2007 Ford Mustang Gt Convertible 2-door 4.6l on 2040-cars

Fargo, North Dakota, United States

|

This is a mint condition Mustang Convertible, always garaged!! Must see!!

|

Mercedes-Benz 500-Series for Sale

1991 chevrolet corvette 6 speed manual red w/ black interior only 38,000 miles!(US $11,900.00)

1991 chevrolet corvette 6 speed manual red w/ black interior only 38,000 miles!(US $11,900.00) 2005 ford mustang boss clone(US $9,900.00)

2005 ford mustang boss clone(US $9,900.00) 1995 chevrolet camaro, 3.4 l(US $1,000.00)

1995 chevrolet camaro, 3.4 l(US $1,000.00) 1990 chevrolet corvette

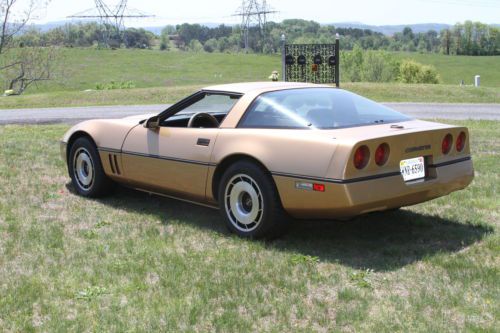

1990 chevrolet corvette 1984 corvette(US $7,000.00)

1984 corvette(US $7,000.00) 2006 mustang convertible(US $8,500.00)

2006 mustang convertible(US $8,500.00)

Auto Services in North Dakota

Midas Auto Service Experts ★★★★★

Gateway Cenex B-One Inc. ★★★★★

Family Auto ★★★★★

Crack Magic Windshield Repair ★★★★★

Safelite AutoGlass ★★★★

Rdo Truck Center Co ★★★★

Auto blog

Online Find of the Day: Lexus-engined Mercedes pickup is a vintage hybrid

Tue, 16 Sep 2014You have to love someone who gets incredibly committed to a very weird idea. What you see for sale here is a right-hand drive 1971 Mercedes-Benz 220D in South Africa, but this old Mercedes is now converted into a pickup, complete with bed cover, and there's big secret under the hood, too.

The pickup conversion appears well done based on seller Sedgefield Classic Cars' photos. Even the tonneau cover fits well. You could almost believe that this Mercedes lived its life as a Chevrolet El Camino-like pickup from the very beginning.

However, the rear-quarters conversion might not be the weirdest thing about this Mercedes. The original diesel is gone from the engine bay in favor of a Lexus V8. It seems really odd to pop the hood and find a Japanese mill in this German car, but the photos make it look like a fairly well performed swap. So, bravo to the crazy thinking. According to the seller speaking to Autoblog by email, "as far as we can establish, this was done a few years ago, with all Lexus components."

BMW reclaims US luxury sales crown from Mercedes

Tue, Jan 6 2015The numbers, they are in: BMW has reclaimed the luxury-sales crown from Mercedes by a margin of 9,347 cars. Mercedes donned the king's headgear in 2013 after a strong final quarter of 2013 when the new CLA and S-Class poured out of dealerships. This year, led by the 3 Series/4 Series and X5, BMW sold 339,738 units – a 9.8-percent increase year-on-year. Mercedes, led by the C-Class and M-Class, saw its sales go up by 5.7 percent to 330,391 units. We'll have to wait a bit to see if there's another registrations-vs-sales challenge as in 2012, when BMW was anointed US luxury ruler. Behind them, a dark horse named Lexus nudged closer to the leading Teutons, selling 311,389 cars. The Japanese luxury automaker also had the biggest gain among the top three, its sales rising by 13.7 percent compared to 2013. Audi had the biggest sales of anyone among the top five, though, with a 15.2-percent gain to 182,011, which moved it a spot ahead of Cadillac; the Wreath-and-Crest brand dropped 6.5 percent to 170,750. Acura (167,843), Infiniti (117,300), and Lincoln (94,474) took the final positions. Speaking of Lincoln, sales at the once-mighty luxury marque stand as the mightiest jump of any on this list, up 15.6 percent. That's the power of Matthew McConaughey... and better cars and a new crossover, sure. So now that we're back to Round One of 2015, in case no one else has said it yet: "Ok, fight!"

Mercedes releases 6x6 G63 AMG specs and pics [w/video]

Fri, 15 Mar 2013Mercedes-Benz has finally dropped full details on its insane G63 AMG 6x6. The machine puts 544 horsepower to all six wheels thanks to a twin-turbocharged 5.5-liter V8. A seven-speed gearbox shuttles power to the ground via three sets of portal axles, which helps give this machine a full 15.75 inches of ground clearance. By comparison, the standard G63 AMG sits with just 8.27 inches of ground clearance. The extra lift allows this 6x6 to ford nearly 40 inches of water and run massive 37-inch tires. All told, there are five differential locks on this thing, all controlled by a special "locking logic" that provides the best traction possible for any given situation.

The controls offer up three stages of locking, which we can only assume range from JKLOL to OMGWTF. Right now, AMG says this monstrosity is only a show vehicle, but we imagine it wouldn't take much to convince the team to whip up one of your very own. Check out our full gallery and the press release below for all the nitty gritty. While you're down there, you can also check out the video on the machine one more time.