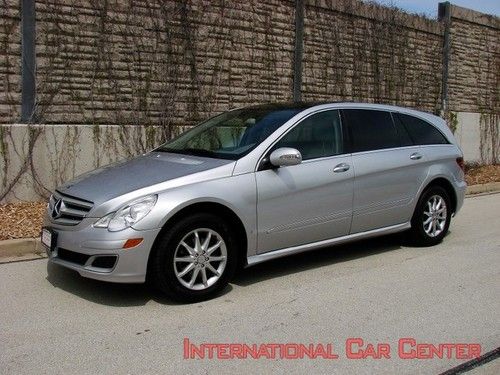

Navigation / Turbo Diesel / R-320 / Awd (4-matic) Cdi / 3rd Seat / No Reserve on 2040-cars

Waterbury, Connecticut, United States

Body Type:Minivan, Van

Vehicle Title:Clear

Engine:3.0

Fuel Type:Diesel

For Sale By:Dealer

Make: Mercedes-Benz

Model: R-Class

Warranty: Vehicle does NOT have an existing warranty

Trim: CDI

Options: Sunroof, 4-Wheel Drive, Leather Seats, CD Player

Drive Type: AWD

Safety Features: Anti-Lock Brakes, Driver Airbag, Passenger Airbag, Side Airbags

Mileage: 63,573

Power Options: Air Conditioning, Cruise Control, Power Locks, Power Windows, Power Seats

Exterior Color: Blue

Interior Color: Gray

Number of Cylinders: 6

Mercedes-Benz R-Class for Sale

R350 4matic low miles with nav / amg alloys / panaramic roof / heated seats /(US $36,990.00)

R350 4matic low miles with nav / amg alloys / panaramic roof / heated seats /(US $36,990.00) 2006 mercedes r350 awd panoramic roof navigation third row 6cd hk sound loaded!(US $16,980.00)

2006 mercedes r350 awd panoramic roof navigation third row 6cd hk sound loaded!(US $16,980.00) 2007 mercedes-benz r320 cdi wagon 4-door 3.0l(US $20,995.00)

2007 mercedes-benz r320 cdi wagon 4-door 3.0l(US $20,995.00) V8 r500 4-matic *super low miles* navigation - 3rd row - heated leather -sunroof

V8 r500 4-matic *super low miles* navigation - 3rd row - heated leather -sunroof 2010 mercedes benz r350 sport 4matic p1 pano heated seats navigation(US $35,444.00)

2010 mercedes benz r350 sport 4matic p1 pano heated seats navigation(US $35,444.00) Navigation - 3rd row seats - harmon /kardon premium sound - low miles -(US $17,990.00)

Navigation - 3rd row seats - harmon /kardon premium sound - low miles -(US $17,990.00)

Auto Services in Connecticut

Whitehall Auto Service Inc ★★★★★

Trasko`s Garage ★★★★★

Tire Shak ★★★★★

Tech Auto ★★★★★

Protech Automotive ★★★★★

People`s Auto LLC ★★★★★

Auto blog

Ultra-rare Maybach 57S Coupe ordered new by Moammar Gadhafi is for sale

Mon, Feb 1 2021One of Maybach's rarest 21st-century cars is for sale in Holland, and it owes its existence to one of the most controversial African leaders in recent history. Dutch exotic car dealer Auto Leitner listed a Xenatec-built Maybach 57S Cruisero coupe ordered and customized by Colonel Moammar Gadhafi but built after his death. Short-lived German coachbuilder Xenatec chose to start with the short-wheelbase 57 rather than with the longer and more stately 62. It didn't alter the sedan's length or wheelbase; instead, it created the Cruisero by extending the front doors, removing the rear doors, and adding more rake to the roof pillars. Several other minor visual tweaks set the coupe apart from the sedan, and the interior was given a more superficial makeover. Xenatec made no mechanical modifications, so power comes from an AMG-built 6.0-liter V12 twin-turbocharged to 604 horsepower and 738 pound-feet of torque. It spins the rear wheels via a five-speed automatic transmission. Although the coupe weighs 6,000 pounds, it takes five seconds to reach 60 miles per hour from a stop. The 57S Coupe was not a hefeweizen-fueled hack job haphazardly welded together in a shed. It was authorized by Daimler, and it was engineered to the same standards as the regular-production car. Executives were confident that they could sell 100 units to politicians, entrepreneurs, oligarchs, and other wealthy people around the world, but Xenatec filed for bankruptcy and closed after making only eight when one its main investors, a Saudi Arabia-based company named Auto Kingdom, abruptly stopped funneling money into the project. Gadhafi configured Auto Leitner's 57S Coupe, which was the fourth one built, and he should have taken delivery of it in 2012, but the Libyan Civil War that erupted in 2011 and ultimately led to his death on October 20 of that year derailed those plans. It was instead sold to another buyer whose identity is unknown. What's certain is that the person who ended up with Gadhafi's Maybach rarely drove it: its odometer shows about 1,429 miles. Highly optioned, this 57S is equipped with 20-inch wheels, soft-close doors, heated and massaging individual rear seats separated by a fridge, rear tray tables, front and rear air conditioning systems, a rear-seat entertainment system, and, for good measure a fire extinguisher.

