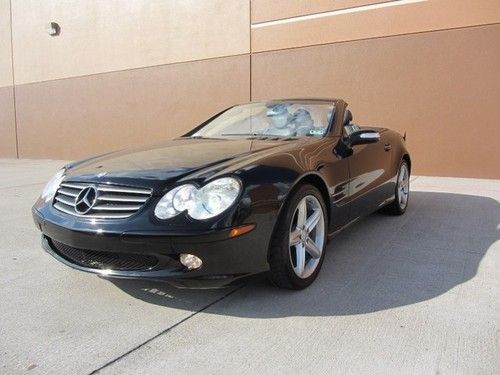

Sl500 Sport,pristine,keyless,navi,very Low Miles,heated,cooled Satellite on 2040-cars

Addison, Texas, United States

For Sale By:Dealer

Engine:5.0L 4966CC V8 GAS SOHC Naturally Aspirated

Body Type:Convertible

Transmission:Automatic

Fuel Type:GAS

Cab Type (For Trucks Only): Other

Make: Mercedes-Benz

Warranty: Vehicle does NOT have an existing warranty

Model: SL500

Trim: Base Convertible 2-Door

Disability Equipped: No

Drive Type: RWD

Doors: 2

Mileage: 34,339

Drive Train: Rear Wheel Drive

Sub Model: 5.0L

Number of Doors: 2

Exterior Color: Black

Interior Color: Gray

Number of Cylinders: 8

Mercedes-Benz SL-Class for Sale

1988 560sl mercedes benz(US $7,500.00)

1988 560sl mercedes benz(US $7,500.00) 1986 mercedes-benz 560sl roadster 65,625 miles collectible quality(US $19,995.00)

1986 mercedes-benz 560sl roadster 65,625 miles collectible quality(US $19,995.00) 2005 mercedes-benz sl 500~cabriolet~nav~htd/cold lea~hid~all options~only 49k(US $28,990.00)

2005 mercedes-benz sl 500~cabriolet~nav~htd/cold lea~hid~all options~only 49k(US $28,990.00) 1971 mercedes-benz sl-class 280 sl(US $65,000.00)

1971 mercedes-benz sl-class 280 sl(US $65,000.00) Low miles sl 55 convertible hard top nav amg wheels nav leather push go white

Low miles sl 55 convertible hard top nav amg wheels nav leather push go white 2005 mercedes-benz sl 500~cabriolet~nav~htd/lea~hid~all options~only 63k(US $27,990.00)

2005 mercedes-benz sl 500~cabriolet~nav~htd/lea~hid~all options~only 63k(US $27,990.00)

Auto Services in Texas

Whatley Motors ★★★★★

Westside Chevrolet ★★★★★

Westpark Auto ★★★★★

WE BUY CARS ★★★★★

Waco Hyundai ★★★★★

Victorymotorcars ★★★★★

Auto blog

Online Find of the Day: Lexus-engined Mercedes pickup is a vintage hybrid

Tue, 16 Sep 2014You have to love someone who gets incredibly committed to a very weird idea. What you see for sale here is a right-hand drive 1971 Mercedes-Benz 220D in South Africa, but this old Mercedes is now converted into a pickup, complete with bed cover, and there's big secret under the hood, too.

The pickup conversion appears well done based on seller Sedgefield Classic Cars' photos. Even the tonneau cover fits well. You could almost believe that this Mercedes lived its life as a Chevrolet El Camino-like pickup from the very beginning.

However, the rear-quarters conversion might not be the weirdest thing about this Mercedes. The original diesel is gone from the engine bay in favor of a Lexus V8. It seems really odd to pop the hood and find a Japanese mill in this German car, but the photos make it look like a fairly well performed swap. So, bravo to the crazy thinking. According to the seller speaking to Autoblog by email, "as far as we can establish, this was done a few years ago, with all Lexus components."

