2018 Land Rover Discovery Hse on 2040-cars

Engine:3.0L 6 Cylinders

Fuel Type:Gasoline

Body Type:--

Transmission:Automatic

For Sale By:Dealer

VIN (Vehicle Identification Number): SALRR2RV2JA058381

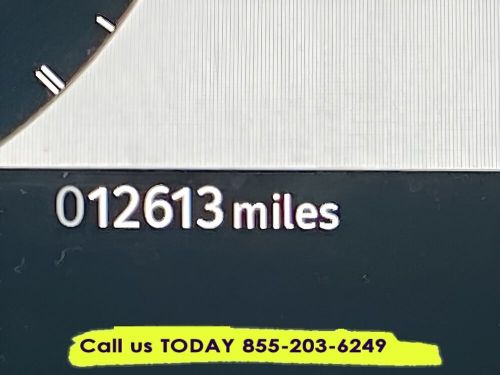

Mileage: 53839

Make: Land Rover

Trim: HSE

Drive Type: 4WD

Features: --

Power Options: --

Exterior Color: White

Interior Color: Ebony/Ebony/Ebony

Warranty: Unspecified

Model: Discovery

Land Rover Discovery for Sale

2023 land rover discovery p360 metropolitan edition(US $64,510.00)

2023 land rover discovery p360 metropolitan edition(US $64,510.00) 2002 land rover discovery se(US $2,000.00)

2002 land rover discovery se(US $2,000.00) 2002 land rover discovery(US $6,750.00)

2002 land rover discovery(US $6,750.00) 2018 land rover discovery hse(US $27,995.00)

2018 land rover discovery hse(US $27,995.00) 2017 land rover discovery hse luxury(US $2,500.00)

2017 land rover discovery hse luxury(US $2,500.00) 2020 land rover discovery se(US $19,995.00)

2020 land rover discovery se(US $19,995.00)

Auto blog

Thieves stole $3.7 million worth of Jaguar Land Rover engines

Fri, Feb 3 2017This past Tuesday was not a good one for Jaguar Land Rover. According to British news source Birmingham Mail, just over $3.7 million worth of engines were stolen from the company's factory in Solihull, England. Reportedly, the thieves drove up to the facility in a stolen semi-truck, found a trailer full of engines, hooked it up, and drove off. The thieves did this twice in one night, with the same truck, and got the first trailer in just six minutes. Perhaps more shocking is that Birmingham Mail reports this is the second time a theft of this type has occurred at the facility. The previous time happened in almost exactly the same way, but the engines taken were valued at just over $1.2 million, and five people were convicted of the crime. Currently, local police are looking for the latest suspects and the engines. The trailers were found, but were empty. We got in touch with a Jaguar representative who provided us the company's official statement: "We can confirm that we are working closely with West Midlands Police to investigate the theft of engines from the Solihull manufacturing plant. A reward is on offer to anyone who has information which leads to the successful recovery of these engines. It would be inappropriate for us to make any further comment whilst this investigation is ongoing." This was the only statement he would provide, and didn't provide answers as to what engines were stolen and if there would be any impact on manufacturing or vehicle deliveries. But if you're in the UK, and you've got a tip, let the cops know. Related Video: Related Gallery 2017 Jaguar F-Pace View 46 Photos News Source: Birmingham Mail, JaguarImage Credit: Jaguar Plants/Manufacturing Weird Car News Jaguar Land Rover Luxury jaguar land rover

Jaguar demanding customer data from reluctant dealers

Tue, 25 Feb 2014

Nearly every major business is collecting consumer data these days, and keeping that data secure has come to the forefront of many customer's minds. Jaguar Land Rover North America's decision to begin requesting more customer info from its dealer network appears unfortunately timed, however. If it had come a few years ago, it might have been ignored, but in today's climate of heightened awareness, a few dealers are pushing back. To put the showrooms in an even tougher position, JLR NA is threatening to deny quarterly incentives if they do not turn over the customer data, according to Automotive News.

JLR NA instated the nationwide plan, which it calls Single View CRM, on February 7, but according to Stuart Schorr, Jaguar Land Rover North America Vice President of Communications, the automaker has been negotiating with its dealers to institute the new program for over a year. Schorr tells Autoblog that no financial information is being shared, noting that such data is limited to customer details, including things like what vehicles they own and whether they have any pending service. The initiative is meant to "improve customers' and owners' engagement with the brand," he said. Also, the company is not accessing dealer data itself; instead showrooms are asked to enter the info into JLR's database.

Jaguar Land Rover data leak reveals employee records, upcoming layoffs

Fri, May 25 2018A massive data leak has revealed the personnel files of hundreds of employees at Jaguar Land Rover's factory in Solihull, England. The documents reveal details such as sick days used, disciplinary issues and — most notably — red lines indicating potential firings in the weeks or months ahead. In total, the personal records of more than 600 workers were released. JLR is scrambling to contain the crisis. The breach was first reported by the Huffington Post UK, with the automaker initially claiming the story was "fake news." That publicity gaff certainly didn't help matters, especially for employees staring at their name with a red line slashed across it. Last month, the British automaker had said it would be eliminating roughly 1,000 employees at factories in the U.K. The Solihull plant, which produces models like the Range Rover, Range Rover Sport, Jaguar F-Pace and Jaguar XE, was among those mentioned in the statement. JLR, which is owned by the Indian conglomerate Tata Motors, is facing a steep drop in sales, particularly in its home market. The main culprits include a huge slump in sales of diesel-powered vehicles - a vital part of JLR's business in the U.K. and throughout Europe - along with fears about how the upcoming "Brexit" will affect business operations. In the HuffPost UK story, one worker called the situation "disgusting" and "embarrassing," adding that people at the factory now know whether they, or their colleagues, are soon due to lose their job. Related Video: This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings. Image Credit: Getty Hirings/Firings/Layoffs Plants/Manufacturing Jaguar Land Rover economy data