2013 Mb Gl63 Blk/blk Designo, Nav, Front Htd & Vented Seats, Keyless, Camera, on 2040-cars

Cleveland, Ohio, United States

Fuel Type:Gas

For Sale By:Dealer

Engine:8

Transmission:Automatic

Body Type:SUV

Make: Mercedes-Benz

Model: GL-Class

Disability Equipped: No

Mileage: 285

Doors: 4

Drivetrain: All Wheel Drive

Mercedes-Benz GL-Class for Sale

2012 mercedes benz gl550 4 matic navigation premium 2 pkg 1 owner clean carfax(US $68,900.00)

2012 mercedes benz gl550 4 matic navigation premium 2 pkg 1 owner clean carfax(US $68,900.00) 2008 mercedes-benz gl450~4matic~awd~p1~nav~htd lea~roofs~only 74k miles(US $25,990.00)

2008 mercedes-benz gl450~4matic~awd~p1~nav~htd lea~roofs~only 74k miles(US $25,990.00) Bluetec-diesel-$77k msrp-p2 pkg-htd/cool seats-full leather-1owner-warranty-wow(US $57,888.00)

Bluetec-diesel-$77k msrp-p2 pkg-htd/cool seats-full leather-1owner-warranty-wow(US $57,888.00) 2007 black mercedes 450gl suv w/warranty(US $23,900.00)

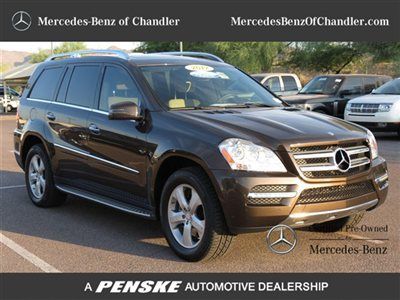

2007 black mercedes 450gl suv w/warranty(US $23,900.00) Call fleet 480 421 4530! p1 pckg/ trailer hitch/ full leather/ blind spot ast.(US $55,999.00)

Call fleet 480 421 4530! p1 pckg/ trailer hitch/ full leather/ blind spot ast.(US $55,999.00) 2009 mercedes-benz gl320 bluetec(US $33,900.00)

2009 mercedes-benz gl320 bluetec(US $33,900.00)

Auto Services in Ohio

Zerolift ★★★★★

Worthington Towing & Auto Care Inc ★★★★★

Why Pay More Motors ★★★★★

Wayne`s Auto Repair ★★★★★

Walt`s Auto Inc ★★★★★

Voss Collision Centre ★★★★★

Auto blog

Geely chairman is now the single biggest investor in Daimler

Fri, Feb 23 2018Li Shufu, the chairman and main owner of Chinese carmaker Geely, has built a stake of 9.69 percent in Daimler AG, the German carmaker said in a regulatory filing on Friday. The stake, worth nearly $9 billion at the current valuation for Daimler shares, makes Li the biggest single shareholder in the maker of Mercedes-Benz cars, trucks and vans headquartered in the German city of Stuttgart. A Daimler spokesman called the stake purchase a private investment by Li. "We are delighted, with Li Shufu, to have won over another long-term investor who is convinced of Daimler's innovative prowess, strategy and future potential," the spokesman said in response to a request for comment. "Daimler knows and respects Li Shufu as a Chinese entrepreneur of particular competence and forward thinking." Li's stake purchase makes him the top shareholder in Daimler ahead of the Kuwait Investment Authority, which owned 6.8 percent as of Sept. 30, according to Thomson Reuters data. Earlier this month, the German newspaper Bild am Sonntag reported that the Chinese industry giant was seeking to become Daimler's biggest shareholder, likely exceeding the 6.8-percent stake of the Kuwait Investment Authority. The paper said Daimler had reportedly turned down Geely's $4.5 billion offer for a 5-percent stake via a discounted share placement, saying that Geely could buy shares in the open market. Institutional investors currently own 70.7 percent of Daimler, and the company already has strong ties to Chinese automakers BAIC and BYD. Bild am Sonntag said the move was intended as a strategic alliance against Apple, Google and Amazon on autonomous and connected cars. And Reuters reported that Daimler wants to have bespoke "robo taxis" on the road quicker than Google's Waymo, and views Geely as a strong partner for that. Geely conversely is interested in Daimler's electric car battery technology, and sources quoted by the German paper say there are plans to establish joint electric car manufacturing in Wuhan, China, to meet China's smog-reducing quotas. Geely is developing the Lynk & Co. brand of electric and hybrid cars. Geely owns Volvo, which has enjoyed a renaissance under the arrangement, as well as the maker of London's black cabs. In December, it bought a stake in AB Volvo, the maker of Volvo trucks.