Ferrari, Mercedes selling cars with faulty Takata airbags

Thu, Jul 21 2016According to the US Senate, a small group of automakers are still selling new cars with faulty Takata airbags. Automotive News reports that Ferrari's entire lineup and various Mercedes-Benz vehicles come with faulty airbags and are subject to being recalled by the end of 2018. US Senator Bill Nelson, (D-FL), claims the affected Ferrari models include: the 2016 to 2017 FF, California T, F12 Berlinetta, F12 TdF, 488 GTB, 488 Spider, and GTC4 Lusso. Mercedes-Benz is also in the mix with the 2016 Sprinter and 2016 to 2017 E-Class Coupe and Convertible. Automotive News reports that both Ferrari and Mercedes-Benz will require its dealers to notify buyers of a recall in the vehicles' future. The National Highway traffic Safety Administration claims the vehicles are legal to be sold, as the airbags are safe until exposed to high humidity for a significant period of time. With the majority of Ferrari drivers storing their vehicles in temperature-controlled garages, this shouldn't be troubling news. What is troubling, however, is that seven out of 17 automakers that Senator Nelson contacted admitted to putting defective Takata airbags into its new cars. Volkswagen, Fiat Chrysler Automobiles, and Toyota are a few automakers that still use Takata's faulty airbags. All have agreed to notify buyers of future recalls. Related Video: News Source: Automotive News-sub.req.Image Credit: Copyright 2015 Lorenzo Marcinno / AOL Government/Legal Recalls Ferrari Mercedes-Benz ferrari ff ferrari f12 berlinetta ferrari 488 gtb ferrari california t ferrari f12 tdf ferrari 488 spider ferrari gtc4 lusso

Recharge Wrap-up: Houston's bus revival, autonomous trucks on the Autobahn

Thu, Apr 7 2016A documentary shows how Houston, Texas significantly improved its outdated bus system. Called High Frequency: Why Houston is Back on the Bus, the short film describes how the city reimagined its bus system to become more efficient, more useful and more popular. Despite some opposition, the change has proven to be effective, with bus ridership up eight percent in three months, and light rail ridership up due to complementary bus routes. See the video above, and read more at CityLab. Automakers sent autonomous semi trucks on the German Autobahn as part of the European Truck Platooning Challenge of 2016. Mercedes-Benz, Volvo and Scania, among other groups, sent platoons of trucks between Stuttgart, Germany, and Rotterdam, Holland. In Mercedes's platoon of three trucks, the lead truck was fitted with lasers and other sensors to guide the convoy down the road. The two following trucks relied on vehicle-to-vehicle communication to trail 50 feet behind the lead, making room for cars to come between them and closing the gaps when able. The close following distance provides fuel economy gains of up to 10 percent in the rearward trucks on account of the reduction in drag. Read more at Hybrid Cars. Renault has reduced NOx emissions in its Euro 6b diesel vehicles in real world driving conditions. By improving its exhaust gas recirculation systems and NOx traps, nitrogen oxide emissions are cut in half on average, under certain driving conditions. The improvements will be included in vehicles leaving the factory beginning in July of 2016. Beginning in October, owners of Renault Euro 6b diesels can have the modifications added to their cars for free. Read more from Renault. Tata Technologies is creating an innovation lab in California to partner with EV technology companies. Having a tech center in California allows Tata to work on technologies that will largely be deployed in the company's main market of Asia. "Today, we are partnering with companies and startups who have aspirations to sell in China, but a lot of what they do is in California," says Samir Yajnik of Tata Technologies. Read more from The Economic Times. BMW's i Ventures is investing in mobility-as-a-service software provider RideCell. RideCell provides technology for services such as carsharing, ridesharing and other transit services. "The convergence of transportation trends in cities is of key importance to BMW," says Ulrich Quay, head of BMW i Ventures.