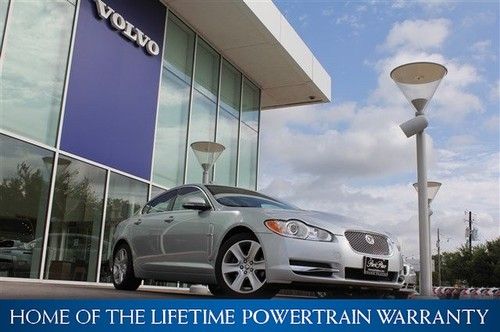

11 Jaguar Xf Premium 42k 1-own Nav Pdc Cam Keyless Moonroof 19in-alloys on 2040-cars

Stafford, Texas, United States

Vehicle Title:Clear

For Sale By:Dealer

Engine:5.0L 5000CC V8 GAS DOHC Naturally Aspirated

Body Type:Sedan

Fuel Type:GAS

Year: 2011

Make: Jaguar

Model: XF

Trim: Premium Sedan 4-Door

Disability Equipped: No

Doors: 4

Drive Type: RWD

Drivetrain: Rear Wheel Drive

Mileage: 42,384

Number of Doors: 4

Sub Model: Premium

Exterior Color: Black

Number of Cylinders: 8

Interior Color: Black

Jaguar XF for Sale

Back up camera leather panoramic navigation bluetooth off lease only(US $42,999.00)

Back up camera leather panoramic navigation bluetooth off lease only(US $42,999.00) 2010 jaguar xf supercharged sedan 470hp claret red ivory 20k miles

2010 jaguar xf supercharged sedan 470hp claret red ivory 20k miles Factory warranty moonroof turbo bluetooth all power off lease only(US $37,999.00)

Factory warranty moonroof turbo bluetooth all power off lease only(US $37,999.00) 2010 jaguar luxury

2010 jaguar luxury 2012 xj portfolio edition 18k miles,1-owner,100-pics,1.49% financing(US $54,950.00)

2012 xj portfolio edition 18k miles,1-owner,100-pics,1.49% financing(US $54,950.00) 2010 xfr supercharged,navi,bowers/wilkins,adaptive cruise,1.49% financing(US $45,450.00)

2010 xfr supercharged,navi,bowers/wilkins,adaptive cruise,1.49% financing(US $45,450.00)

Auto Services in Texas

Whatley Motors ★★★★★

Westside Chevrolet ★★★★★

Westpark Auto ★★★★★

WE BUY CARS ★★★★★

Waco Hyundai ★★★★★

Victorymotorcars ★★★★★

Auto blog

Jaguar planning additional models, engines

Fri, May 1 2015Jaguar is in the midst of a product offensive, rolling out the new XE and XF sedans while preparing the upcoming F-Pace crossover. But it's not about to sit on its leather-upholstered laurels. According to Motor Trend, the British automaker has a slew of projects in the cooker. For starters, there will reportedly be more versions of the flexible new Ingenium engine family. The lineup is being launched with gasoline and diesel four-cylinder engines, but is tipped to breed smaller three-cylinder versions as well to slot into a variety of Jaguar and Land Rover models. More intriguing, however, is the suggestion that Coventry is planning to replace its long-serving 3.0-liter supercharged V6 with a new straight six engine that could go turbocharged – which would make some sense out of the 35t moniker being worn by the supercharged XE. Of course Jaguar is going to need some new vehicles to slot those engines into, and MT suggests there are several possibilities under consideration (if not actual current development). The XE could breed wagon, coupe and convertible versions, as well as an SVR variant to take on the the BMW M4, Cadillac ATS-V et al. If the F-Pace proves a success, it could lead to larger and smaller crossovers in the future. The next XK is tipped to grow larger and go up-market. There, it would compete with the likes of the Bentley Continental GT, Rolls-Royce Wraith and Mercedes S-Class Coupe, while steering clear of the smaller F-Type. Related Video:

Jaguar Land Rover parent Tata posts a loss over coronavirus

Tue, Oct 27 2020BENGALURU — India's Tata Motors posted a wider loss for the September quarter on Tuesday as the COVID-19 pandemic sapped demand in several of its key markets. The global health crisis has hammered sales for automakers worldwide and compounded problems for Tata Motors, which was trying to improve Jaguar Land Rover (JLR) sales amid weak demand and uncertainty related to Brexit. Tata Motors reported a consolidated net loss of 3.14 billion rupees ($42.47 million) for the second quarter ended Sept. 30, compared with a loss of 2.17 billion rupees a year earlier. Retail unit sales at luxury car unit JLR, which rakes in most of the company's revenue, was down nearly 12% for the reported quarter. Tata Motors, however, said it expects JLR sales to gradually improve. "Despite concerns around the risk of a second wave of (COVID-19) infections ... we expect a gradual recovery of demand and supply in the coming months," the carmaker said in an exchange filing. Total revenue from operations fell 18.2% to 535.3 billion rupees. Tata Motors said it was committed to achieving near-zero net automotive debt in the coming years. Shares of Tata Motors ended 1.46% higher on Tuesday while the broader Mumbai market settled 1.03% higher.

Jaguar Land Rover hands Tata the biggest loss in Indian corporate history

Fri, Feb 8 2019BENGALURU/NEW DELHI — Jaguar Land Rover's owner Tata Motors Ltd stunned markets by posting the biggest-ever quarterly loss in Indian corporate history of about $4 billion on slumping China sales, sending its shares crashing as much as 30 percent. Tata Motors also warned that the Jaguar Land Rover (JLR) unit, which brings in most of its revenue, would swing to an operating loss for the year versus an earlier projection it would break even, given weak sales at the luxury British carmaker. JLR's China retail sales were cut almost in half in the December quarter as overall demand in the world's biggest auto market contracted last year for the first time since the 1990s. The firm has also been buffeted by Brexit woes and weaker business for diesel cars that account for bulk of its sales in Europe. Tata Motors turned in a third-quarter loss of 269.93 billion rupees ($3.8 billion) on Thursday, more than half its current market capitalization of $6.1 billion, mostly due to a massive impairment at JLR. Analysts were expecting a profit. "We are now taking clear and decisive actions in JLR to step up its competitiveness, reduce costs and improve cash flows and make the business fit for the future," Chief Financial Officer PB Balaji told reporters on a conference call on Thursday. JLR has taken steps to address the slide in China sales by changing its strategy to focus on profits for dealers instead of sales and incentivising retail sales over wholesale, he said. "We are encouraged by continued demand for the refreshed Range Rover and Range Rover Sport," JLR Chief Commercial Officer Felix Brautigam said in a statement. "With deliveries of the new Evoque due to start later this quarter, we look forward to building momentum." But analysts expect JLR to struggle to generate profit with China's economy projected to slow further this year after growth eased to its weakest pace in almost three decades in 2018. JLR's overall retail sales in January plunged 11 percent. The dour numbers prompted Tata investors to make a beeline for the exits as markets opened on Friday, with shares of the company skidding to their lowest in nine years at one point. The stock was down about 20 percent by 0720 GMT near 150 rupees, on track for its sharpest drop since 2003. At least four brokerages cut their price target for Tata Motors shares after its quarterly loss. Analysts at Jefferies pegged the stock at 250 rupees, versus an earlier target of 300 rupees, citing weak performance at JLR.

2040Cars.com © 2012-2025. All Rights Reserved.

Designated trademarks and brands are the property of their respective owners.

Use of this Web site constitutes acceptance of the 2040Cars User Agreement and Privacy Policy.

0.068 s, 7900 u