1985 Mercedes Benz 280sl Roadster Rare Find Euro Edition Both Tops No Reserve on 2040-cars

Pompano Beach, Florida, United States

Body Type:Convertible

Engine:2.8 LITRE

Vehicle Title:Clear

Fuel Type:Gasoline

For Sale By:Dealer

Interior Color: TWO TONE GREY

Make: Mercedes-Benz

Number of Cylinders: 6

Model: SL-Class

Trim: EURO

Drive Type: REAR WHEEL DRIVE

Options: Leather Seats, CD Player, Convertible

Mileage: 126,000

Power Options: Air Conditioning, Power Windows

Sub Model: 280SL ROADSTER EURO EDITION

Exterior Color: ANTHRACITE GREY METALLIC

Mercedes-Benz SL-Class for Sale

Rare pewter grey, hardtop convertible. excellent condition with a rebuilt title(US $16,500.00)

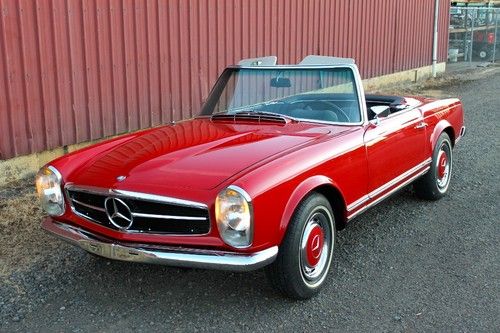

Rare pewter grey, hardtop convertible. excellent condition with a rebuilt title(US $16,500.00) 1968 mercedes-benz 280sl, 4-speed, rare european car, fully restored!!

1968 mercedes-benz 280sl, 4-speed, rare european car, fully restored!! 1964 230 sl w113 euro-pagoda(US $24,000.00)

1964 230 sl w113 euro-pagoda(US $24,000.00) 1991 mercedes benz 500sl red on black(US $7,700.00)

1991 mercedes benz 500sl red on black(US $7,700.00) Mercedes sl 500 hardtop(US $1,500.00)

Mercedes sl 500 hardtop(US $1,500.00) 1976 mercedes 450sl - two owner original, ready for the open road !!

1976 mercedes 450sl - two owner original, ready for the open road !!

Auto Services in Florida

Yogi`s Tire Shop Inc ★★★★★

Window Graphics ★★★★★

West Palm Beach Kia ★★★★★

Wekiva Auto Body ★★★★★

Value Tire Royal Palm Beach ★★★★★

Valu Auto Care Center ★★★★★

Auto blog

Poor headlights cause 40 cars to miss IIHS Top Safety Pick rating

Mon, Aug 6 2018Over the past few months, we've noticed a number of cars and SUVs that have come incredibly close to earning one of the IIHS's highest accolades, the Top Safety Pick rating. They have great crash test scores and solid automatic emergency braking and forward collision warning systems. What trips them up is headlights. That got us wondering, how many vehicles are there that are coming up short because they don't have headlights that meet the organization's criteria for an "Acceptable" or "Good" rating. This is a revision made after 2017, a year in which headlights weren't factored in for this specific award. This is also why why some vehicles, such as the Ford F-150, might have had the award last year, but have lost it for this year. We reached out to someone at IIHS to find out. He responded with the following car models. Depending on how you count, a whopping 40 models crash well enough to receive the rating, but don't get it because their headlights are either "Poor" or "Marginal." We say depending on how you count because the IIHS actual counts truck body styles differently, and the Infiniti Q70 is a special case. Apparently the version of the Q70 that has good headlights doesn't have adequate forward collision prevention technology. And the one that has good forward collision tech doesn't have good enough headlights. We've provided the entire list of vehicles below in alphabetical order. Interestingly, it seems the Volkswagen Group is having the most difficulty providing good headlights with its otherwise safe cars. It had the most models on the list at 9 split between Audi and Volkswagen. GM is next in line with 7 models. It is worth noting again that though these vehicles have subpar headlights and don't quite earn Top Safety Pick awards, that doesn't mean they're unsafe. They all score well enough in crash testing and forward collision prevention that they would get the coveted award if the lights were better.

Mercedes-Benz working on S-Class EV in accelerated green car lineup?

Mon, Mar 10 2014With Mercedes-Benz bringing out coupe and plug-in hybrid versions of its S-Class sedan, the German automaker just may follow through with a battery-electric variant as well. That's what the company's Uwe Ernstberger told the folks at Top Gear during the Geneva Motor Show. And while he noted the company still needs to work in a larger-than-usual battery pack and was less than specific with details, he did envision an all-electric S-Class "in the future." Of course, rumors started bubbling about an EV S-Class as far back as 2011, so we'll see. Christian Bokich, department manager for product and technology communications for Mercedes-Benz USA, would not confirm anything about an electric S-Class, but he did give AutoblogGreen an official rundown of MB's upcoming green cars in the US, starting with the launch of the all-electric B-Class ED in July of this year in the ZEV states (launch details for other states are TBA, he said). An S-Class plug-in hybrid is coming in the first half of 2015, followed by a C-Class PHEV closer towards the end of that year in the USA. There is also a C-Class four-cylinder BlueTEC coming at some point in 2016. Until we get more concrete information about the possible S-Class EV, let's review what we know about the PHEV. Last September, Mercedes-Benz started showing off the plug-in hybrid S-Class, saying that it could go as far as 19 miles on electric power alone and had a preliminary fuel efficiency rating of more than 78 miles per gallon, using the more lenient European driving cycle. Earlier this week, Mercedes showed off its S-Class Coupe. That model's US version will have a twin-turbocharged V8 that kicks in 449 horsepower, a few more than the presumptive S-Class EV will have. Ernstberger also said Mercedes would join the ranks of automakers offering autonomous driving systems and mentioned the S-Class as being at the "top of the movement." He held his tongue when asked about the possibility of an S-Class cabriolet.

Highlights from the Goodwood Festival of Speed, including the McLaren P1 and a Ford Transit running the hill

Mon, 15 Jul 2013The sole purpose of this post is as a time-waster, and since you shouldn't have to work to waste time, we've done it for you. In the numerous videos below you'll find cars that have lately been in the news tramping all over the grounds of Lord March's estate in Goodwood, England.

There's the McLaren P1 heading up the hill, the Jaguar Project 7, then a casually-driven Porsche 917 followed by an even-more-casually-driven Porsche 956, topped off by a Porsche 936 that is anything but casually driven. The next round is the flame-spitting Peugeot 405 T16 Pikes Peak from Climb Dance, a camera mounted on the Peugeot RCZ R after it showing you what the whole, uninterrupted run up the hill looks like. For a real head-turner, we couldn't embed it but there's Andy Reid blasting up the hill in a Ford Transit Supervan with a Cosworth 3000 V6 engine.

The modern racing contingent has Allan McNish doing the hill in the Audi R18 e-tron quattro he used to win Le Mans and Lewis Hamilton making lots of tire smoke in the Mercedes-AMG Petronas MGP-W02. For comparison, that's followed by Nick Heidfeld's record-setting run up the hill in 1999 in the McLaren MP4/14 . The classic racing contingent is headlined by 71-year-old Giacomo Agostini on an MV Agusta.