for Nissan, and an area where Nissan could seek more favorable terms. "Whenever Nissan transfers platform, powertrain or other technology to Renault, there is a margin or royalty which Renault has to pay for use of that tech," one of the people said. "In that sense, FCA, if everything went well, would become another 'client' of ours and that's good. More business for us." A Nissan spokesman declined to comment on its royalty system. The potential Renault-FCA deal has complicated the Japanese automaker's already uneasy alliance with Renault. A further deal with Fiat Chrysler looks likely at least in the near term to weaken Nissan's influence in the 20-year-old partnership. Renault owns a 43.4% stake in Nissan and is its top shareholder. Nissan holds a 15% non-voting stake in Renault and would see that diluted to 7.5% after the FCA deal, albeit with voting rights. The imbalance between the two has long rankled Nissan, which is by far the larger company. Alliance imbalance Renault had previously angled for a merger with Nissan but has been rebuffed by CEO Hiroto Saikawa. Securing benefits from the merger deal will be important for Saikawa, who is grappling with poor financial performance while he struggles to right the company after the ouster of former chairman Carlos Ghosn last year.

Recharge Wrap-up: Japan supports hydrogen, Fools against fuel cells, BlueIndy controversy

Wed, Jun 25 2014Japan hopes to expand the use of hydrogen energy by subsidizing fuel cell vehicles, according to The Japan News. The trade ministry plans to include the subsidies in its 2015 budget to coincide with the expected launch of Toyota's Fuel Cell Vehicle and the Honda FCEV hydrogen car. By jump-starting purchases of hydrogen cars, Japan hopes that innovation and mass-production will get a boost and the cost of fuel cell vehicles will be competitive with gasoline-powered models by the year 2025. Japan plans to have 100 hydrogen fueling locations operating by March 2016, and wants to halve the cost of building those stations by 2020. The amount of the subsidies has not yet been set. Investing website The Motley Fool isn't quite as optimistic as Japan about hydrogen cars, and is instead bullish about Tesla Motors. The Fool points to Tesla's strong stock performance, and predicts future growth will come from more car models in the future - starting with the Model X - as well as the company's proposed Gigafactory for manufacturing batteries. If Tesla's charging technology continues to catch on, that only improves its financial prospects. The article has some harsh words, however, for hydrogen: "Fuel cells are an inferior automotive technology and for fundamental efficiency, cost, and infrastructure reasons always will be mere compliance gimmicks." Yeesh. As part of a program to build charging stations for the Indianapolis EV carsharing service BlueIndy, utility company Indianapolis Power & Light (IPL) wants to raise its electricity rates an average of 44 cents a month per residential customer to help pay for its share of the project. State consumer advocacy agency Indiana Office of Utility Consumer Counselor and consumer watchdog group Citizens Action Coalition oppose the plan, according to Greenfield, Indiana's Daily Reporter. The BlueIndy program, which is a partnership between the city of Indianapolis and battery manufacturer Bollore Group, will provide up to 500 cars for rent at 25 charging sites around the city. Those who oppose the rate hike call IPL a monopoly and say the amount of the increase is not allowed under state law and that the program wouldn't benefit working class and low-income citizens. A hearing regarding IPL's proposal is scheduled for July 23. A Mitsubishi Outlander PHEV will run the 2014 Asia Cross Country Rally, Hybrid Cars reports. The rally covers 1,367 miles of woods, swamps and mountains from Thailand to Cambodia.

Facts point to legal violations by Carlos Ghosn, says Nissan external review

Thu, Mar 28 2019YOKOHAMA, Japan — An external committee reviewing governance at Nissan Motor Co said on Wednesday there were enough facts to suspect violations of laws and the private use of company funds by ousted chairman Carlos Ghosn. Following a three-month audit of Nissan's governance after a scandal that shook the global auto industry, the committee put the blame squarely on what it called Ghosn's concentration of power. It also acknowledged Nissan CEO Hiroto Saikawa's role in Ghosn's salary arrangement at the heart of the scandal. Twenty years to the day since French automaker Renault SA agreed to rescue Nissan, the committee described a corporate culture at Nissan "in which no one can make any objections to Mr. Ghosn," who was "in a way deified within Nissan as a savior who had redeemed Nissan from collapse." A representative for Ghosn replied in a statement that the allegations made against the former Nissan chairman "will be revealed for what they are: part of an unsubstantiated smear campaign against Carlos Ghosn to prevent the integration of the Alliance and conceal Nissan's deteriorating performance." The group issued 38 recommendations to bolster Nissan's governance, including that top executive positions at the Japanese car maker should not be held by people serving in executive positions at Renault or junior partner Mitsubishi Motors. It also proposed that the majority of directors, including the chairman of the board, be independent, outside directors and that the role of company chairman be abolished. Responding to the committee's comments, Saikawa told reporters on Thursday that Nissan would seriously consider the committee's recommendations, which he characterized as "tough." Saikawa, who was speaking outside his home, did not specifically address his responsibility in the scandal but has previously said that top management, including himself, were responsible for weak governance which led to the misconduct. The recommendations from the external, seven-member committee came weeks after Nissan and Renault said they would retool their alliance, one of the world's biggest automaking groupings, to break up the all-powerful chairmanship previously held by Ghosn. "There are facts sufficient to suspect violations of laws and regulations, violation of internal rules and private use of company funds and expenses ... by Mr. Ghosn," the committee said in its report.