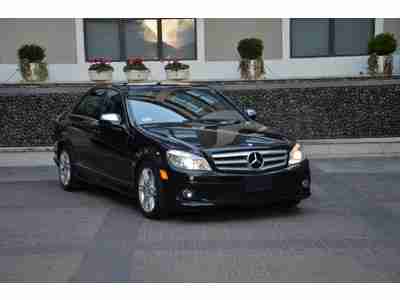

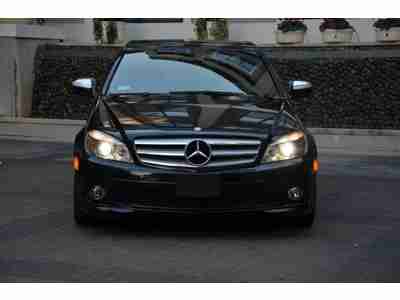

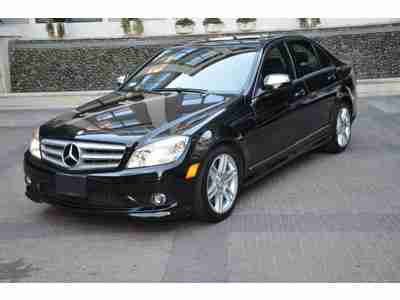

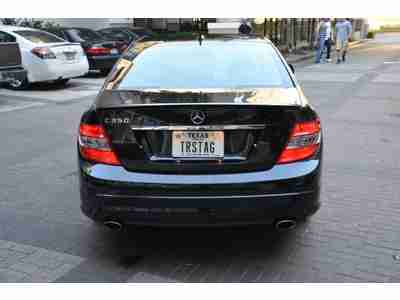

2008 Mercedes Benz C350 Very Low Miles 1 Owner!!! on 2040-cars

Houston, Texas, United States

Engine:3.5L 3498CC V6 GAS DOHC Naturally Aspirated

For Sale By:Dealer

Body Type:Sedan

Fuel Type:GAS

Transmission:Automatic

Warranty: Vehicle does NOT have an existing warranty

Make: Mercedes-Benz

Model: C350

Options: Sunroof

Trim: Sport Sedan 4-Door

Safety Features: Anti-Lock Brakes

Power Options: Power Windows

Drive Type: RWD

Mileage: 30,904

Number of Doors: 4

Sub Model: 4dr Sdn 3.5L

Exterior Color: Blue

Number of Cylinders: 6

Interior Color: Black

Mercedes-Benz C-Class for Sale

Mercedes-benz c300 sport premium package heated seats moonroof ipod(US $20,495.00)

Mercedes-benz c300 sport premium package heated seats moonroof ipod(US $20,495.00) Leather seats power everything am/fm stereo satellite radio bluetooth mp3

Leather seats power everything am/fm stereo satellite radio bluetooth mp3 4dr sdn 2.3l 4 cylinder engine abs 4-wheel disc brakes 5-speed a/t a/c cassette

4dr sdn 2.3l 4 cylinder engine abs 4-wheel disc brakes 5-speed a/t a/c cassette C300 4matic 3.0l bluetooth 228 horsepower 4 doors 4-wheel abs brakes tachometer

C300 4matic 3.0l bluetooth 228 horsepower 4 doors 4-wheel abs brakes tachometer 2002 mercedes-benz c-class(US $8,800.00)

2002 mercedes-benz c-class(US $8,800.00) Mercedes benz 2007 c230 sport edition super clean car low reserve price set a+

