All Wheel Drive! on 2040-cars

Newton, New Jersey, United States

Vehicle Title:Clear

Engine:6

Fuel Type:Gasoline

For Sale By:Dealer

Transmission:Automatic

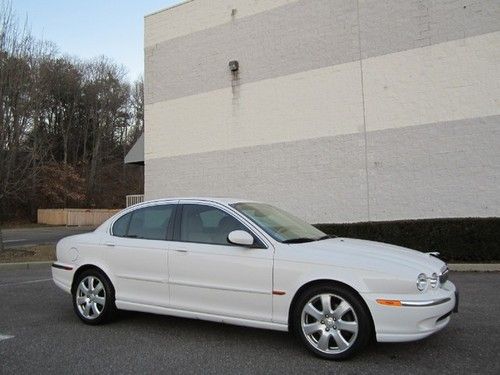

Make: Jaguar

Warranty: Vehicle does NOT have an existing warranty

Model: X-Type

Options: Leather Seats, Sunroof, 4-Wheel Drive, CD Player

Mileage: 103,790

Safety Features: Anti-Lock Brakes, Driver Airbag

Sub Model: 4dr Sdn 3.0

Power Options: Cruise Control, Power Locks, Power Seats, Power Windows, Air Conditioning

Exterior Color: Black

Interior Color: Tan

Number of Cylinders: 6

Vehicle Inspection: Inspected (include details in your description)

Inspection: Vehicle has been inspected (include details in your description)

Jaguar X-Type for Sale

2005 jaguar x-type 3.0l all wheel drive navi jag racing green new tires -clean-

2005 jaguar x-type 3.0l all wheel drive navi jag racing green new tires -clean- 2002 jaguar x-type green w/ tan leather interior

2002 jaguar x-type green w/ tan leather interior 2004 jaguar x type all wheel drive white(US $6,999.00)

2004 jaguar x type all wheel drive white(US $6,999.00) 2004 jaguar x-type sedan 4-door 3.0l only 85660 miles, clean car(US $7,900.00)

2004 jaguar x-type sedan 4-door 3.0l only 85660 miles, clean car(US $7,900.00) Beautiful 2002 jaguar x-type, only 43,076 miles, serviced

Beautiful 2002 jaguar x-type, only 43,076 miles, serviced 2003 jaguar x-type base sedan 4-door 3.0l

2003 jaguar x-type base sedan 4-door 3.0l

Auto Services in New Jersey

XO Autobody ★★★★★

Wizard Auto Repairs Inc ★★★★★

Trilenium Auto Recyclers ★★★★★

Towne Kia ★★★★★

Total Eclipse Master of Auto Detailing, Inc. ★★★★★

Tony`s Garage ★★★★★

Auto blog

Jaguar Land Rover likely to build US plant... in three years

Mon, Mar 9 2015Jaguar Land Rover may very well open a plant in the United States, but the latest word has it that it'll be another three years or so before the company even makes a decision on the matter. The prospect first came up on our radar back in October when we reported that JLR was considering building a plant in the South. Georgia governor Nathan Deal even flew to the UK to solicit JLR's business. Former parent-company chairman Ratan Tata subsequently confirmed the idea was under consideration last month. And now the British automaker's CEO has told Automotive News that JLR will need a US assembly plant to fuel its growth in the vital North American market, but that'll it'll take a while to get going. The reasons for the delay, according to chief executive Ralf Speth, are threefold. For one thing, the automaker has its hands full at the moment opening plants in other locations: last year it opened one in China and this year it opened one in Brazil. It also recently opened a new SVO facility, an electric-propulsion R&D center and a new engine plant all in the UK, and can only handle building so many new facilities at a time. JLR will also need US suppliers of aluminum components to step up their game, as the company relies heavily on aluminum construction for their vehicles. US automakers shifting to aluminum for models like the new Ford F-150 will encourage American suppliers to get into the game, but it may be a while before they're up to Jaguar Land Rover standards. Finally, JLR will need to increase its sales potential in the US in order to justify local production. Speth says the company would need one model of which it could sell 30,000 to 40,000 units in the US alone, and it sold less than 18,000 units of its best-selling the Range Rover Sport here last year. In fact the entire Jaguar brand sold less than 16,000 units throughout all of last year in America, with Land Rover selling far more at over 50,000 units to contribute to total sales of over 67,000 units. Related Video: Featured Gallery Jaguar Land Rover Engine Manufacturing Center View 16 Photos News Source: Automotive News - sub. req.Image Credit: Jaguar Land Rover Plants/Manufacturing Jaguar Land Rover jaguar land rover jlr

