2004 Mercedes-benz C230 Kompressor Sedan 4-door 1.8l on 2040-cars

Orlando, Florida, United States

|

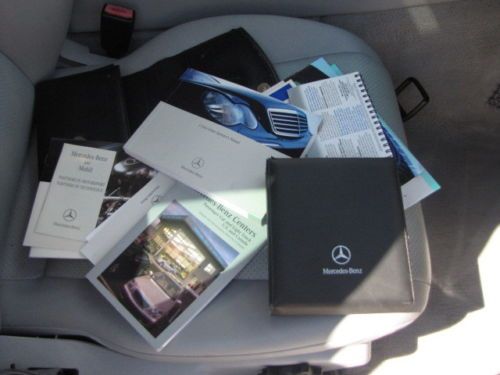

2004 MERCEDES BENZ C230 KOMPRESSOR SPORT SEDAN, IN IMMACULATE CONDITIONS, LUXURY 4D SPORT SEDAN WITH ONLY 111XXX HIGHWAY MILES, THIS CAR LOOKS AND RUN AS A BRAND NEW, COLD AC, KEYLESS ENTRY, POWER WINDOWS, POWER LOCKS, POWER SEATS, RECENTLY SERVICED BY A CERTIFICATED MERCEDES BENZ SHOP, THIS CAR NEEDS NOTHING!!! SE HABLA ESPA~NOL CALL OR TXT 407-7387588 |

Mercedes-Benz C-Class for Sale

3.0l v6 luxury package navigation harman kardon sound sunroof leather

3.0l v6 luxury package navigation harman kardon sound sunroof leather 2001 mercedes c320 bankruptcy seizure-virginia

2001 mercedes c320 bankruptcy seizure-virginia 2010 c300 sport 4matic 4x4 leather/amg front bumper/moon/heated/salvage/rebuilt

2010 c300 sport 4matic 4x4 leather/amg front bumper/moon/heated/salvage/rebuilt 2007 mercedes c28 4matic

2007 mercedes c28 4matic 2008 mercedes benz c300 sport 18" amg wheels(US $24,500.00)

2008 mercedes benz c300 sport 18" amg wheels(US $24,500.00) 2004 mercedes-benz c230 kompressor sedan 4-door 1.8l supercharged rwd

2004 mercedes-benz c230 kompressor sedan 4-door 1.8l supercharged rwd

Auto Services in Florida

Xtreme Car Installation ★★★★★

White Ford Company Inc ★★★★★

Wheel Innovations & Wheel Repair ★★★★★

West Orange Automotive ★★★★★

Wally`s Garage ★★★★★

VIP Car Wash ★★★★★

Auto blog

Daimler rebuffs Geely offer to buy stake

Wed, Nov 29 2017HONG KONG/BEIJING - Daimler AG has turned down an offer from China's Geely to take a stake of up to 5 percent via a discounted share placement, as the German automaker has long been reluctant to see existing shareholdings diluted, sources with knowledge of the talks said. A stake of that size would be worth $4.5 billion at current market prices. Although Daimler declined the offer, it told Geely it was welcome to buy shares in the open market, the sources added. Carmakers in China have embarked on a flurry of dealmaking, as they scramble to boost production of electric and plug-in hybrid vehicles ahead of tough new quotas to be imposed by Beijing, which wants to reduce urban smog and lower the country's reliance on oil. People with knowledge of Geely's thinking said the company was keen to access Daimler's electric car battery technology and wanted to establish an electric car joint venture in Wuhan, the capital of Hubei province. Geely, which also owns Swedish car maker Volvo, is still hopeful it can secure a deal in some form over the coming weeks, they added. The two automakers met in Beijing in recent weeks at Geely's behest. There, the Chinese firm, formally known as Zhejiang Geely Holding Group, offered to take a stake of between 3 percent and 5 percent if Daimler would issue new shares at a discount, the sources said. It was not immediately clear what kind of discount for the shares Geely had in mind or whether Geely was interested in buying the shares on the open market. A spokesman for Geely declined to comment. A spokesman for Daimler said the company was "very happy with our shareholder structure at present", but added that it would welcome new investors with a long-term interest in the company. Shares in Daimler were up 1 percent in early Wednesday trade, in line with the broader market.DAIMLER ALREADY TIED TO BAIC, BYD Geely, which has a market value of some $32 billion, is the leading domestic brand in China with a 5 percent market share, according to an analysis by Nomura Securities. A stake of 5 percent would establish it as Daimler's third-largest shareholder behind the Kuwait Investment Authority and BlackRock, who hold 6.8 percent and 6 percent respectively, according to Reuters data.

