1968 Buick on 2040-cars

Edmonds, Washington, United States

Engine:455

Make: Buick

Trim: gran sport

Model: Other

Mileage: 0

Drive Type: rear

1968 buick gs 400 parts or project car rebuilt 455 about 500 horse ta heads roller rockers ta intake electric water pump new center force clutch headers paint is about a 50 footer needs interior work exhaust and power steering pump will include ehaust and power stearing pump with buy it now price I have paper work from NewYork New York cars do not have titles after 25 years old

Maserati Gran Sport for Sale

2006 maserati gransport base coupe 2-door 4.2l(US $37,900.00)

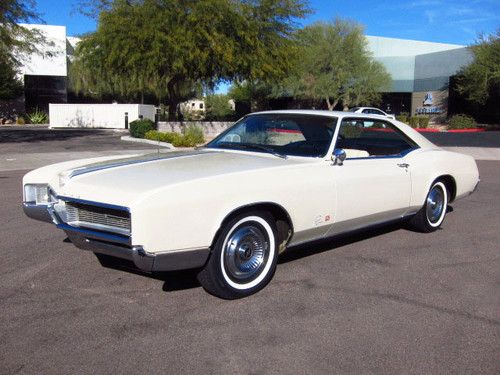

2006 maserati gransport base coupe 2-door 4.2l(US $37,900.00) 1966 buick riviera gran sport gs - all original az car - 59k orig miles - rare!!

1966 buick riviera gran sport gs - all original az car - 59k orig miles - rare!! 2006 maserati gransport base coupe 2-door 4.2l(US $38,900.00)

2006 maserati gransport base coupe 2-door 4.2l(US $38,900.00) Maserati at a great price!(US $29,950.00)

Maserati at a great price!(US $29,950.00) 2005 maserati gransport 2dr cpe automated manual transmission clean 21k miles(US $35,989.00)

2005 maserati gransport 2dr cpe automated manual transmission clean 21k miles(US $35,989.00) 2006 white coupe leather headliner maserati crest auditorium sound we finance !!(US $39,999.00)

2006 white coupe leather headliner maserati crest auditorium sound we finance !!(US $39,999.00)

Auto Services in Washington

Yire Automotive Care ★★★★★

Woodland Auto Body ★★★★★

University Place Tire & Auto ★★★★★

Town Chrysler Dodge ★★★★★

Superior Auto ★★★★★

Sparky`s Towing & Auto Sales ★★★★★

Auto blog

V8-powered Maserati Levante spied nearly naked

Thu, Sep 14 2017I love fast SUVs. A big engine can do wonders to make a boring crossover exciting, even if they still handle like an overstuffed goldfish on wheels. That's why I'm really excited to see spy shots that show a V8-powered Maserati Levante in the flesh. Even before the Levante hit showrooms, Maserati admitted to us that a V8-powered prototype was already in existence. It seems that a full reveal is imminent. Visually, the prototype we see here only does with revised front and rear fascias. It's slightly more aggressive, but not that far removed from what's currently available. Still, we're more interested in what's under the hood. Maserati said the Quattroporte's Ferrari-assembled 3.8-liter twin-turbo V8 fits in the Levante with no issues. That should be no surprise, as the two models share a basic platform. In the Quattroporte, the engine makes 523 horsepower and 479 pound feet of torque. Don't be surprised if things are cranked up in the Levante to compete with the 567 horsepower BMW X5 M and the all-new 550 horsepower Porsche Cayenne Turbo. Look for bigger brakes, stiffer suspension and more aggressive rubber. Typical performance modifications. While we don't know for sure, the V8 Levante is likely to wear the GTS badge, just like the top-dog Quattroporte. Unfortunately, the model ditches hydraulic steering for an electrically assisted unit. Still, it's sure to be a riot, at least in a straight line. Related Video: Featured Gallery Maserati Levante GTS spy shots View 12 Photos Image Credit: CarPix Spy Photos Maserati Crossover SUV Luxury Performance maserati levante gts

Stellantis announces ‘Circular Economy’ business to drive revenue, decarbonization

Tue, Oct 11 2022Stellantis has already announced its plans to reach net-zero carbon emissions by 2038. Today, the automaker has announced a new business unit to help it reach that goal while generating 2 billion euros per year in revenue by 2030. The “Circular Economy” business will help make revenue less dependent on finite, rare and ecologically problematic materials. The Circular Economy model features what Stellantis calls a “4R” strategy, comprising remanufacturing, repair, reuse and recycling. The goal is to make materials last as long as they can, reducing reliance on the acquisition of those precious new materials in the future by returning them to the business loop when theyÂ’ve reached the end of their first life. Through these processes, Stellantis says it can save up to 80% raw material and 50% energy compared to manufacturing a new part. Remanufacturing, or “reman” in Stellantis shorthand, means dismantling, cleaning and rebuilding parts to OEM spec. Nearly 12,000 remanufactured parts are available for customers to purchase. Some remanufacturing is done in-house, and some with partners and through joint ventures. Repair is pretty obvious — fixing parts to put back into vehicles. This also consists of reconditioning, to make a vehicle feel like new. Stellantis boasts 21 “e-repair” centers for repairing electric vehicle batteries. Reuse refers to parts still in good condition from end-of-life vehicles sold as-is. Stellantis says it has 4.5 million multi-brand parts in inventory. These are sold in 155 countries through the B-Parts e-commerce platform. Reuse also refers second-life options, such as using batteries outside of automotive purposes. Recycling involves dismantling parts and scraps back into raw material form that is then looped back into the manufacturing process. Stellantis says it has collected 1 million parts for recycling in the past six months. Recycling doesnÂ’t get counted in that aforementioned 2 billion euros of revenue, but it does save the company money on acquisition of raw materials. As for batteries, specifically, Stellantis expects this recycling business to ramp up after 2030, when the packs currently in service begin to reach the end of their lifecycle. Stellantis will use its new “SUSTAINera” label to denote parts that are offered as part of its Circular Economy business.

This is our clearest look yet at the next Maserati Quattroporte

Fri, 02 Nov 2012The best look we've had at the next Maserati Quattroporte so far was found in patent drawings that could have substituted for a whole lot of other cars. But seen here is a more useful glimpse, courtesy of someone on the lookout in Italy who caught a prototype in a skin-hugging wrap.

Maserati has apparently gone with the Charles Eames philosophy on the redesign: "The details are not details. They make the design." The overall line is familiar - not such a bad thing even on this 10-year-old sedan - but the detailing appears to have been refined and made sleeker. The taillights themselves should make for an especially interesting feature if the camo'ed car can be trusted.

The next Quattroporte is predicted to be roughly 450 pounds lighter than the current car, and underhood grunt is expected to come from a 520-horsepower, 5.2-liter turbocharged V8 at launch, followed by a 420-hp, supercharged V6 supplied by Ferrari, both working through an eight-speed ZF transmission.