Mercedes benz 2007 c230 sport edition super clean car low reserve price set a+

Auto Services in Texas

Yescas Brothers Auto Sales ★★★★★

Whitney Motor Cars ★★★★★

Two-Day Auto Painting & Body Shop ★★★★★

Transmission Masters ★★★★★

Top Cash for Cars & Trucks : Running or Not ★★★★★

Tommy`s Auto Service ★★★★★

Auto blog

Continental Automotive recalls 5 million airbag control units

Thu, Feb 4 2016Takata isn't the only supplier having airbag problems. Rival manufacturer Continental Automotive Systems announced a recall of 5 million airbag control units fitted to vehicles from Honda, Fiat Chrysler Automotive, Mercedes-Benz, and even a certain Chrysler-based Volkswagen. This sweeping recall has actually been in progress for some time, although the exact scope is only now becoming evident. In October of 2015, Mercedes-Benz recalled 2008 and 2009 model year C- and GLK-Class vehicles because their Continental-made airbag control units could corrode. Such a condition could cause the airbags to deploy without cause or warning, or in the event of a crash, not deploy at all. You can read all about it in our post from last year. Now, Continental's recall is going wide. Alongside the already recalled C and GLK, you've already heard about the 2008 and 2009 Honda Accord airbag recall, which we reported on yesterday. Now, Fiat Chrysler is announcing the recall of the 2009 Dodge Journey, as well as the 2008 and 2009 Dodge Grand Caravan, Chrysler Town and Country, and their rebadged counterpart, the Volkswagen Routan. Yes, one manufacturer is recalling another manufacturer's vehicle. The models listed above only amount to about 580,000 vehicles out of 5 million bad airbag control units. And since Continental will notify manufacturers who will then issue their own recalls, it's extremely likely that more brands and vehicles will be ensnared. Stay tuned. Related Video: News Source: NHTSA via Automotive News - sub. req.Image Credit: Fabian Bimmer / Reuters Recalls Chrysler Dodge Fiat Honda Mercedes-Benz Safety Crossover Minivan/Van Sedan FCA

Mercedes rules out hybrid supercar, promises SLS successor

Sat, 16 Mar 2013The recent Geneva Motor Show was a festival of hypercars, with the presence of not one, but three over-the-top debuts: the Lamborghini Veneno, McLaren P1 and Ferrari LeFerrari. The latter two have hitched their carbon fiber bumpers to the electrification bandwagon by using hybrid-electric powertrains not entirely unlike the propulsion systems we've come to know in cars like the Toyota Prius and Chevrolet Volt. Does that mean the flow of electrons up the four-wheeled food chain will eventually consume our hallowed supercars? Not if AMG has anything to say about it.

AMG Director of Vehicle Development Tobias Moers recently confirmed that not only will there be a successor to the Mercedes-Benz performance division's SLS AMG, he notes that its internal combustion engine will most definitely not be sharing living quarters with an electric drivetrain. Instead, AMG plans to focus on further pushing the power and efficiency envelope of the internal combustion engine and advancing the use of lightweight materials to achieve their goals. The first example of this effort can be seen in the new SLS AMG Black Series that incorporates many weight-saving techniques to shed some 154 pounds from the SLS AMG GT (above), which itself is lighter than the standard SLS AMG.

Furthermore, Moers remarks that his company is happy to leave the hypercar segment to companies like Ferrari and McLaren. He admits that, "Ferrari in the hyper-car segment is still a different brand than AMG. We have to be honest..." So rather than taking the SLS further upmarket to do battle with bulls and stallions, Moers hinted that the next-generation SLS may be joined by another performance model that fits neatly between itself and the C63 AMG.

Aston or Bust? Maybach's fate to be decided next month

Mon, 13 Jun 20112011 Maybach 62 - Click above for high-res image gallery

What will become of Maybach? That question has been rattling around the halls of Daimler headquarters in Stuttgart for some time now. But all questions will be answered, and answered soon: according to reports, the German automaker is currently evaluating prototypes and propositions for its top-end marque, and will make its decision next month.

So, what are the options? On the one hand, Daimler could kill the Maybach brand altogether. It was a notion ill conceived and even more poorly executed, taking an old platform and building a new flagship atop it. In that way, it was sort of like the Chrysler Crossfire, only far more costly to both the buyer and manufacturer. On the other hand, Daimler could opt for the long-time-coming proposition of contracting the production (and possibly much of the development) of a new generation of Maybachs to Aston Martin.