2010 Jaguar Xf Supercharged Sedan 4-door 5.0l on 2040-cars

Pasadena, California, United States

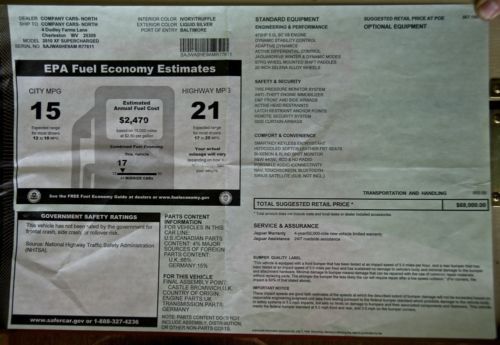

|

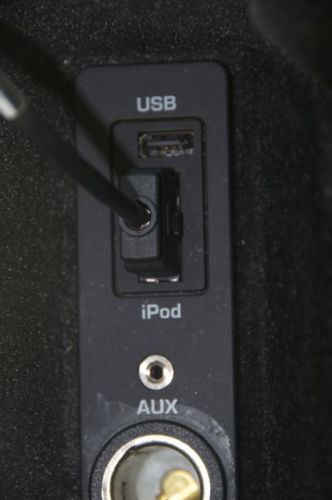

Balancing style, refinement and performance, this 2010 Jaguar XF Supercharged is in pristine condition and has LOW MILES - less than 39,000! Key features include 470 horsepower 5.0 liter SC V8 engine, dynamic stability control, active differential control, steering wheel mounted shift paddles, 20” Selena wheel (wider rear wheels), smartkey keyless entry/start, security system, bi-xenon & blind spot monitor, parking aid pack with rear camera, anti-theft engine immobilizer, headlamps with auto leveling, voice activator, 2010 VIN, 2010.5 model year parts. This performance sedan also features supercharged trim, liquid silver exterior, ivory/truffle interior, rich oak veneer trim, Bowers & Wilkins 440W sound system, CD 6 disc multi-changer, iPod/MP3 input, sunroof, heated leather steering wheel, Bluetooth connectivity, navigation system, Jaguar Suedecloth premium headlining, soft grain console, cruise control, heated and cooled leather front seats with 16/12 way power & memory function, electric rear window sunblind, split folding rear seat, premium footwell rugs. Original Sticker Price: $68,000 PURCHASE WITH CONFIDENCE The balance of the Jaguar Select Edition warranty applies until August 2016 or 100,000 miles. Corrosion warranty applies until August 2016 EXPERTS ARE SAYING Car and Driver says “Put your right foot to the floor of the Supercharged, and 60 mph comes in 4.3 seconds, beating the 2009 XF Supercharged by 0.7 second—and tying our best XFR run.” Edmunds.com explains "Refined ride, sporty handling, powerful V8 performance, stylish and well-crafted interior." We purchased this vehicle from Rusnak Pasadena in January of 2011 - it was an unregistered factory executive vehicle. Buyer responsible for local pick-up, we will not ship the car. |

Jaguar XF for Sale

2011 jaguar xf 5.0 navigation 1 owner mint perfect ebony over black 17k mi(US $35,944.00)

2011 jaguar xf 5.0 navigation 1 owner mint perfect ebony over black 17k mi(US $35,944.00) Cpo, immaculate, loaded, low mileage, portfolio edition(US $29,000.00)

Cpo, immaculate, loaded, low mileage, portfolio edition(US $29,000.00) 2013 jaguar xf navigation, backup camera, certified, clean carfax, non- smoker(US $47,988.00)

2013 jaguar xf navigation, backup camera, certified, clean carfax, non- smoker(US $47,988.00) 2009 jaguar xf 4dr sdn luxury bluetooth, backup aid, wheels, sunroof, leather(US $29,990.00)

2009 jaguar xf 4dr sdn luxury bluetooth, backup aid, wheels, sunroof, leather(US $29,990.00) 2011 jaguar xf sunroof nav htd leather pwr sunshade 35k texas direct auto(US $30,980.00)

