Cl55 Amg, Fast, Goregeous And Timeless Classic on 2040-cars

Bossier City, Louisiana, United States

|

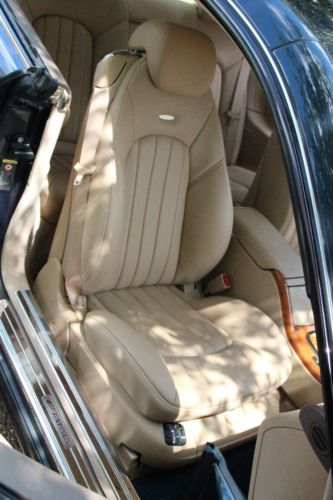

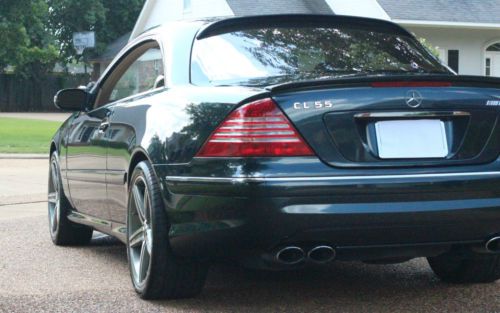

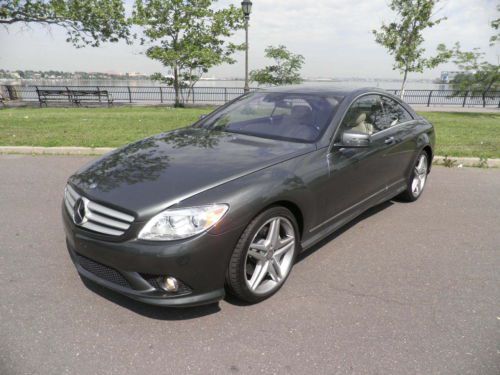

The color is black opal metallic (code 197). It looks dark blue. The interior is java, light camel, with rare light wood trim. Color combination is spectacular. Very low mileage at 28,300. Yes, that is correct. I've owned the car for three years. It was previously owned by a famous golfer (S.G.) from Florida. Equipped with every option available. List price new was over $130,000. The interior is spotless and the exteriors near perfect, never any paint work, scratches, dents or dings. Stored in garage and covered. 493 HP and 516 LB Torque. Everything works PERFECTLY! No malfunction lights. Selling to thin down the herd

|

Mercedes-Benz CL-Class for Sale

04 mercedes benz cl600 coupe v-12 automatic silver exterior gray interior

04 mercedes benz cl600 coupe v-12 automatic silver exterior gray interior 2002 mercedes-benz cl500 low miles cl(US $9,300.00)

2002 mercedes-benz cl500 low miles cl(US $9,300.00) We finance! 22871 miles 2012 mercedes-benz cl-class cl550 4matic

We finance! 22871 miles 2012 mercedes-benz cl-class cl550 4matic Cl55 amg breath taking condition! must see 20" wheels best color combo! spotless(US $23,995.00)

Cl55 amg breath taking condition! must see 20" wheels best color combo! spotless(US $23,995.00) 1999 mercedes-benz cl500 coupe perfect color combo and extra clean!(US $11,750.00)

1999 mercedes-benz cl500 coupe perfect color combo and extra clean!(US $11,750.00) 2010 cl550 4 matic amg sports package

2010 cl550 4 matic amg sports package

Auto Services in Louisiana

Walker`s Wrecking Yard & Auto Parts ★★★★★

Walker Tire ★★★★★

Upholstery Limited ★★★★★

Universal Diesel Service ★★★★★

Tropical Car Wash & Brake Tag Station ★★★★★

Supreme Collision & Towing ★★★★★

Auto blog

The 10 car brands most expensive to maintain over 10 years

Mon, Apr 22 2024Car maintenance has got to be one of the least fun things you can do with your free time, right behind going to the dentist and filing your taxes. However, depending on the brand you buy, your time spent at the shop could be much more than you bargained for. Consumer Reports’ new study on the most- and least-expensive-to-maintain car brands found that European car companies are most likely to break your wallet with costs nearly five times that of the automakers at the other end of the spectrum. Land Rover had the highest ten-year maintenance costs, at an average of $19,250. Porsche was second worst with $14,090 in costs. 10 car brands most expensive to maintain over 10 years: Land Rover: $19,250 Porsche: $14,090 Mercedes-Benz: $10,525 Audi: $9,890 BMW: $9,500 Volvo: $9,285 Infiniti: $8,500 Acura: $7,800 Mini: $7,625 Subaru: $7,200 The Euro brands at the “top” of this list arenÂ’t all that surprising. Land Rover has consistently landed as one of the most expensive vehicle brands to maintain for years now, though Porsche is generally viewed as being one of the more solid performance brands. That could suggest that some models donÂ’t always require more repairs, but the fixes they do need are significantly more expensive. Tesla, Buick, and Toyota were the three cheapest to maintain car brands, with 10-year maintenance costs of $4,035, $4,900, and $4,900, respectively. Consumer Reports noted that these numbers could be slightly skewed due to the fact that some automakers offer free maintenance for the first few years of ownership, and all companies cover their new vehicles for at least a few years after the purchase. Routine maintenance is a great way to avoid costly repairs over time, as itÂ’s much cheaper to catch a problem before it starts causing other issues. Check your oil, rotate your tires, and avoid driving like a wild person, and youÂ’ll likely fare much better than others, even if you own one of the scarier-to-maintain brands.

