2013 V8 Supercharged Navigation Backup Camera Heated Seats Bluetooth Sirius on 2040-cars

Dallas, Texas, United States

For Sale By:Dealer

Engine:5.0L 5000CC V8 GAS DOHC Supercharged

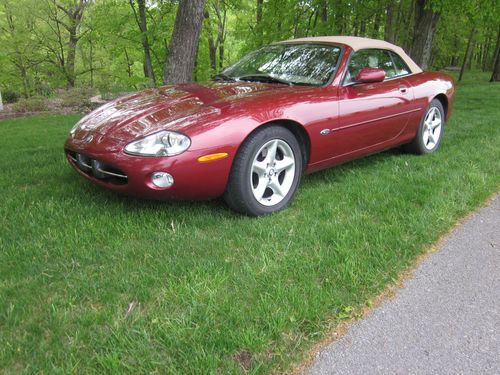

Body Type:Convertible

Fuel Type:GAS

Transmission:Automatic

Warranty: Vehicle has an existing warranty

Make: Jaguar

Model: XKR-S

Trim: Base Convertible 2-Door

Disability Equipped: No

Doors: 2

Drive Type: RWD

Drive Train: Rear Wheel Drive

Mileage: 1,872

Number of Doors: 2

Sub Model: Convertible

Exterior Color: Burgundy

Number of Cylinders: 8

Interior Color: Red

Jaguar XK for Sale

2000 jaguar xk8 convertible 4.0l, 20" wheels, clean! alpine stereo, make offer!(US $9,995.00)

2000 jaguar xk8 convertible 4.0l, 20" wheels, clean! alpine stereo, make offer!(US $9,995.00) 2001 jaguar xk8 base convertible 2-door 4.0l manufactures buy back(US $15,900.00)

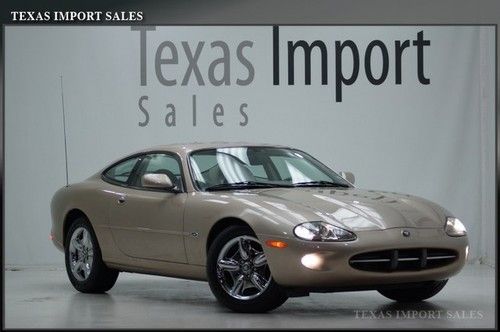

2001 jaguar xk8 base convertible 2-door 4.0l manufactures buy back(US $15,900.00) 2010 jaguar xk coupe - green metallic(US $42,000.00)

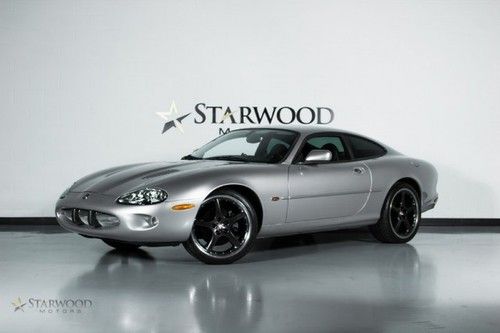

2010 jaguar xk coupe - green metallic(US $42,000.00) 1998 xk8 coupe78k miles! chrome wheels,warranty,l@@k(US $10,650.00)

1998 xk8 coupe78k miles! chrome wheels,warranty,l@@k(US $10,650.00) 2000 jaguar xk8 supercharged(US $19,888.00)

2000 jaguar xk8 supercharged(US $19,888.00) 1959 jaguar xk 150 roadster rare classic restored collector car excellent!(US $99,000.00)

1959 jaguar xk 150 roadster rare classic restored collector car excellent!(US $99,000.00)