Jaguar Land Rover cutting production in face of falling demand

Sat, Feb 8 2020LONDON — Jaguar Land Rover will reduce or stop production on certain days at two of its British factories over the next few weeks as Britain's biggest carmaker pursues cost-cutting measures in response to falling demand. JLR posted a 2.3% drop in retail sales in the three months to the end of December and has targeted billions of pounds worth of savings to tackle falling diesel demand in Europe and a tough sales environment in China. The firm will halt production on selected days over a four-week period from late February at its Castle Bromwich factory in central England and stop production on some half or full days at its nearby Solihull facility until the end of March. "The external environment remains challenging for our industry and the company is taking decisive actions to achieve the necessary operational efficiencies to safeguard long-term success," the company said in a statement. "We have confirmed that Solihull and Castle Bromwich will make some minor changes to their production schedules to reflect fluctuating demand globally, whilst still meeting customer needs." The move is not connected to coronavirus, a spokeswoman said, which prompted Fiat Chrysler to warn on Thursday that a European plant could shut down within two to four weeks if Chinese parts suppliers cannot get back to work. Related Video:

Jaguar Land Rover hands Tata the biggest loss in Indian corporate history

Fri, Feb 8 2019BENGALURU/NEW DELHI — Jaguar Land Rover's owner Tata Motors Ltd stunned markets by posting the biggest-ever quarterly loss in Indian corporate history of about $4 billion on slumping China sales, sending its shares crashing as much as 30 percent. Tata Motors also warned that the Jaguar Land Rover (JLR) unit, which brings in most of its revenue, would swing to an operating loss for the year versus an earlier projection it would break even, given weak sales at the luxury British carmaker. JLR's China retail sales were cut almost in half in the December quarter as overall demand in the world's biggest auto market contracted last year for the first time since the 1990s. The firm has also been buffeted by Brexit woes and weaker business for diesel cars that account for bulk of its sales in Europe. Tata Motors turned in a third-quarter loss of 269.93 billion rupees ($3.8 billion) on Thursday, more than half its current market capitalization of $6.1 billion, mostly due to a massive impairment at JLR. Analysts were expecting a profit. "We are now taking clear and decisive actions in JLR to step up its competitiveness, reduce costs and improve cash flows and make the business fit for the future," Chief Financial Officer PB Balaji told reporters on a conference call on Thursday. JLR has taken steps to address the slide in China sales by changing its strategy to focus on profits for dealers instead of sales and incentivising retail sales over wholesale, he said. "We are encouraged by continued demand for the refreshed Range Rover and Range Rover Sport," JLR Chief Commercial Officer Felix Brautigam said in a statement. "With deliveries of the new Evoque due to start later this quarter, we look forward to building momentum." But analysts expect JLR to struggle to generate profit with China's economy projected to slow further this year after growth eased to its weakest pace in almost three decades in 2018. JLR's overall retail sales in January plunged 11 percent. The dour numbers prompted Tata investors to make a beeline for the exits as markets opened on Friday, with shares of the company skidding to their lowest in nine years at one point. The stock was down about 20 percent by 0720 GMT near 150 rupees, on track for its sharpest drop since 2003. At least four brokerages cut their price target for Tata Motors shares after its quarterly loss. Analysts at Jefferies pegged the stock at 250 rupees, versus an earlier target of 300 rupees, citing weak performance at JLR.