2019 Autoblog Technology of the Year finalists revealed

Fri, Jan 4 2019Every fall, we line up a range of new models with the latest and most compelling automotive technology from the past year. We test everything from semi-autonomous systems like Tesla's Autopilot to trick suspension setups like the Multimatic spool-valve shocks on the Chevy Colorado ZR2. We spend months paring down the list to a small group of contenders. After testing, dinner and healthy debate, we tally up the votes and name our winner. For Autoblog's 2019 Technology of the Year Award, our three finalists are the Cadillac CT6 with Super Cruise, the Infiniti QX50 with Variable Compression Turbo and the Mercedes-AMG E 53 with EQ Boost. Super Cruise is an advanced SAE Level 2 semi-autonomous system, though Cadillac (unlike some of its rivals) is reluctant to push that point. Cadillac would like you to think of this as an advanced driver assistance feature rather than a semi-autonomous system. Super Cruise allows completely hands-free highway driving. Thanks to a driver-facing camera, the system forces the driver to keep his or her eyes on the road even if hands are off the wheel. Although the CT6 is being discontinued, look for Super Cruise to make its way to other Cadillacs soon. VC Turbo is a little more complicated. Basically, Infiniti's 2.0-liter turbocharged inline-four can vary the compression ratio on the fly. In general, turbocharged engines are more efficient than naturally-aspirated engines when on boost, but can perform worse at low revs. VC Turbo allows for a best-of-both-worlds situation, increasing the compression at low revs and backing it off once the turbo spools up. The best part is that it does so seamlessly, with only a dash readout letting you know what's going on under the hood. Our third finalist is the EQ Boost 48-volt system in the Mercedes-AMG E 53. Like VC Turbo, EQ Boost does a lot just beneath the surface. Mercedes has developed a new turbocharged 3.0-liter inline-six and paired it with a small electric motor. While the car can't run on electricity alone, the motor helps improve both efficiency and performance, smoothing shifts and filling in low-end torque before the turbos spool up. Think torque fill, similar to a McLaren P1. Who can complain about better fuel economy and more torque? Look for the 48-volt system to make its way into most of the Mercedes-Benz lineup. The winner will be revealed next week on Autoblog, and we'll present the award Jan. 15 at the Detroit Auto Show. Related Video:

Daimler rebuffs Geely offer to buy stake

Wed, Nov 29 2017HONG KONG/BEIJING - Daimler AG has turned down an offer from China's Geely to take a stake of up to 5 percent via a discounted share placement, as the German automaker has long been reluctant to see existing shareholdings diluted, sources with knowledge of the talks said. A stake of that size would be worth $4.5 billion at current market prices. Although Daimler declined the offer, it told Geely it was welcome to buy shares in the open market, the sources added. Carmakers in China have embarked on a flurry of dealmaking, as they scramble to boost production of electric and plug-in hybrid vehicles ahead of tough new quotas to be imposed by Beijing, which wants to reduce urban smog and lower the country's reliance on oil. People with knowledge of Geely's thinking said the company was keen to access Daimler's electric car battery technology and wanted to establish an electric car joint venture in Wuhan, the capital of Hubei province. Geely, which also owns Swedish car maker Volvo, is still hopeful it can secure a deal in some form over the coming weeks, they added. The two automakers met in Beijing in recent weeks at Geely's behest. There, the Chinese firm, formally known as Zhejiang Geely Holding Group, offered to take a stake of between 3 percent and 5 percent if Daimler would issue new shares at a discount, the sources said. It was not immediately clear what kind of discount for the shares Geely had in mind or whether Geely was interested in buying the shares on the open market. A spokesman for Geely declined to comment. A spokesman for Daimler said the company was "very happy with our shareholder structure at present", but added that it would welcome new investors with a long-term interest in the company. Shares in Daimler were up 1 percent in early Wednesday trade, in line with the broader market.DAIMLER ALREADY TIED TO BAIC, BYD Geely, which has a market value of some $32 billion, is the leading domestic brand in China with a 5 percent market share, according to an analysis by Nomura Securities. A stake of 5 percent would establish it as Daimler's third-largest shareholder behind the Kuwait Investment Authority and BlackRock, who hold 6.8 percent and 6 percent respectively, according to Reuters data.