Auto Services in Texas

Your Mechanic ★★★★★

Yale Auto ★★★★★

Wyatt`s Discount Muffler & Brake ★★★★★

Wright Auto Glass ★★★★★

Wise Alignments ★★★★★

Wilkerson`s Automotive & Front End Service ★★★★★

Auto blog

Jaguar design chief Ian Callum rules out station wagons

Wed, Apr 20 2016If you liked the idea of a Jaguar wagon and were secretly hoping that the British automaker might bring one over, we have some unfortunate news for you. Not only will the company not bring any wagons to the North American market, but according to design chief Ian Callum, it won't be making any at all. "The [wagon] market is massively shrinking. I'm very sad about it but it's a very difficult market to justify," Callum told Automotive News Europe. German automakers Audi, BMW, and Mercedes can make wagons work because their home market is the largest for wagons in the world and any wagons they sell elsewhere are just chocolate icing on the Black Forest cake. For its part, Jaguar has produced two wagon models in the X-Type and the previous XF Sportbrake. That's a shame in Jaguar's case, because the XFR-S Sportbrake was a heck of a ride that left us wondering why anyone would want something taller. Those of like mind, we suppose, will just have to content themselves instead with German wagons like the Audi A6 Allroad, BMW 3 Series, Mercedes E-Class, and Volkswagen Golf SportWagen – and hope that Volvo doesn't get squeezed out of the wagon market as well. Related Video:

Ford Mustang chief engineer, mid-engine Corvette | Autoblog Podcast #488

Fri, Sep 16 2016Note: There were some technical difficulties that prevented some of you from downloading this week's podcast. The player and link below should be working now, and the file has reached iTunes and other feeds as well. Thanks to everyone who wrote in to let us know of the issues! On the podcast this week, we have some questions for Ford Chief Engineer Carl Widman. Plus, Associate Editor Reese Counts joins Mike Austin to talk about the latest news, most notably the spy photos of the upcoming mid-engine Corvette. We also chat about the Jaguar F-Type Coupe, the Nissan Armada, and why 0-60 mph is a stupid performance figure. And, of course, we get into some Spend My Money advice, telling strangers what car to buy. And new this week is a cost-no-object what-cars-would-you-buy game. The rundown is below. And don't forget to send us your questions, money-spend or otherwise, to podcast at autoblog dot com. Autoblog Podcast #488 The video meant to be presented here is no longer available. Sorry for the inconvenience. Topics and stories we mention Mid-engine Chevrolet Corvette spied Chevy Bolt EV comes with 238 miles of range Ford will sell self-driving cars by 2025 Jaguar F-Type Coupe 2017 Nissan Armada (yes, Mike knows it's not a Patrol) Ford Mustang Chief Engineer Carl Widman interview Spend My Money - we give purchase advice Why 0–60 mph is a stupid performance test Rundown Intro - 00:00 The news - 03:30 What we've been driving - 16:20 Carl Widman - 26:44 Spend my money - 37:03 New fun game - 51:48 0–60 mph is overrated - 56:50 Total Duration: 1:04:57 Get The Podcast iTunes – Subscribe to the Autoblog Podcast in iTunes RSS – Add the Autoblog Podcast feed to your RSS aggregator MP3 – Download the MP3 directly Feedback Email – Podcast at Autoblog dot com Review the show in iTunes Podcasts Chevrolet Ford Jaguar Nissan Car Buying nissan armada mid-engine corvette jaguar f-type coupe

Jaguar F-Type SVR graphics package makes it look like the Project 7

Mon, Mar 5 2018If you missed out on buying a Jaguar F-Type Project 7 roadster a few years ago, Jaguar will now offer a way to get the next best thing. It's rolling out a new graphics package for the F-Type SVR that adds a set of stripes and contrasting accents that are very reminiscent of the special Project 7 and the race cars that inspired it. And since the current SVR makes the same power as the Project 7, you won't be missing out on much except the custom bodywork. Across the hood and fenders are similar horizontal stripes that only really differ in how the number "575" is included. This number represents the car's 575 horsepower. The front stripes are joined by more on the sideskirts and mirrors, with those on the sideskirts also getting the 575 designation. The stripes are complemented by a grille surround and wing end caps finished with the same color as the stripes. Jaguar will offer the graphics package in six color combinations. It can be had in white with red stripes, black with gold stripes, grey with blue stripes, red with black stripes, blue with grey stripes, or silver with black stripes. Also, while it will be a no-cost option overseas, it will add a bit to the cost of North American examples. Jaguar didn't say how much the option will be here, though. Related Video: Featured Gallery Jaguar F-Type SVR Graphics Package: Geneva 2018 View 11 Photos Related Gallery 2019 Jaguar F-Type SVR 575 with optional graphics View 13 Photos Image Credit: Live photos copyright 2018 Drew Phillips / Autoblog.com Design/Style Motorsports Jaguar Coupe Luxury Performance jaguar f-type svr jaguar project 7