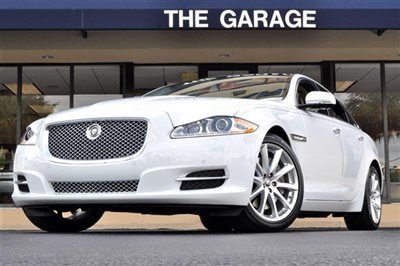

2012 Xjl (4dr Sdn Xjl) Used 5l V8 32v Automatic Rwd Sedan Premium on 2040-cars

Houston, Texas, United States

Vehicle Title:Clear

Engine:5.0L 5000CC V8 GAS DOHC Naturally Aspirated

For Sale By:Dealer

Body Type:Sedan

Fuel Type:GAS

Interior Color: Tan

Make: Jaguar

Model: XJ

Warranty: Yes

Trim: L Portfolio Sedan 4-Door

Drive Type: RWD

Number of Doors: 4 Doors

Mileage: 16,021

Sub Model: XJL (4dr Sdn XJL)

Number of Cylinders: 8

Exterior Color: White

Jaguar XJ for Sale

Jaguar xjl supercharged v8 navigation panorama(US $62,995.00)

Jaguar xjl supercharged v8 navigation panorama(US $62,995.00) 20k miles nav navigation leather paddle carfax panoramic factory warranty

20k miles nav navigation leather paddle carfax panoramic factory warranty 2012 jaguar xj sedan,pano sunroof,keyless entry/start,white over cashew/truffle(US $56,900.00)

2012 jaguar xj sedan,pano sunroof,keyless entry/start,white over cashew/truffle(US $56,900.00) 2012 jaguar xjl portfolio sedan**blind spot**pano roof**navi**camera**paddles**

2012 jaguar xjl portfolio sedan**blind spot**pano roof**navi**camera**paddles** Portfolio heated cooled nav navigation massage panoramic portfolio streaming sat(US $59,995.00)

Portfolio heated cooled nav navigation massage panoramic portfolio streaming sat(US $59,995.00) 2012 jaquar xj. rhodium brilliant silver. looks truly amazing!! 11k.

2012 jaquar xj. rhodium brilliant silver. looks truly amazing!! 11k.

Auto Services in Texas

Wynn`s Automotive Service ★★★★★

Westside Trim & Glass ★★★★★

Wash Me Car Salon ★★★★★

Vernon & Fletcher Automotive ★★★★★

Vehicle Inspections By Mogo ★★★★★

Two Brothers Auto Body ★★★★★

Auto blog

Audi and Jaguar Land Rover recalls address seatbelt issues

Tue, Aug 2 2022Audi and Jaguar Land Rover are each recalling several thousand vehicles for separate potential seatbelt issues. The recalls cover the 2022 Audi A3 and S3; 2022 Jaguar F-Type, F-Pace and XF; and the 2022-23 Land Rover Defender, Discovery, Discovery Sport, Range Rover Sport and Range Rover Velar. Examples of these vehicles may have shipped with seatbelt pretensioners that will not function properly in the event of an accident. Audi is recalling its sedans for tensioner devices that may not adequately restrain drivers or passengers during a crash. The issue was discovered during Korean market crash testing of the high-performance RS 3. "The seat belt tensioner in the affected vehicles serve the purpose of holding the passenger in his position in the seat," Audi said in its defect report to NHTSA. "In the event of a crash, the retention force of the seat belt may not reach the intended level. As a result, the position of the body can be further to the front of the seat, which leads to a negative influence on the whole restraint system, increasing the risk of injury." A different company, Jaguar Land Rover (JLR), meanwhile, also has an issue with a batch of pretensioners installed in its cars and SUVs. Pretensioners are the devices that fire off to rapidly retract the seatbelt when a crash is detected. Most utilize an explosive charge and pressure tube JLR says that some pretensioner devices provided by one of its suppliers may not have properly-specified pressure tubes that may not channel the gasses to the retraction mechanism correctly. "A damaged front seat belt pretensioner tube may have been installed on the seat belt retractor," JLR's report said. "This may result in a reduced level or complete loss of pre-tensioning in the event of a crash and increased occupant injury." Owners of the models included in both recall campaigns should receive notices from the manufacturers in the coming months. Related video: Recalls Audi Jaguar Land Rover Ownership Safety SUV Sedan

Jaguar Land Rover opens winter testing facility in Minnesota

Wed, 12 Dec 2012As it begins the rollout of the all-wheel-drive Jaguar XJ and XF models, Jaguar Land Rover has just announced that it has opened a new facility in northern Minnesota for winter testing. Located in International Falls, MN (on the US and Canadian border), the British automaker says it is one of the coldest locations in the Continental US. Jaguar's new Instinctive All Wheel Drive system was developed primarily to help sell more cars in the northern US, so it only makes sense to open a testing area in the US as well.

With temperatures that can drop to minus 55 degrees Fahrenheit, International Falls was chosen to mimic some of the worst weather a Jaguar or Land Rover will ever see. The grounds house testing chambers, various road surfaces and even a frozen lake. This new facility complements the hot-weather testing grounds in Phoenix, AZ.

The official press release is posted below.

Jaguar's electric speedboat smashes decade-old record

Mon, Jun 18 2018We knew Jaguars prowl on dry land, but apparently they dabble with water, too. Jaguar teamed up with powerboat racing specialist Vector and Williams Advanced Engineering to beat the existing British and world records for fastest battery-powered boat with some expertise from Jaguar's Formula E team. The team had to top 76.8 mph, a record set in 2008 by Helen Loney in her Firefly electric hydroplane with Agni motors. The attempt was made in the same location, Coniston Water in the English Lake District, where speedboat record runs have been made since the days of Sir Malcolm Campbell as early as the 1930s, and son Sir Donald Campbell into the 1950s and 1960s – including the fateful record attempt that cost the younger Campbell his life in 1967. The company's documented the attempt in the video shown above. It reveals that the 2008 record wasn't easy to beat. At first, pilot and Jaguar Vector co-founder Peter Dredge managed to get the boat to 76.6 mph – annoyingly close to, and just under, the record. But a later run rewarded the team's efforts, with a clear improvement of nearly 12 mph, making the new record 88.61 miles per hour. This achievement is also impressive considering that Jaguar and Vector only announced their partnership in October 2017, so progress has been swift. The tech in the boat is reportedly derived from Formula E technology, though Jaguar Vector and Williams Advanced Engineering have not disclosed the boat's exact specifications nor what parts are based on Jaguar Formula E car parts. Related Video: Green Jaguar Electric Racing Vehicles Videos williams advanced engineering