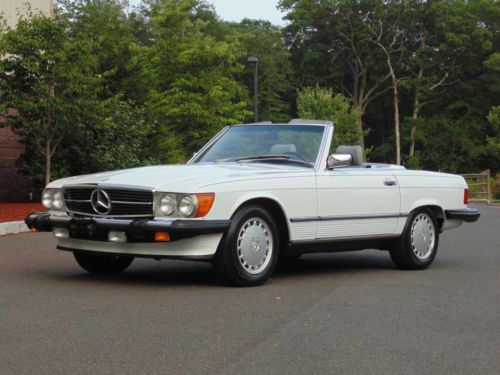

1991 Mercedez Benz 500sl on 2040-cars

Ocala, Florida, United States

|

2 top convertible, original hard top, new convertible top. Complete tune-up 2 years ago, driven for 6 months after, new battery. Garage kept. Hydrolics leak on convertible. AC needs work possible leak, interior in good shape but needs work, minor scratches on body, needs struts, possible alternator. Approximately 150K miles, odometer starts and stops. Original stereo.

|

Mercedes-Benz 500-Series for Sale

1991 mercedes-benz 500sl base convertible 2-door 5.0l

1991 mercedes-benz 500sl base convertible 2-door 5.0l 1991 mercedes benz 500sl two tops 5.0l auto new tires california car zero rust

1991 mercedes benz 500sl two tops 5.0l auto new tires california car zero rust (US $15,000.00)

(US $15,000.00) Mercedes benz 560 sel(US $3,500.00)

Mercedes benz 560 sel(US $3,500.00) 1989 mercedes benz 560sl 27k miles pristine condition inside & out must see !!!

1989 mercedes benz 560sl 27k miles pristine condition inside & out must see !!! 1987 mercedes 560sec black beauty timeless lines

1987 mercedes 560sec black beauty timeless lines

Auto Services in Florida

Zych`s Certified Auto Svc ★★★★★

Yachty Rentals, Inc. ★★★★★

www.orlando.nflcarsworldwide.com ★★★★★

Westbrook Paint And Body ★★★★★

Westbrook Paint & Body ★★★★★

Ulmerton Road Automotive ★★★★★

Auto blog

Win a trip to the Porsche Experience Center, including track time in a 911

Mon, Feb 28 2022Autoblog may receive a share from purchases made via links on this page. Pricing and availability is subject to change. No donation or payment necessary to enter or win this sweepstakes. See official rules on Omaze. Enter this sweepstakes today and get 150 bonus entries by signing up for the Autoblog Newsletter right here! The feeling of getting a new car is wonderful. Winning that new car, especially your dream car, feels even better, or so we would imagine. And Omaze is here with a chance to experience that feeling. Plus, between now and March 4, if you enter to win a car you'll also be entered to win a trip to the Porsche Experience Center. According to Omaze, one winner and a guest "will receive receive a one-day performance driving experience at the Porsche Experience Center in Los Angeles or Atlanta, which will include: 1.5 hours driving either a Porsche 911 GT3, a 911 Turbo S, or any vehicle available at the Porsche Driving Experience Center of equal or greater value (actual vehicle to be driven is subject to scheduling availability), on Porsche's private race track with a professional driver." Flights and accommodation will also be covered. You’re probably asking yourself, what does it take to win? First of all, according to Omaze, "no donation or payment is necessary to enter or win this sweepstakes." $10 will get you 100 entries in this sweepstakes, while $50 will get you 1,000 entries and $100 will get you 2,000 entries. The best part? Each paid entry raises money for a worthy cause. See more about these causes at Omaze. Here are our favorite vehicle giveaways weÂ’ve found online this week. Win a 1958 Porsche 356 A - Enter at Omaze Every now and then, a car comes along in a sweepstakes that makes you wonder why in the world they would be giving something so beautiful away for pennies on the dollar.

Mercedes A-Class next up for facelift

Sun, Jan 11 2015This is the coming Mercedes-Benz A-Class, and in case the paucity of camouflage didn't make it clear, it won't look much different the one that's been on sale for all of two years. Caught in Sweden braving the temperatures, its exterior updates aren't expected to go much further than a reworked face that brings it in line with the recently updated B-Class, including a new grille, headlights and taillights, and bumpers. The cabin is where most of the work is being done, to give it a better punch against the BMW 1 Series. A tweaked dash cluster, better fabrics and materials, the eight-inch tablet-style nav/multimedia screen, and ambient lighting should join the party. The updated range of B-Class engines should also make the jump into the A. A photo caught at a dealer meeting in Barcelona last year makes us pretty sure it will be introduced at the Frankfurt Motor Show in September this year. Until then, there are spy shots to peruse.

Daimler rebuffs Geely offer to buy stake

Wed, Nov 29 2017HONG KONG/BEIJING - Daimler AG has turned down an offer from China's Geely to take a stake of up to 5 percent via a discounted share placement, as the German automaker has long been reluctant to see existing shareholdings diluted, sources with knowledge of the talks said. A stake of that size would be worth $4.5 billion at current market prices. Although Daimler declined the offer, it told Geely it was welcome to buy shares in the open market, the sources added. Carmakers in China have embarked on a flurry of dealmaking, as they scramble to boost production of electric and plug-in hybrid vehicles ahead of tough new quotas to be imposed by Beijing, which wants to reduce urban smog and lower the country's reliance on oil. People with knowledge of Geely's thinking said the company was keen to access Daimler's electric car battery technology and wanted to establish an electric car joint venture in Wuhan, the capital of Hubei province. Geely, which also owns Swedish car maker Volvo, is still hopeful it can secure a deal in some form over the coming weeks, they added. The two automakers met in Beijing in recent weeks at Geely's behest. There, the Chinese firm, formally known as Zhejiang Geely Holding Group, offered to take a stake of between 3 percent and 5 percent if Daimler would issue new shares at a discount, the sources said. It was not immediately clear what kind of discount for the shares Geely had in mind or whether Geely was interested in buying the shares on the open market. A spokesman for Geely declined to comment. A spokesman for Daimler said the company was "very happy with our shareholder structure at present", but added that it would welcome new investors with a long-term interest in the company. Shares in Daimler were up 1 percent in early Wednesday trade, in line with the broader market.DAIMLER ALREADY TIED TO BAIC, BYD Geely, which has a market value of some $32 billion, is the leading domestic brand in China with a 5 percent market share, according to an analysis by Nomura Securities. A stake of 5 percent would establish it as Daimler's third-largest shareholder behind the Kuwait Investment Authority and BlackRock, who hold 6.8 percent and 6 percent respectively, according to Reuters data.