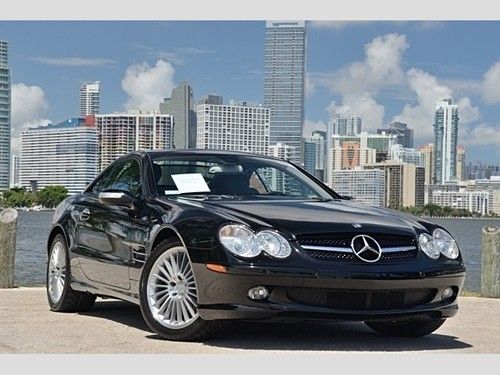

2006 Mercedes-benz Sl500 Automatic 2-door Convertible on 2040-cars

Miami, Florida, United States

For Sale By:Dealer

Engine:5.0L 4966CC V8 GAS SOHC Naturally Aspirated

Body Type:Convertible

Fuel Type:GAS

Transmission:Automatic

Warranty: Full

Make: Mercedes-Benz

Model: SL500

Trim: Base Convertible 2-Door

Doors: 2

Fuel: Gasoline

Drive Type: RWD

Drivetrain: RWD

Mileage: 44,812

Number of Doors: 2

Sub Model: SL500

Exterior Color: Black

Number of Cylinders: 8

Interior Color: Black

Mercedes-Benz SL-Class for Sale

Free shipping warranty sl55 cheap fast k40 radar clean convertible pano navi amg(US $17,250.00)

Free shipping warranty sl55 cheap fast k40 radar clean convertible pano navi amg(US $17,250.00) 1994 mercedes benz sl600 sl-class v12 r129 needs tlc project clear title

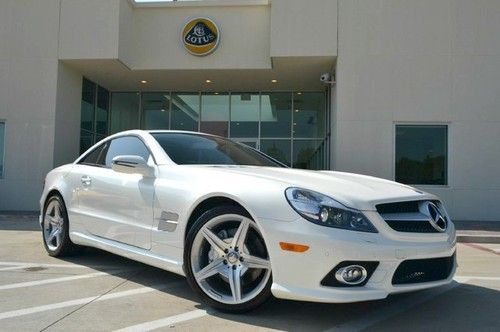

1994 mercedes benz sl600 sl-class v12 r129 needs tlc project clear title Premium 1 package panoramic roof sport wheel package(US $69,900.00)

Premium 1 package panoramic roof sport wheel package(US $69,900.00)

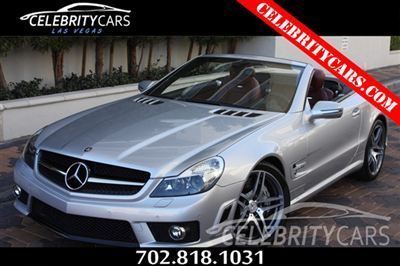

2009 mercedes benz sl63 amg "silver arrow" 1 of 100 excellent condition(US $82,500.00)

2009 mercedes benz sl63 amg "silver arrow" 1 of 100 excellent condition(US $82,500.00) 1959 mercedes-benz 190sl roadster california car fully restored(US $305,000.00)

1959 mercedes-benz 190sl roadster california car fully restored(US $305,000.00)

