2020 Jeep Wrangler Unlimited Sahara on 2040-cars

Delray Beach, Florida, United States

Engine:2.0L I4 DOHC

Fuel Type:Gasoline

Body Type:4D Sport Utility

Transmission:Automatic

For Sale By:Dealer

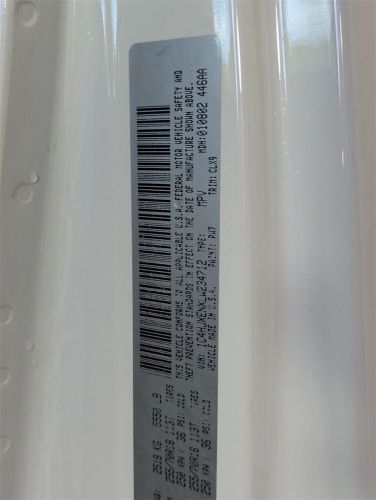

VIN (Vehicle Identification Number): 1C4HJXENXLW234712

Mileage: 25289

Make: Jeep

Trim: Unlimited Sahara

Features: --

Power Options: --

Exterior Color: White

Interior Color: Black

Warranty: Unspecified

Model: Wrangler

Jeep Wrangler for Sale

2019 jeep wrangler unlimited sport s(US $29,598.00)

2019 jeep wrangler unlimited sport s(US $29,598.00) 2023 jeep wrangler freedom 4x4 4dr suv(US $69,995.00)

2023 jeep wrangler freedom 4x4 4dr suv(US $69,995.00) 2024 jeep wrangler sport s 4xe 4x4 4dr suv(US $64,999.00)

2024 jeep wrangler sport s 4xe 4x4 4dr suv(US $64,999.00) 2003 jeep wrangler(US $11,500.00)

2003 jeep wrangler(US $11,500.00) 2020 jeep wrangler rubicon(US $65,000.00)

2020 jeep wrangler rubicon(US $65,000.00) 2017 jeep wrangler unlimited sahara(US $22,453.00)

2017 jeep wrangler unlimited sahara(US $22,453.00)

Auto Services in Florida

Wildwood Tire Co. ★★★★★

Wholesale Performance Transmission Inc ★★★★★

Wally`s Garage ★★★★★

Universal Body Co ★★★★★

Tony On Wheels Inc ★★★★★

Tom`s Upholstery ★★★★★

Auto blog

Stellantis expects to hit emissions target without Tesla's help

Tue, May 4 2021Franco-Italian carmaker Stellantis expects to achieve its European carbon dioxide (CO2) emissions targets this year without environmental credits bought from Tesla, its CEO said in an interview published on Tuesday. Stellantis was formed through the merger of France's PSA and Italy's FCA, which spent about 2 billion euros ($2.40 billion) to buy European and U.S. CO2 credits from electric vehicle maker Tesla over the 2019-2021 period. "With the electrical technology that PSA brought to Stellantis, we will autonomously meet carbon dioxide emission regulations as early as this year," Stellantis boss Carlos Tavares said in the interview with French weekly Le Point. "Thus, we will not need to call on European CO2 credits and FCA will no longer have to pool with Tesla or anyone." California-based Tesla earns credits for exceeding emissions and fuel economy standards and sells them to other automakers that fall short. European regulations require all car manufacturers to reduce CO2 emissions for private vehicles to an average of 95 grams per kilometer this year. A Stellantis spokesman said the company is in discussions with Tesla about the financial implications of the decision to stop the pooling agreement. "As a result of the combination of Groupe PSA and FCA, Stellantis will be in a position to achieve CO2 targets in Europe for 2021 without open passenger car pooling arrangements with other automakers," he added. Tesla's sales of environmental credits to rival automakers helped it to announce slightly better than expected first-quarter revenue this week. The next tightening of European regulations will soon be the subject of proposals from the European Commission. The 2030 target could be lowered to less than 43 grams/km. Related Video: Government/Legal Green Alfa Romeo Chrysler Dodge Fiat Jeep Maserati RAM Tesla Citroen Peugeot Emissions Stellantis

NHTSA still mulling crash tests for recalled Jeeps

Thu, 15 Aug 2013Well, no one should ever accuse the government of not giving things plenty of thought. The National Highway Traffic Safety Administration is still debating whether it will retest any of the 1.56 million 1992 to 1998 Grand Cherokees and 2002 to 2007 Libertys that were part of a recall regarding fires after rear-end collisions. And yes, this debate has been going on for over a month. In other news...

The recall dustup started in early June, when Chrysler took the unusual position of refusing a recall request from NHTSA regarding placement of the fuel tank on the effected vehicles. NHTSA said a collision could cause a fire, a position Chrysler took issue with. Extensive negotiations ensued, with Chrysler agreeing to fit certain Jeeps with trailer hitches, which it said would provide some protection to fuel tanks mounted behind the rear axle in the event of a collision.

Part of the issue rests with the amount of data that needs to be processed, according to The Detroit News. NHTSA administrator David Strickland said during a Washington Auto Press Association meeting, "There's a lot of data and Chrysler is being very cooperative in giving us more data." Until that information has been sorted, it looks like re-testing will still be up for debate.

China's Great Wall confirms its interest — in Jeep, or all of FCA

Tue, Aug 22 2017HONG KONG/SHANGHAI — Chinese automaker Great Wall Motor reiterated its interest in Fiat Chrysler Automobiles NV on Tuesday, but said it had not held talks or signed a deal with executives at the Italian-American automaker. China's largest sport utility vehicle manufacturer made a direct overture to Fiat Chrysler on Monday, with an official saying the company was interested in all or part of FCA, owner of the Jeep and Ram truck brands. Automotive News first reported the news, quoting Great Wall Motor President Wang Fengying as saying she planned to contact FCA to discuss acquiring the Jeep brand specifically. Those comments sent FCA shares higher but also raised questions over the ability of China's seventh-largest automaker by sales to buy larger Western rival FCA, or even Jeep, which some analysts value at as much as one-and-a-half times FCA. Great Wall sought to dampen speculation on Tuesday. It confirmed it had studied Fiat Chrysler, but said there was "no concrete progress so far" and "substantial uncertainty" over whether it would eventually bid. "The company has not built any relationship with the directors of FCA nor has the company entered into any discussion or signed any agreements with any officer of FCA so far," the company said in an English-language stock exchange filing. It did not give further detail. Fiat Chrysler stock dipped on the statement on Tuesday. Great Wall said trading in its Shanghai-listed shares would resume on Wednesday after having been suspended. Fiat Chrysler declined to comment on Great Wall's statement. On Monday, it said it had not been approached and was fully committed to implementing its current business plan. FLUSHING OUT RIVALS? Great Wall Motor, which was early to spot China's love of SUVs, had revenue of $14.8 billion last year and sold 1.07 million vehicles - but that compares with FCA's 2016 revenue of 111 billion euros ($130.6 billion). Analysts said Great Wall would need to raise both debt and equity to complete any deal, meaning its chairman Wei Jianjun could lose majority control. One possible scenario, according to analysts at Jefferies, would see Wei keeping a roughly 30 percent stake, while Great Wall would raise $10-$14 billion in debt and $10 billion in equity - hefty for a group currently worth just $16 billion. Ultimately, politics could be the clincher.