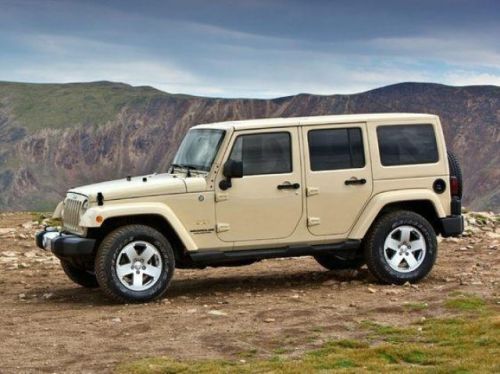

2014 Jeep Wrangler Sport on 2040-cars

4505 W. 96th St, Indianapolis, Indiana, United States

Engine:3.6L V6 24V MPFI DOHC

Transmission:5-Speed Automatic

VIN (Vehicle Identification Number): 1C4AJWAG2EL304419

Stock Num: 432197

Make: Jeep

Model: Wrangler Sport

Year: 2014

Exterior Color: Black

Interior Color: Black

Options: Drive Type: 4WD

Number of Doors: 2 Doors

***Pricing Incentives structure good through 6/30/14******#1 Sales Advocacy Indiana 3 Month Rolling Average 95.1%, 100% month of May (Source: Chrysler CEI - Customer experience initiative report***GLBC Chrysler Capital Commercial Bonus GLCEZ $750Bonus cash for Type B/E sales. Customer must finance through Chrysler Capital. 2014 Conquest Lease to Retail/Lease 38CEA1 $1,000 Bonus cash for Type 1/B and L/E sales to consumers currently leasing a competitive vehicle. No turn-in required. NOT COMPATIBLE WITH EMPLOYEE PURCHASE OR CERTAIN DESIGNATED INDIVIDUAL (CDI) PURCHASES. Discerning drivers will appreciate the 2014 Jeep Wrangler! Feature-packed and decked out! Jeep infused the interior with top shelf amenities, such as: variably intermittent wipers, heated door mirrors, and 1-touch window functionality. It features four-wheel drive capabilities, a durable automatic transmission, and a refined 6 cylinder engine. We pride ourselves in the quality that we offer on all of our vehicles. Stop by our dealership or give us a call for more information. Please call 877-512-8665 to schedule an appointment or PRINT THIS AD and bring it in with you.

Jeep Wrangler for Sale

2014 jeep wrangler unlimited sport(US $29,569.00)

2014 jeep wrangler unlimited sport(US $29,569.00) 2011 jeep wrangler unlimited sahara(US $29,900.00)

2011 jeep wrangler unlimited sahara(US $29,900.00) 2011 jeep wrangler unlimited 70th anniversary(US $30,900.00)

2011 jeep wrangler unlimited 70th anniversary(US $30,900.00) 2014 jeep wrangler unlimited sport(US $31,088.00)

2014 jeep wrangler unlimited sport(US $31,088.00) 2014 jeep wrangler sahara(US $31,609.00)

2014 jeep wrangler sahara(US $31,609.00) 2014 jeep wrangler unlimited sport(US $31,781.00)

2014 jeep wrangler unlimited sport(US $31,781.00)

Auto Services in Indiana

Wood`s Battery & Auto Elctrc ★★★★★

Wilsons Auto Repair ★★★★★

Tread Express Tires Inc ★★★★★

The Zone Honda Kawasaki ★★★★★

Ted Brown`s Quality Paint & Body Shop ★★★★★

Swinehart Auto Service ★★★★★

Auto blog

12 new cars that will never go out of style

Tue, Nov 23 2021Some cars never go out of style. Itís rare, but it happens. They get old. They get depreciated. But they never stop looking cool.¬† Some might call them modern or instant classics. Within a few years they¬íre no longer the latest and greatest, no longer the flavor of the month, but they remain special. Eternally special. Timeless.¬† These cars aren¬ít necessarily going to be worth a fortune someday. However, some may not depreciate as rapidly or as far as other models. But that¬ís not what we¬íre talking about here. These are the cars that enthusiasts will always find desirable from the curbside. They¬íre the cars you end up shopping on eBay late at night 10 years later because you can¬ít get them out of your head. They¬íre the cars that will forever excite you when you spot a clean one in traffic or in a parking lot.¬† There are plenty of recent examples over the past couple of decades that could count as instant design classics. But then we got to thinking, what 2021 models will be forever cool to stare at? Which new cars and trucks on sale today will we be shopping on eBay late at night in the 2030s? We kept supercars and other ultra-expensive cars off the list to keep things within the realm of attainability, and ended up with 12 total cars. Lexus LC We¬íre not applying a numerical ranking to any of the cars on this list, but if we were, the Lexus LC would be No. 1. There isn¬ít another car design out there that can stir our emotions the way an LC can when it¬ís just standing still. This car is a concept design come true in the most beautiful of ways, and it¬ís a shoo-in winner for Concours events decades into the future. All of this heaping praise, and we haven¬ít even gotten to the LC 500¬ís intoxicating 5.0-liter V8. It doesn¬ít win drag races. It won¬ít be the fastest around the track against any similarly-priced competition. But none of that matters. It¬ís quite possibly the best car you can buy new, and that says it all when it comes to the LC. Chevrolet Corvette It might not be the stunner that the Lexus LC is, but the new C8 Corvette is and will always be a special vehicle. It¬ís the first mid-engine Corvette, which instantly cements it into an automotive hall of fame section of sorts. All of the performance stats and specs are there to back up its supercar-like looks, and it remains the best performance bargain on sale today.

2014 Jeep Cherokee facing production delay

Fri, 17 May 2013Jeep's bold-faced new direction spearheaded by the 2014 Cherokee is facing some teething issues. According to a report by the Detroit Free Press, production start-up of the controversial new utility vehicle at its Toledo North facility is running about a month behind schedule "due to a wide range of issues." That's according to Mark Chernoby, senior vice president of engineering at Chrysler.

Chernoby maintains that the issues being encountered aren't unusual for the launch of a new vehicle - particularly one with a new powertrain - and he downplayed the delay, telling Jeep dealers that they "will have ample inventory of the midsize SUV by fall." Among the kinks being worked out? Calibrating the Cherokee's cutting-edge ZF nine-speed automatic transmission and refining assembly line tasks to make the process more efficient.

Chrysler expects to start building retail-ready versions of the Cherokee around mid-June, with official sales slated to start in September.

Jeep Gladiator Mojave and Acura MDX A-Spec | Autoblog Podcast #627

Fri, May 15 2020In this week's Autoblog Podcast, Editor-in-Chief Greg Migliore is joined by Consumer Editor Jeremy Korzeniewski and Senior Editor, Green, John Beltz Snyder. This week, they're driving a Jeep Gladiator Mojave, Acura MDX A-Spec, our long-term Subaru Forester and a Honda CR-V Hybrid. A little stir-crazy from quarantine, they also derail the conversation for a little bit to talk about beer before launching into this episode's "Spend My Money" segment. Autoblog Podcast #627 Get The Podcast iTunes Ė Subscribe to the Autoblog Podcast in iTunes RSS ¬Ė Add the Autoblog Podcast feed to your RSS aggregator MP3 ¬Ė Download the MP3 directly Rundown Cars we're driving 2020 Jeep Gladiator Mojave 2020 Acura MDX A-Spec (Here's one of those "Off The Clock" episodes we reference in our derailment about beer) Our long-term 2019 Subaru Forester gives us a moist surprise 2020 Honda CR-V Hybrid Spend My Money Feedback Email ¬Ė Podcast@Autoblog.com Review the show on iTunes Related Video: