2012 Jaguar Xkr-s on 2040-cars

Dallas, Texas, United States

Jaguar XKR for Sale

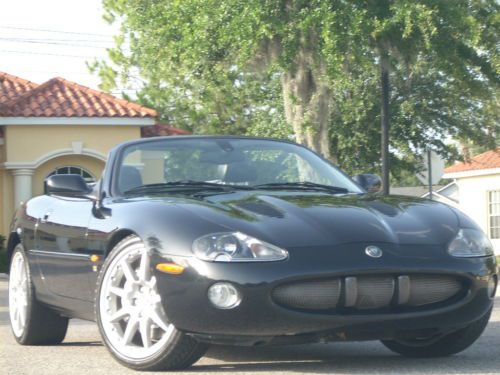

Xkr convertible,4.2l,triple black, 20'' montreals, just beautiful!!!(US $18,950.00)

Xkr convertible,4.2l,triple black, 20'' montreals, just beautiful!!!(US $18,950.00) Low mile xk-r conv new ferrari trade indigo blue immaculate condition(US $54,899.00)

Low mile xk-r conv new ferrari trade indigo blue immaculate condition(US $54,899.00) 2001 jaguar xkr base convertible 2-door 4.0l - supercharged luxury !(US $21,900.00)

2001 jaguar xkr base convertible 2-door 4.0l - supercharged luxury !(US $21,900.00) 2006 jaguar xkr convertible 73k miles*leather*navigation*clean carfax*we finance(US $22,973.00)

2006 jaguar xkr convertible 73k miles*leather*navigation*clean carfax*we finance(US $22,973.00) Jaguar xkr coupe 2002(US $13,000.00)

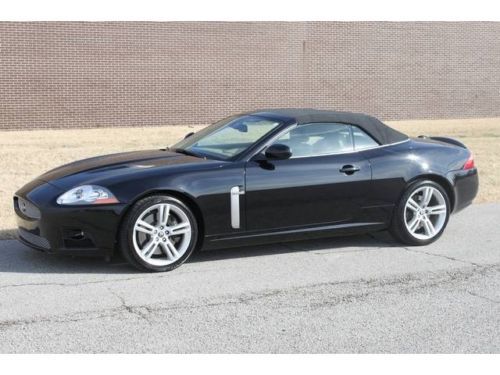

Jaguar xkr coupe 2002(US $13,000.00) 2007 jaguar xkr automatic 2-door convertible

2007 jaguar xkr automatic 2-door convertible

Auto Services in Texas

Yescas Brothers Auto Sales ★★★★★

Whitney Motor Cars ★★★★★

Two-Day Auto Painting & Body Shop ★★★★★

Transmission Masters ★★★★★

Top Cash for Cars & Trucks : Running or Not ★★★★★

Tommy`s Auto Service ★★★★★

Auto blog

2019 Jaguar F-Pace SVR First Drive Review | Magnificent beast

Tue, Apr 23 2019ST. TROPEZ, France — Summarizing a new car in just two words is a wicked challenge, but here goes: Magnificent beast. That's the nickname Jaguar's engineering team gave the 2019 F-Pace SVR, and ... spoiler alert ... it's actually a damn fine descriptor for the 550-horsepower sport ute. The hot-rod SUV genre has been endlessly expanding, pioneered by the likes of the Porsche Cayenne. Recent contenders like the Alfa Romeo Stelvio Quadrifoglio and Mercedes-AMG GLC 63 keep the competition on its toes by busting Nurburgring Nordschleife lap records that shamed supercars from just a few years ago. The Jaguar F-Pace SVR arrives a tad late to the high-speed party. Previously available with as much as 380 horsepower from a supercharged V6, the new SVR plays ball packing a 5.0-liter V8 beneath its vented hood. The supercharged mill punches 550 hp and 502 lb-ft through an eight-speed ZF automatic. Power is routed to all four wheels, naturally, but the SVR is also the first F-Pace to get torque vectoring thanks to an electronically controlled rear differential. Also aiding the F-Pace through the corners are stiffer springs, reprogrammed adaptive Bilstein dampers, 12-inch forged aluminum wheels and a brake-based torque vectoring system. Additional go-fast goodies include lift-reducing aero, better engine ventilation, and larger four-piston front and two-piston rear ventilated brakes housed in larger 21-inch wheels. The F-Pace SVR's cabin offers more sporty austerity than before. Slimmer, supportive 10-way adjustable seats echo the SUV's more focused road manners, as do aggressive color schemes, contrast stitching, and a suede headliner. Small touches also signal the sharper edges, including an F-Type-derived shifter in place of the mediocre rotary gear selector. It doesn't inherit Jaguar's latest dual-screen infotainment system, updated steering wheel, or second-gen heads up display, as does the recently updated XE sedan. The F-Pace SVR shares a similar tune to the 575-hp F-Type SVR, but the SUV's V8 fires up with a milder bark. A new exhaust valve adjusts its butterfly valves gradually, avoiding the "light switch" transition from quiet to loud. And speaking of loud, while the blarty exhaust note isn't as in-your-face as some of Jaguar's more vocal models, U.S. versions might be slightly raspier since the European model I was driving was equipped with a gasoline particulate filter that has a slight muffling effect.

2016 Jaguar XE is ready to stalk the competition

Mon, 08 Sep 2014

The XE wears some of the best styling elements from Jaguar's current litter.

Big sedans and sports cars. Jaguar has been known for those two things since the company's name was birthed in 1945. Stylish saloons like the Mark 2 and performance machines like the E-Type make up the brand's heritage, but the compact sedan market is one where the British marque has lacked great product.

California adapts ZEV mandate with PHEVs for smaller automakers

Fri, Jun 5 2015California is the nation's largest market for zero-emissions vehicles with over 100,000 of them estimated to be on the roads there. The state's goal is to keep that number growing every year. To that end, the California Air Resources Board is now tweaking its rules in a way that might not boost ZEVs but could mean more plug-in hybrids for the Golden State. Jaguar Land Rover, Mazda, Mitsubishi, Subaru, and Volvo asked for an exemption to the state's zero-emissions vehicle mandate last year due to their relatively small development budgets compared to larger automakers. CARB denied their request but did craft a compromise, according to Automotive News. Rather than being required to offer a ZEV in the state, companies with an annual global revenue of less than $40 billion, like those in this group, may instead sell plug-in hybrids to earn ZEV credits. The companies aren't completely off the hook, though. If these plug-in hybrids don't earn enough credits, the corporations must buy them on the market to make up the difference. Automakers with popular electric models like Nissan and Tesla have made a big business through this trading system by selling their surplus to rivals. Tesla alone pocketed $51 million in the first quarter from this part of its business, according to Automotive News. The changes to the regulations also aren't set in stone, yet. CARB is meeting in 2016 and could adjust things further at that time. Related Video: News Source: Automotive News - sub. req. via Hybrid CarsImage Credit: Justin Sullivan / Getty Images Government/Legal Green Jaguar Land Rover Mazda Mitsubishi Subaru Volvo Emissions Electric Hybrid California zev credits zero emissions vehicle