Did BMW really win the luxury car sales race?

Sun, Feb 14 2016As anyone who follows our monthly By The Numbers series already knows, the luxury car sales race in the United States was close all of last year as BMW, Lexus and Mercedes-Benz seesawed up and down for sales supremacy. At the end of the year, it was BMW on top of the standings with 346,023 total sales. Or was it? According to data released by Polk, comparing the actual number of vehicles registered between the three top luxury players in the US paints a slightly different picture. Polk's data suggests that only 335,259 BMWs were registered in 2015, compared to 340,392 Lexus models. Why the disparity? It's all a matter of timing. Actual end consumers buy new cars, in almost all cases, from a franchised dealer. BMW delivered 346,023 vehicles in 2015, but only 335,259 of them were registered by their new owners. Presumably, those 11,000 BMWs did (or will) end up registered in the driveways of consumers, but they hadn't before January 1, 2016. Lexus General Manager Jeff Bracken wrote in an email to Automotive News, "Luxury sales leadership as measured by vehicle registrations is important to Lexus as it represents actual consumers engaging directly with our dealers." Of course, it goes without saying that we'll be paying keen attention to the 2016 luxury car sales race as it unfolds. If it's anything like it was in 2015, it'll come down to the wire, and even then may not be entirely clear. Related Video: News Source: Automotive News - sub. req.Image Credit: Andrew Harrer/Bloomberg via Getty BMW Lexus Mercedes-Benz Car Buying Car Dealers Luxury luxury cars

Daimler could sell off Li-Tec's EV battery business

Sat, May 24 2014Five-plus years may have been about enough time for Daimler AG to know whether it wanted to be in the battery-pack production business. The Mercedes-Benz parent may stop making electric-vehicle batteries and ultimately sell its Li-Tec battery-cell factory in Germany within two years, according to Bloomberg News which cites Manager Magazin. The beneficiary may be LG Electronics, which would likely take over battery-production duties for models such as Daimler's Smart ED battery-electric vehicle. Daimler is taking a number of steps to improve profit margins, which are thinner than those of its German rivals like BMW. Like its German competition, the company has lagged behind companies such as Nissan, Renault and Tesla Motors in terms of aggressively pursuing growth via plug-in vehicle sales. Daimler spokesman Hendrik Sackmann, in an e-mail to AutoblogGreen, would only say that the battery business is growing "rapidly" and that Li-Tec is developing "according to our plans." "Regarding Li-Tec, we are working on a concept for the future line-up," he added. "The battery cells for the successor of the Smart electric drive won't be provided by Li-Tec." Daimler in 2008 launched Li-Tec as a joint venture with Evonik, though Daimler recently put plans together to buy out Evonik's 50-percent share of Li-Tec, Bloomberg reported last month. Evonik's role was manufacturing electrodes and separators for batteries. Daimler also said last fall that it was looking to cooperate more extensively with Tesla in regards to electric vehicle development. The two companies first said they'd work together in 2009. Featured Gallery 2013 Smart Fortwo ED View 16 Photos News Source: Bloomberg NewsImage Credit: Daimler Green Plants/Manufacturing Mercedes-Benz battery