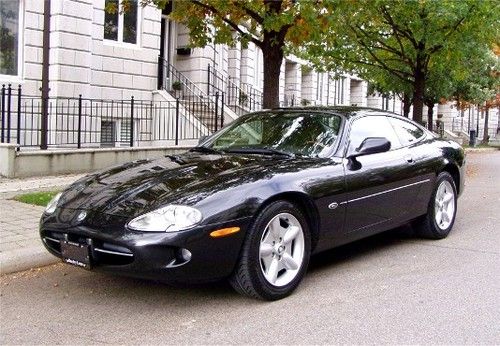

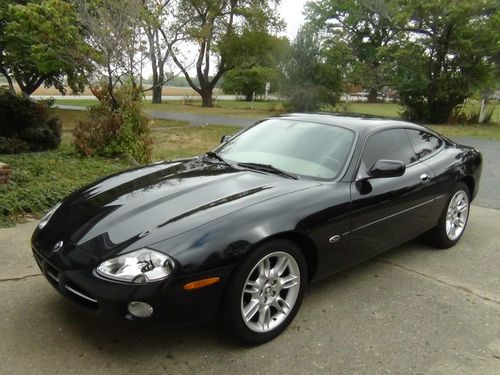

2000 Jaguar Xk8 Luxury Coupe! on 2040-cars

Columbus, Ohio, United States

Body Type:Coupe

Engine:4.0-liter V8

Vehicle Title:Clear

Fuel Type:Gasoline

For Sale By:Private Seller

Interior Color: Black

Make: Jaguar

Number of Cylinders: 8

Model: XK

Trim: XK8 Luxury Coupe

Drive Type: RWD

Mileage: 111,000

Exterior Color: Black

Jaguar XK for Sale

Jaguar xk 8 convertible 1997(US $12,000.00)

Jaguar xk 8 convertible 1997(US $12,000.00) 99 jaguar xk8 convertible 79k british racing green(US $11,500.00)

99 jaguar xk8 convertible 79k british racing green(US $11,500.00) 2002 jaguar xk8 coupe 63,500 miles, clean inside and out. rare, pristine coupe(US $14,995.00)

2002 jaguar xk8 coupe 63,500 miles, clean inside and out. rare, pristine coupe(US $14,995.00) Chrome wheels navigation bowers & wilkins reverse camera(US $73,999.00)

Chrome wheels navigation bowers & wilkins reverse camera(US $73,999.00) Certified navigation bluetooth reverse camera cooled seats(US $49,900.00)

Certified navigation bluetooth reverse camera cooled seats(US $49,900.00) 07 jaguar xk luxury convertible 25k alpine nav pdc keyless-go 20in-senta-whls(US $35,995.00)

07 jaguar xk luxury convertible 25k alpine nav pdc keyless-go 20in-senta-whls(US $35,995.00)

Auto Services in Ohio

Zig`s Auto Service ★★★★★

Zeppetella Auto Service ★★★★★

Willis Automobile Service ★★★★★

Voss Collision Centre ★★★★★

Updated Automotive ★★★★★

Tri C Motors ★★★★★

Auto blog

Jaguar F-Pace SVR with 550 horsepower headlines 2019 F-Pace refresh

Thu, May 3 2018Jaguar has introduced the lightly refreshed F-Pace for 2019. The regular models are updated with better infotainment and interior touches, but the big deal is the SVR version with its 5.0-liter V8 engine. We already saw the F-Pace SVR at the New York Auto Show, and it will now be available as a 2019 model. The supercharged V8 engine with a variable valve active exhaust system produces a whopping 550 horsepower and a touch over 501 lb-ft, hitting 60 mph in just 4.1 seconds. The SVR's top speed is 176 mph, and it's priced from $79,990. The entire gasoline-powered F-Pace lineup gets exhaust particulate filters, even the SVR. Jaguar says the ultrafine particle trapping system is regenerated every time the driver lifts his foot off the throttle. Jaguar does say the setup is market-specific. There are also larger, 21.66-gallon fuel tanks for the 250- and 300-horsepower Ingenium I4 cars, the 380-hp V6 version and the SVR, to improve range. There's now adaptive cruise with steering assist, which operates between 0 and 112 mph, and emergency braking and lane-keeping assists are standard as well as a driver condition monitoring system and a rear camera. Safety tech has also been packaged into optional safety packs, called Park Pack, Drive Pack and Driver Assist Pack; the third of these combines the earlier two and adds adaptive cruise with steering assist. The 10-inch infotainment touchscreen is standard, and Jaguar now offers new, 14-way adjustable "slimline" sports seats as an option. Related Video: This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings. Featured Gallery 2019 Jaguar F-Pace View 11 Photos Image Credit: Jaguar Jaguar SUV Luxury

Jaguar I-Pace sets Laguna Seca record, virtually matches Tesla Model S P100D

Fri, Aug 24 2018Jaguar has announced that the I-Pace crossover has set the Laguna Seca lap record for production electric vehicles. With racing driver Randy Pobst behind the wheel, the I-Pace HSE completed a lap in 1 minute and 48.18 seconds. Jaguar was adamant to stress that the record-setting vehicle was bone stock with "no modifications whatsoever." As Jalopnik reports, a bit of a dispute arose about the lap time, as a Tesla Model S P100D is said to have completed a lap in 1 minute, 47.62 seconds. However, the Tesla in question had received brake upgrades, unlike the factory specification Jaguar. The I-Pace's two electric motors are good for a combined 400 horsepower and 513 pound-feet, propelling the SUV to 62 mph in just 4.8 seconds. Jaguar has also released video footage from the Laguna Seca run, above. Look for the slide at the 30-second mark! Pobst must have been enjoying himself, as you can hear him guffawing after the famous Corkscrew section. While this record was all about the prowess of a production EV, there will be a racing series featuring the I-Pace, as the I-Pace eTrophy begins in the fifth season of ABB FIA Formula E. View 3 Photos Related Video:

This classic Jaguar XJ has a 720-hp ungentlemanly secret

Tue, 19 Nov 2013Forget Tawny Kitaen. If you want to make a Jaguar XJ rock, just do what this guy did: stuff a heavily modified and turbocharged General Motors V8 under the hood, and take it to the track.

The video calls this Series 1 XJ a sleeper, but with its open exhaust and obvious turbo whistle, the once-gentlemanly sedan is anything but. The owner says that the engine is GM LQ9 V8 that has been stroked to 402 cubic inches putting out around 720 horsepower with 12 pounds of boost (in standard form, this 6.0-liter V8 was used in the second-gen Cadillac Escalade). Check out the video below to see what that kind of power does for this classic Jaguar in the eighth-mile.