2014 Mercedes-Benz SLS AMG Black Series [w/video]

Fri, 15 Nov 2013The biggest misconception about the Mercedes-Benz SLS AMG Black Series is that it's simply a higher-performing version of the SLS GT - a closer look, or better yet, a few hot laps on a high-speed racing circuit, reveals that is anything but the case.

Launched in the States in mid-2011, the standard SLS GT is a 583-horsepower, all-aluminum, gull-wing coupe with performance that positions it near the top of the exotic segment. While the AMG team at Mercedes-Benz could have left it alone, their experience with the SLS AMG GT3 race car said there was room for improvement, so they devised the SLS Black Series. The transformation from SLS GT to SLS Black Series is extensive, with no fewer than 17 different significant enhancements.

The engine mapping, crankshaft, connecting rods, valve-train, intake, exhaust and cooling are all modified and the engine's redline bumps up from 7,200 to 8,000 rpm, which pushes output of the hand-built 6.3-liter V8 to 622 horsepower. The power steering receives a new ratio, a coil-over AMG Adaptive Performance suspension is installed along with underbody braces, the track is widened, two-piece carbon-ceramic brakes replace iron rotors at each corner and a lightweight titanium exhaust is fitted beneath. The AMG Speedshift seven-speed dual-clutch gearbox is modified and an electronically controlled AMG rear differential lock ensures the power goes to the pavement. Last on the mechanical upgrades are new lightweight forged wheels (10x19 inches front and 12x20 inches rear) wrapped in special R-compound Michelin Pilot Sport Cup tires.

Geely chairman is now the single biggest investor in Daimler

Fri, Feb 23 2018Li Shufu, the chairman and main owner of Chinese carmaker Geely, has built a stake of 9.69 percent in Daimler AG, the German carmaker said in a regulatory filing on Friday. The stake, worth nearly $9 billion at the current valuation for Daimler shares, makes Li the biggest single shareholder in the maker of Mercedes-Benz cars, trucks and vans headquartered in the German city of Stuttgart. A Daimler spokesman called the stake purchase a private investment by Li. "We are delighted, with Li Shufu, to have won over another long-term investor who is convinced of Daimler's innovative prowess, strategy and future potential," the spokesman said in response to a request for comment. "Daimler knows and respects Li Shufu as a Chinese entrepreneur of particular competence and forward thinking." Li's stake purchase makes him the top shareholder in Daimler ahead of the Kuwait Investment Authority, which owned 6.8 percent as of Sept. 30, according to Thomson Reuters data. Earlier this month, the German newspaper Bild am Sonntag reported that the Chinese industry giant was seeking to become Daimler's biggest shareholder, likely exceeding the 6.8-percent stake of the Kuwait Investment Authority. The paper said Daimler had reportedly turned down Geely's $4.5 billion offer for a 5-percent stake via a discounted share placement, saying that Geely could buy shares in the open market. Institutional investors currently own 70.7 percent of Daimler, and the company already has strong ties to Chinese automakers BAIC and BYD. Bild am Sonntag said the move was intended as a strategic alliance against Apple, Google and Amazon on autonomous and connected cars. And Reuters reported that Daimler wants to have bespoke "robo taxis" on the road quicker than Google's Waymo, and views Geely as a strong partner for that. Geely conversely is interested in Daimler's electric car battery technology, and sources quoted by the German paper say there are plans to establish joint electric car manufacturing in Wuhan, China, to meet China's smog-reducing quotas. Geely is developing the Lynk & Co. brand of electric and hybrid cars. Geely owns Volvo, which has enjoyed a renaissance under the arrangement, as well as the maker of London's black cabs. In December, it bought a stake in AB Volvo, the maker of Volvo trucks.