Infiniti shows Q30 interior ahead of Frankfurt debut

Tue, Sep 1 2015Infiniti is supposed to debut the all-new Q30 hatchback at the 2015 Frankfurt Motor Show, but as the show is still a couple of weeks away and the company has elected to release yet another image, we aren't sure there'll be all that much to see come Sept. 15. With that in mind, then, we give you the first images of the entry-level hatch's cabin, and they're, um, wow. We knew the Q30 had a lot in common with the Mercedes-Benz A-Class but as these images show, this is far more than a common platform. The steering wheel, instrument cluster, switchgear, and shifter are direct from the Mercedes parts bin. From the looks of the images, the Q30 will even have a Mercedes-style key. This might not garner much attention in the budget ranks – take the Scion iA and Mazda2, for example – but this degree of parts sharing in the premium market is sure to raise some eyebrows. It's also a rather bewildering move for Infiniti. The company is, in effect, selling a Mercedes-Benz to any new customers it attracts. That'll certainly make a Q50 a hard sell when it comes time for an upgrade. Now, in Infiniti's defense, there are some differences in the layout here. The triple nozzle-style HVAC vents have been replaced with a more conventional pair of outlets, and the instrument cluster hood extends over the built-in navigation screen. That design decision, in particular, will certainly appeal to critics of the tacked-on-tablet look offered by Mercedes. The analog buttons for the multimedia system have also been tweaked, with the result looking far cleaner than the mess of buttons offered on Mercedes' products (we wouldn't be shocked to see this layout arrive on a facelifted A-, CLA-, or GLA-Class in the near future, though). Beyond those changes, though, there are multiple Mercedes design hallmarks here, including the location of the controls for the seat adjustments. You can check out the Q30's cabin in both right- and left-hand drive varieties courtesy of the images above. And for comparison's sake, we also included our most recent gallery of the Mercedes-Benz GLA-Class at the bottom of the page. Have a look and be sure to scroll down for the official press release. September 1, 2015 Countdown Frankfurt: First ever Infiniti Q30 active compact opens its doors before world premiere ? Q30 – The first global Infiniti compact ? Q30 interior design echoes daring expression of exterior ?

Infiniti Q50 Red Sport 400 priced at $48,855, AWD at $50,855

Fri, Apr 8 2016Infiniti's most powerful production model, the new Q50 Red Sport 400, now has a starting price. You'll need at least $48,855 for the rear-drive model or $50,855 for all-wheel drive. (Both figures include the $905 destination charge.) A fully loaded, rear-drive Q50 RS400 with Direct Adaptive Steering, navigation, adaptive cruise control, a heated steering wheel, and Infiniti's entire alphabet soup of safety equipment, tops out at $57,045. (Again, add $2,000 for AWD). When it comes to rear-drive competition, the closest base price to the Q50 is the 320-hp BMW 340i. This German undercuts the Infiniti by two grand, $46,795 to $48,855. But the BMW outprices the Q50 as soon as you start selecting options. A 340i with similar equipment to a loaded Q50 Red Sport 400 costs just under $60,000. All-wheel-drive German competitors also lose out in the price war. Like with the rear-drive models, the BMW 340i xDrive undercuts the Q50 RS400 by around $2,000. Add the options, and the Infiniti becomes a better value. The other two big German rivals, the Audi S4 and Mercedes-Benz C450 AMG start at a higher price and only get more expensive. Technically the S4 starts cheaper than the Q50, but only with the standard manual transmission. Selecting the S-Tronic dual-clutch model kicks the price from $50,125 to $51,125, and going for the top-end Prestige trim will bump potential Audi owners up to $57,025. Throw on must-have S4 options, including adaptive cruise control, adaptive dampers, and a sport differential and you'll be shell out $64,425 for the Audi. The Mercedes-Benz C450 AMG is the priciest choice in this group, starting at $51,725, or roughly $900 more than a base Q50 RS400 with AWD. Options, again, are the downfall here. Building a C450 to match a loaded Infiniti will drive the Mercedes' price up to $64,315. While it occupies something of a weird space relative to these vehicles, it's also worth mentioning the Cadillac CTS VSport. It's the only car in this impromptu pricing comparo that can outgun the Q50, with its 3.6-liter, twin-turbo V6 good for 420 hp and 430 lb-ft of torque. It also starts at $60,950, although that includes plenty of standard equipment. All this means that the Q50 Red Sport 400 represents a relative value. It packs more power than the Germans – 80 more than the 340i, 67 more than the S4, and 38 more than the C450 – and a more comprehensive list of options, too.