2011 jaguar xf sunroof nav htd leather pwr sunshade 35k texas direct auto(US $30,980.00) 2010 xfr used 5l v8 32v rwd sedan premium(US $39,991.00)

2010 xfr used 5l v8 32v rwd sedan premium(US $39,991.00)

Auto Services in California

Young`s Automotive ★★★★★

Yas` Automotive ★★★★★

Wise Tire & Brake Co. Inc. ★★★★★

Wilson Motorsports ★★★★★

White Automotive ★★★★★

Wheeler`s Auto Service ★★★★★

Auto blog

Jaguar considering lightweight F-Type Club Sport?

Wed, 02 Apr 2014In the market for a Jaguar F-Type? Then let us commend you, first of all, on your good taste. But you've got a difficult decision ahead of you: Do you go for the power of the V8 or the lighter weight of the V6? It's a tough call, even if the ~$30k range in price from the entry model to the flagship doesn't phase you.

Well, to make the decision easier (or potentially more difficult), Jaguar is said to be looking into yet another tempting option: that of a lightweight Club Sport model. Tipped to be based on the coupe (and not the heavier roadster), the F-Type Club Sport would allegedly shed a good 400 pounds or so off the curb weight, not so much through the removal of one component or another but through a "holistic" approach that would call on all aspects of the car to play their part in ditching excess weight. That could mean everything from carbon-fiber body panels to a stripped-out interior denuded of sound-deadening materials and creature comforts, says Auto Express.

In developing the rumored F-Type Club Sport, Jaguar is apparently facing a similar dilemma to what buyers are pondering: will it base the track-focused model on the top-of-the-line F-Type R, with its 5.0-liter supercharged V8 driving 542 horsepower to the rear set of lighweight alloys but weighing down the schnoz? Or should it try to get more power out of the lighter 3.0-liter supercharged V6, which currently nets 340 hp in base form and 380 in S spec? Let Jag know what you'd do by leaving your thoughts in Comments.

Jaguar F-Type squares off against Porsche 911, Aston V8 Vantage with Chris Harris

Fri, 21 Jun 2013Chris Harris is back on the job, taking on really really difficult car questions like: Which enormously sexy and good-to-drive, high-performance convertible is the top of the heap? As one of the hottest cars in the luxury space right now, the Jaguar F-Type S is, of course, in on the action. Competition comes in the form of the Aston Martin V8 Vantage Roadster and the Porsche 911 Carrera S Cabriolet. Sun-loving CEOs who despise test-driving need look no further.

Scroll on below for a fully featured (with a running time of more than 20 minutes) comparison video. Harris does his best to entertain - in a typically nitpicky and made-up-British-words fashion - and the moving pictures are lovely to look at. Kick back, pour a pint and get your weekend started off right.

Jaguar Land Rover considering Mexican plant

Mon, Apr 27 2015Jaguar Land Rover has been expanding its production out of the UK and into overseas markets, and according to the latest word from Bloomberg, the British automaker is considering spending more than half a billion dollars to build a new assembly plant somewhere in Mexico. Since the Range Rover Sport and Evoque are two of the company's top sellers in the US, those would reportedly be the most likely to be manufactured at the Mexican plant, although Jaguars could follow as well. The automaker was previously said to be leaning towards a location in the Southern US, and while it could conceivably proceed with plans for both, it would be more likely to go with one or the other. State and local authorities below the Mason-Dixon line have been soliciting the business with various incentives, but lower labor costs South of the Border could prove more attractive to JLR and its parent company Tata. It wouldn't be the first, after all. Over the past month alone, General Motors committed to building the next Chevy Cruze in Mexico, Toyota did the same with the Corolla, Hyundai was reported to be considering a similar step, and Ford announced two new plants in the country amounting to a $2.5-billion investment. Luxury automakers like Audi, BMW and Mercedes have also been delving into Mexican production as well, blazing a path that JLR could potentially follow. The British automaker recently opened a plant in China and another in Brazil, while investing in additional facilities in the UK as well.