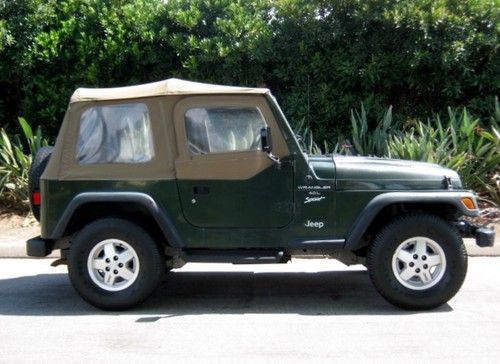

2005 Jeep Wrangler Unlimited Sport Utility 2-door 4.0l on 2040-cars

midway, GA, Georgia

Body Type:Sport Utility

Vehicle Title:Clear

Engine:4.0L 242Cu. In. l6 GAS OHV Naturally Aspirated

Fuel Type:GAS

For Sale By:Private Seller

Make: Jeep

Model: Wrangler

Warranty: Vehicle does NOT have an existing warranty

Trim: Unlimited Sport Utility 2-Door

Options: Hard Top included, 3 Inch Lift, Mickey Thompson Off Road Tires, Chrome Running Boards, Soft Top included, 4-Wheel Drive, CD Player, Convertible

Drive Type: 4WD

Safety Features: Anti-Lock Brakes, Driver Airbag

Mileage: 45,709

Power Options: Air Conditioning, Cruise Control

Exterior Color: Black

Interior Color: Black

Number of Cylinders: 6

Never off road, Garage kept

Jeep Wrangler for Sale

2004 jeep wrangler sahara sport utility 2-door 4.0l

2004 jeep wrangler sahara sport utility 2-door 4.0l 2013 jeep wrangler unlimited rubicon ***no reserve***

2013 jeep wrangler unlimited rubicon ***no reserve*** So cal-dependable-original-good cond top down fun tj 98 99 00 01 02 03 04 05 06(US $5,749.00)

So cal-dependable-original-good cond top down fun tj 98 99 00 01 02 03 04 05 06(US $5,749.00) Free shipping! rubicon 4x4 1 owner clean carfax weels(US $16,991.00)

Free shipping! rubicon 4x4 1 owner clean carfax weels(US $16,991.00) 1999 jeep wrangler 4x4 low miles, 2.5l, manual trans, gas saver, excellent cond.(US $7,499.00)

1999 jeep wrangler 4x4 low miles, 2.5l, manual trans, gas saver, excellent cond.(US $7,499.00) Awesome one of a kind wrangler with four inch lift, new tires and wheels.

Awesome one of a kind wrangler with four inch lift, new tires and wheels.

Auto Services in Georgia

Wright`s Professional Window ★★★★★

Vick`s Auto ★★★★★

V-Pro Vinyl & Leather Repair ★★★★★

Trailers & Hitches ★★★★★

Tire Town ★★★★★

Thornton Auto Care ★★★★★

Auto blog

Stellantis not looking for further mergers, including with Renault

Mon, Feb 5 2024MILAN — Stellantis Chairman John Elkann on Monday denied the carmaker was hatching merger plans, responding to press speculation about a possible French-led tie-up with rival Renault. Elkann said that the Peugeot owner, the world's third largest carmaker by sales, was focused on the execution of its long-term business plan. "There is no plan under consideration regarding merger operations with other manufacturers," said Elkann, who also heads Exor, the Agnelli family holding company that is the largest single shareholder in Stellantis. After abandoning the Russian market, at the time its second largest after France, and reducing the scope of its global cooperation with Nissan, Renault has been seen as a potential M&A target. Speculation intensified after an electric vehicle market slowdown forced it last week to cancel IPO plans for its EV and software unit Ampere. Its market cap remains stubbornly low at little over 10 billion euros ($10.8 billion) despite a financial recovery over the past few years. Stellantis, the product of a 2021 merger between France's PSA and Fiat Chrysler and one of the most profitable groups in the industry, has a market cap of more than 85 billion euros when unlisted shares are factored in. It has a 14 brand portfolio also including Citroen, Jeep, Opel and Alfa Romeo. NEWSPAPER REPORT Italian daily Il Messaggero had said on Sunday that the French government, which is Renault's largest shareholder and also has a stake in Stellantis, was studying plans for a merger between the two groups. A spokeswoman for Renault said on Monday the group did not comment on rumors. France's Finance Ministry had declined to comment on Sunday. Stellantis has crossed swords with the Italian government, which has accused it of acting against the national interest on occasions. Industry Minister Adolfo Urso last week raised the prospect of the Italian government taking a stake in Stellantis to help to balance the French influence. Renault shares pared gains after Elkann's comments to stand 1.2% higher by 1220 GMT, having initially risen more than 4%. Stellantis CEO Carlos Tavares, a Portuguese-national, last week said in an interview with Bloomberg that the group was "ready for any kind of consolidation" and that its job was to make sure that it would be "one of the winners". Analysts, however, question the rationale of a Stellantis-Renault merger, which would also expand the group's excess capacity in Europe.