Auto Services in Florida

Wildwood Tire Co. ★★★★★

Wholesale Performance Transmission Inc ★★★★★

Wally`s Garage ★★★★★

Universal Body Co ★★★★★

Tony On Wheels Inc ★★★★★

Tom`s Upholstery ★★★★★

Auto blog

BMW negotiates Daimler alliance, buys out car-service partner Sixt

Mon, Jan 29 2018Sixt sells its stake in DriveNow car-sharing to BMW BMW in talks with Daimler to combine car-sharing Combining car-sharing business to aid robotaxi plans FRANKFURT — Germany's BMW has bought out partner Sixt from their joint venture DriveNow, paving the way for a broader car-sharing and driverless taxi alliance with Daimler to compete against Uber and Lyft. Car rental company Sixt said on Monday it would generate an extraordinary pre-tax profit of about 200 million euros ($248 million) in 2018 from the sale of the DriveNow stake to BMW for 209 million euros. "With DriveNow as a wholly-owned subsidiary, we have all options for continued strategic development of our services," said Peter Schwarzenbauer, BMW's board member for Digital Business Innovation. "Our experience with mobility services supports our development of future autonomous, electrified and connected fleets," he said, adding that BMW aims to have 100 million customers for "premium mobility services" by 2025. The Sixt deal comes as BMW moves closer to a deal to combine its car-sharing services with Daimler's Car2Go, a person familiar with the discussions told Reuters last week. The German carmakers want to build a joint business that includes car sharing, ride-hailing, electric vehicle charging, and digital parking services, a senior executive at one of the companies said on Monday. Mercedes-Benz parent Daimler and BMW declined comment on the status of potential talks on their car-sharing business. "This is speculation, we do not comment," BMW said. The senior executive, who declined to be named because the plan is not public, said: "This will create an ecosystem which can also be used for managing robotaxi (driverless taxi) fleets." BMW would contribute its ParkNow and ChargeNow businesses to the common company, the executive said, adding that there were still differences of opinion over the valuation of Car2Go. The market for ride-hailing services currently makes up around 33 percent of the global taxi market, and could grow eightfold to $285 billion by 2030, once autonomous robotaxis are in operation, Goldman Sachs said in a recent research note. BMW and Daimler are now working on developing autonomous cars, vehicles which could enable them to up-end the market for taxi and ride-hailing services.

8 cars we're most looking forward to driving in 2015

Mon, Jan 5 2015Now that 2014 is officially in the books, it's time to look ahead. And following our list of the cars we liked best last year, we're now setting our sights at the hot new metal that's coming our way in 2015. Some of these, we've already seen. And some are still set to debut during the 2015 auto show season. But these are the machines that keep us going – the things on the horizon that we're particularly stoked to drive, and drive hard. Jeep Renegade Not the Chevrolet Corvette Z06. Not the Ford Mustang GT350. Not the new John Cooper Works Mini. Nope, I'm looking forward to the adorable, trail-rated Jeep Renegade. And that's because I really, really, really like our long-term Jeep Cherokee Trailhawk. I do not, however, care too much for the Cherokee's looks, and I really don't like its $38,059 price tag. The Renegade Trailhawk, meanwhile, promises much of the same rough-and-tumble character as its big brother, but at what we expect will be a more reasonable price (I'm personally wagering on the baby Jeep's off-road model starting at no more than $23,000). With a 2.4-liter four-cylinder and a nine-speed automatic, it should also be a bit easier to fill than the V6-powered Cherokee. Also, I can't help but love the way the Renegade looks. It's like someone took a Wrangler, squished it by 50 percent and then handed it off to George Clinton for a healthy dose of funk. The interior, with its bright, expressive trims and color schemes should also be a really nice place to spend some time. I'll be attending the Renegade's launch later this month, so I'll have a much shorter wait than my colleagues. Here's hoping the baby Jeep lives up to my expectations. – Brandon Turkus Associate Editor Mazda MX-5 Miata Here's an uncomfortable truth: I'd rather spend a day driving a properly sorted Mazda MX-5 Miata of any generation on a winding road than I would nearly any other vehicle, regardless of power, price or prestige. It's not just that I prize top-down driving and enjoy the Miata's small size because it gives me more road to play with. I just find there's more motoring joy to be had with high-fidelity handling and an uncorrupted car-to-driver communication loop than I do with face-distorting power or grip – let alone valet-stand gravitas. But perhaps most of all, I love Miatas because they can deliver that level of feedback and driver reward at modest speeds that won't put the locals on edge or endanger lives – you can use more of the car more of the time.

Mercedes-Petronas AMG W04 launched to little fanfare, lots of pressure [w/video]

Tue, 05 Feb 2013No indoor cocktail hour for the launch of the W04, the newest chassis built by the Mercedes AMG Petronas Formula One team. Instead, Nico Rosberg and Lewis Hamilton spent a morning in photo and video sessions at the track in Jerez, Spain then paused a moment to introduce the car. The team will want the W04 to demonstrate the World Championship credentials of the team personnel and one of the team drivers, instead of the mostly humble performances we've seen over the past three years.

The W04 has been fitted with a new five-element front wing, pushrod front and pull-rod rear suspension, a second-generation Coanda exhaust and an "aggressively packaged" rear end. A small vanity panel, à la Infiniti Red Bull's RB9, covers the stepped nose.

Team principal Ross Brawn has called it "a clear step forward in design and detail sophistication," but as much as we truly respect Brawn's abilities and achievements, we heard him say similar things about the updated W03 last year before almost every race weekend from about mid-season. We really hope he's right this time, and so does the team's newest driver, Lewis Hamilton. We'll do our best to ignore the parallels of the Mercedes F1 team having signed a sponsorship deal with Blackberry, another company trying to find its way back to the top and still struggling, and just point you to the video below of the W04 in action.