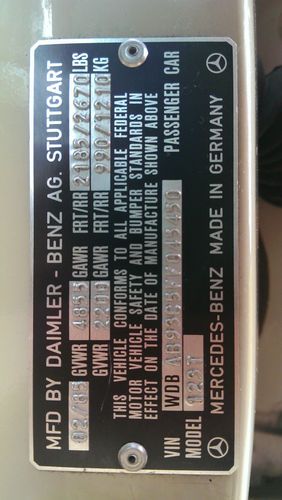

Seeking Good Home For 1985 Mercedes 300td- 121,000 Original Miles on 2040-cars

Tallahassee, Florida, United States

Body Type:Wagon

Vehicle Title:Clear

Engine:5 Cylinders

Fuel Type:Diesel

For Sale By:Private Seller

Number of Cylinders: 5

Make: Mercedes-Benz

Model: 300-Series

Trim: TD Wagon W-123

Options: Sunroof, Cassette Player

Drive Type: RWD

Power Options: Air Conditioning, Cruise Control, Power Locks, Power Windows

Mileage: 121,055

Exterior Color: Beige

Interior Color: Palomino MB Tex

Warranty: Vehicle does NOT have an existing warranty

Mercedes-Benz 300-Series for Sale

1984 mercedes-benz 300d base sedan 4-door 3.0l(US $8,000.00)

1984 mercedes-benz 300d base sedan 4-door 3.0l(US $8,000.00) Mercedes-benz : 300-series diesel

Mercedes-benz : 300-series diesel 1999 mercedes-benz e300 turbodiesel 4d sedan epa 26 / 36 mpg city / highway

1999 mercedes-benz e300 turbodiesel 4d sedan epa 26 / 36 mpg city / highway 1954 mercedes benz 300b with rare webasto roof 300 b w-186 adenauer

1954 mercedes benz 300b with rare webasto roof 300 b w-186 adenauer 1993 mercedes-benz 300d diesel

1993 mercedes-benz 300d diesel 1988 mercedes benz 300se 28,000 4 door 5 passenger mint(US $17,999.00)

1988 mercedes benz 300se 28,000 4 door 5 passenger mint(US $17,999.00)

Auto Services in Florida

Zych`s Certified Auto Svc ★★★★★

Yachty Rentals, Inc. ★★★★★

www.orlando.nflcarsworldwide.com ★★★★★

Westbrook Paint And Body ★★★★★

Westbrook Paint & Body ★★★★★

Ulmerton Road Automotive ★★★★★

Auto blog

2014 Mercedes-Benz S-Class caught totally undisguised

Mon, 18 Mar 2013Based on the lightly camouflaged spy shots of the 2014 Mercedes-Benz S-Class we've seen lately, it hasn't taken a vivid imagination to picture what the next iteration of this big luxury sedan will look like. Even so, we now we have our first unobstructed views of the redesigned S-Class, codenamed W222, as it has just been caught out flaunting for some promo shots.

The first thing we notice about the new S-Class design is the disappearance of the last generation's flared wheel arches. Yet the new design adds even more character with bodyside creases similar to the CLS-Class and some elements reminiscent of 2007's F700 Concept, including the massive grille and vertical LED taillights. Other key details include a large panoramic roof and the narrow exhaust outlets, but the large LED-trimmed headlights and the aggressive front fascia are probably the biggest departure from the current design. With these spy shots, we also catch a blurry shot of the interior, but we've seen a practically uncovered look at the new S-Class' cabin back in January.

Overall, the next S-Class sports an expressive and premium new look, but as far as all-new designs go, it's quite conservative - a move no doubt fitting for these lean financial times.

Weekly Recap: Jaguar takes a leap with price cut, new strategy

Sat, Sep 5 2015Jaguar was one of the famous automotive props and plotlines in the now-iconic drama Mad Men. There's a scene where the show's protagonist, Don Draper, deftly undercuts an influential Jaguar dealer by indicating that get-me-in-the-door local radio spots would be an effective way to sell cars like the slinky E-Type. The British executives think this is folly – Draper knows they will – and his advertising strategy wins out over the dealer's approach to move the metal. Jaguar's not doing that, but half a century later in the real world the company is launching plans to make its cars more attainable to new and younger customers like Millenials. These aren't coupons, but this is a leap for Jaguar, which has long banked on sexy styling and its rich motorsports history to overshadow its past mechanical flaws. Put simply, Jaguar is addressing the reasons why people, especially the younger set, don't buy its cars. The 2017 XE will start at $35,895 when it launches next spring – which makes it an attractive buy for a successful, relatively young person. When it's time to move up, the redesigned XF will be more attainable, coming in at $52,895, which is $5,275 less than the 2015 model. The flagship XJ sedan and the enthusiast-oriented F-Type sports car will also get thousands of dollars worth of added standard features, and Jag is actively pitching them as a better value than their competitors. "The Jaguar brand is on the eve of a major transformation that will see it dramatically increase its presence in the United States luxury marketplace with an expanded lineup, pricing focused on the core of the luxury market, and an all-new ownership package with best-in-class coverage," Joe Eberhardt, CEO of Jaguar Land Rover North America, said in a statement. The brand's quality and reliability dings have also lurked in the back of buyers' minds for decades, though that's an outdated notion. Jaguar placed third in J.D. Power's Initial Quality Study in June and was the top-ranked luxury brand in J.D. Power's Customer Service Index in March. Not content, the company is rolling out an enhanced program called Jaguar EliteCare that launches on 2016 models. It offers a five-year, 60,000-mile limited warranty, the longest among its competitors, with free scheduled maintenance during that period. The plan also covers roadside assistance and connectivity features.

Mercedes-Benz GLA45 AMG spied in Sweden

Wed, 16 Jan 2013We've spotted the all-new Mercedes-Benz GLA testing a couple times in recent months in getting closer to production form and shedding camouflage, but now it looks like we're see our first look at the AMG version of this compact crossover. The low ride height might trick some into thinking that we're just seeing the already-confirmed A45 AMG out testing, but the unique beltline, rear doors and side windows confirm this is some version of the GLA-Class.

What makes us so confident that this is the AMG model? Well, for starters, this prototype has beefier brakes with cross-drilled front and rear rotors and bigger front calipers, but it also sports dual exhaust outlets poking through the rear fascia and a suspension that has been lowered considerably. Our spy shooters said that this car's exhaust note made it almost certainly an AMG model.

Just to be clear, the GLA AMG will not be powered by a 4.5-liter engine. The closely related A45 AMG will carry the "45" in its name to celebrate the first 45 years of AMG, and our sources seem to indicate the AMG version of the GLA will do the same. We're expecting this sporty crossover to produce as much as 350 horsepower from its AMG-tuned four-cylinder engine, and like the all-new E63 AMG, it could very well come standard with 4Matic all-wheel drive.