FCA goes all-in on Jeep and Ram brands on cheap gas bet

Wed, Jan 27 2016It's no surprise that as SUV and truck sales remain strong in the wake of unusually cheap gas, Jeep and Ram sales are taking off. What is a surprise is that FCA CEO Sergio Marchionne thinks that cheap gas will be a "permanent condition," and feels strongly enough about it to change up North American manufacturing plans. Jeep appears to be the biggest beneficiary of the product realignment. In addition to increasing the sales estimates for the brand worldwide upwards to 2 million units a year by 2018, the brand will get a flood of investment for new product and powertrains. Consider the Wrangler Pickup to be part of the salvo, as well as the Grand Wagoneer three-row announced in 2014 as part of the original five-year plan. The Wrangler four-door will get at least two new powertrains, a diesel and mild hybrid version, in its next generation. That mild hybrid powertrain may utilize a 48-volt electrical system like the one that's being developed by Delphi and Bosch – which the suppliers think will be worth a 10 to 15 percent fuel economy gain at a minimum. Down the road, in the 2020s, the Wrangler could adopt a full hybrid system. The diesel powertrain is planned for 2019 or 2020. The Ram 1500 is also pegged to receive a mild hybrid system, again potentially based on 48-volt architecture, sometime after 2020. Lastly, Jeep and Ram will take over some of the production capacity of existing plants. The Sterling Heights, MI, plant that builds the Chrysler 200 will now build the Ram 1500; the Belvidere, IL, facility that produces the Dodge Dart will take over Cherokee output; the big Jeep facility in Toledo, OH, will be used for increased Wrangler demand. In 2015, according to FCA's numbers, car and van demand went down by 10 percent, but SUV demand went up 8 percent and truck demand 2 percent. Considering that these are high-margin vehicles, FCA can't ignore the math. FCA also won't build any new factories to supplement production to meet demand, but instead are reshuffling production priorities. Think of it this way: FCA is gambling on cheap gas being a permanent part of our lives, at least into the 2020s. By doubling down on SUVs and trucks, the company stands to win big, unless a spike in gas prices changes the landscape. FCA isn't talking about a Plan B, so they're all in. It'll be interesting to see how this plays out.

FCA spends $1.5 billion to retool plant for Ram production

Tue, Jul 26 2016Fiat Chrysler Automobiles (FCA) is planning to invest $1.48 billion to retool its Sterling Heights Assembly plant in metro Detroit to build the next generation of the Ram 1500. The investment will allow the assembly plant to go from unibody to body-on-frame construction. FCA also confirmed that production of the Chrysler 200 will end in December in order for the plant to be altered. As previously reported, FCA is looking to move production of the 1500 from its current assembly plant in Warren to the Sterling Heights Assembly plant (both are in Michigan). While FCA has not released any official plans for the Warren Truck Assembly Plant, Automotive News reports that the plant will be retooled to manufacture the Jeep Wagoneer and Grand Wagoneer SUVs. Earlier this month, FCA announced plans to invest $1.05 billion to retool the Jeep Wrangler factory. FCA's current investment plans are part of the automaker's push to put competitive products on the road. Related Video: News Source: FCA, Automotive NewsImage Credit: FCA Plants/Manufacturing Chrysler Jeep RAM SUV Sedan