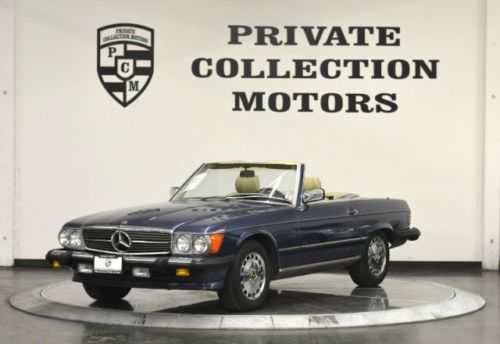

1988 Mercedes-benz 560sl 1 Owner Service Records Immacu on 2040-cars

Costa Mesa, California, United States

Mercedes-Benz 500-Series for Sale

Auto Services in California

Zube`s Import Auto Sales ★★★★★

Yosemite Machine ★★★★★

Woodland Smog ★★★★★

Woodland Motors Chevrolet Buick Cadillac GMC ★★★★★

Willy`s Auto Service ★★★★★

Western Brake & Tire ★★★★★

Auto blog

Formula One's Valtteri Bottas can turn it up to 11 in Spain

Wed, May 10 2017BARCELONA - Valtteri Bottas can add his name to one of Formula One's longest sequences by following up his breakthrough win in Russia with another triumph when the European season starts in Spain this weekend. The Finn, fresh from his first Grand Prix victory with champions Mercedes in Russia, is the man most likely to become the 11th different winner in a row at Barcelona's Circuit de Catalunya. No other track on the calendar has had such a variety of winners over the past decade, an ironic fact given that it is the most familiar to drivers from winter testing and was once famed for its predictability. Last year it was Dutch 18-year-old Max Verstappen who became the sport's youngest winner when he triumphed for Red Bull, on his team debut, after both Mercedes drivers collided at the start. In 2012, it was now-departed Venezuelan Pastor Maldonado -- a one-hit wonder -- who handed Williams a surprise victory that remains their most recent. Ferrari's championship leader Sebastian Vettel and Mercedes rival Lewis Hamilton, 13 points behind the German, will start as favorites and success for either could be an omen given that both went on to take the title last time they won in Spain. But Bottas, who joined Mercedes from Williams in January as replacement for retired 2016 world champion Nico Rosberg, is the best bet to continue the streak of different winners in Spain even if he has yet to finish higher than fourth there. "Getting that first win definitely gives me a lot of confidence that I can do it, even though I always knew I had the ability," he said after Sochi. "And now it's done, I just want to do it again and again." RICCIARDO REVIVAL The only other driver from the leading trio of teams yet to triumph in Barcelona is Verstappen's Australian team mate Daniel Ricciardo, but the Red Bull has lagged Mercedes and Ferrari on pace so far this year. That will surely change, with the flow of upgrades set to speed up now that teams are closer to their factories, and Red Bull have some big chassis modifications in the pipeline with engine improvements still to come. "I hope the upgrade will give us a chance to really fight with Mercedes and Ferrari or at least get us closer," said Ricciardo. The driver of car number 11, Force India's Mexican Sergio Perez, has racked up 14 successive points finishes and he too will have aerodynamic updates on his car.

EVO "2012 Car of the Year: The Track Battles" is a sports car salmagundi

Sun, 25 Nov 2012EVO has come out with another gotta-watch-it video, throwing its 2012 Car of the Year contestants around the UK's 1.5-mile Blyton Park track. It's actually a 15-minute teaser for the full-length DVD detailing the magazine's Car of the Year selection, but the tease is worth every penny free second.

Tiff Needell and sports car racer Richard Meaden handle the wheel duties, the two driving five pairs of sports cars: Lotus Exige S vs. Porsche Boxster S, Morgan Three-Wheeler vs. Toyota GT86, BMW M135i vs. Porsche 911, Mercedes-Benz C63 AMG Black Series vs. Alpina B3 GT3, the marquee event pits the McLaren MP4-12C vs. the Pagani Huayra. After a head-to-head lap with commentary during drifts, Meaden takes each car out to set a representative lap time.

You'll find the verdicts, lots of tire smoke, and lines like "Anything you can do sideways I can do sideways" in the video below.

Continental Automotive recalls 5 million airbag control units

Thu, Feb 4 2016Takata isn't the only supplier having airbag problems. Rival manufacturer Continental Automotive Systems announced a recall of 5 million airbag control units fitted to vehicles from Honda, Fiat Chrysler Automotive, Mercedes-Benz, and even a certain Chrysler-based Volkswagen. This sweeping recall has actually been in progress for some time, although the exact scope is only now becoming evident. In October of 2015, Mercedes-Benz recalled 2008 and 2009 model year C- and GLK-Class vehicles because their Continental-made airbag control units could corrode. Such a condition could cause the airbags to deploy without cause or warning, or in the event of a crash, not deploy at all. You can read all about it in our post from last year. Now, Continental's recall is going wide. Alongside the already recalled C and GLK, you've already heard about the 2008 and 2009 Honda Accord airbag recall, which we reported on yesterday. Now, Fiat Chrysler is announcing the recall of the 2009 Dodge Journey, as well as the 2008 and 2009 Dodge Grand Caravan, Chrysler Town and Country, and their rebadged counterpart, the Volkswagen Routan. Yes, one manufacturer is recalling another manufacturer's vehicle. The models listed above only amount to about 580,000 vehicles out of 5 million bad airbag control units. And since Continental will notify manufacturers who will then issue their own recalls, it's extremely likely that more brands and vehicles will be ensnared. Stay tuned. Related Video: News Source: NHTSA via Automotive News - sub. req.Image Credit: Fabian Bimmer / Reuters Recalls Chrysler Dodge Fiat Honda Mercedes-Benz Safety Crossover Minivan/Van Sedan FCA

Mercedes 500sl

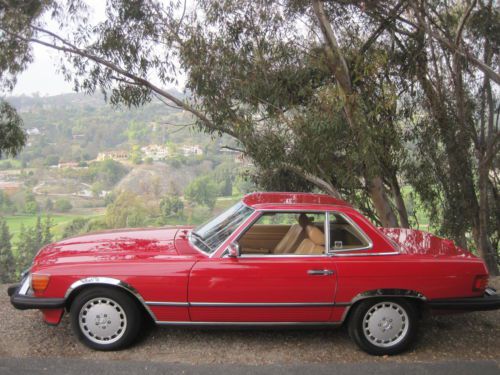

Mercedes 500sl Two owners, hard top, well documented

Two owners, hard top, well documented 2003 mercedes benz sl- class sl500 brabus edition 32k miles!!!

2003 mercedes benz sl- class sl500 brabus edition 32k miles!!! 1988 560sl mercedes ( 35,000 orig miles!!! )

1988 560sl mercedes ( 35,000 orig miles!!! ) 1985 mercedes-benz 500sel base sedan 4-door 5.0l

1985 mercedes-benz 500sel base sedan 4-door 5.0l 1996 mercedes benz sl 500

1996 mercedes benz sl 500