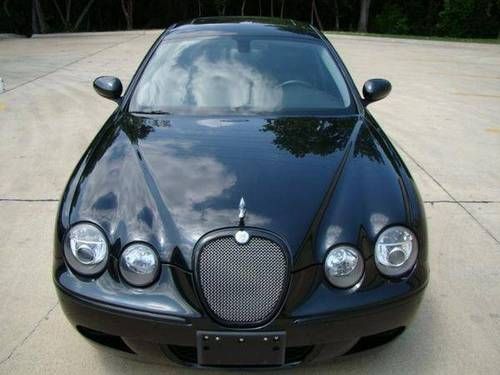

2008 Jaguar S-type Base Sedan 4-door 3.0l on 2040-cars

Randallstown, Maryland, United States

Body Type:Sedan

Vehicle Title:Rebuilt, Rebuildable & Reconstructed

Engine:V6

Fuel Type:GAS

For Sale By:Dealer

Make: Jaguar

Model: S-Type

Trim: S type

Options: Sunroof, Leather Seats, CD Player

Safety Features: Anti-Lock Brakes, Passenger Airbag, Side Airbags

Drive Type: Automatic

Power Options: Air Conditioning, Cruise Control, Power Locks, Power Windows, Power Seats

Mileage: 40,330

Exterior Color: Gray

Interior Color: Black

Number of Doors: 4

Number of Cylinders: 6

Warranty: Vehicle has an existing warranty

Jaguar S-Type for Sale

2000 jaguar s-type base sedan 4-door 4.0l(US $5,000.00)

2000 jaguar s-type base sedan 4-door 4.0l(US $5,000.00) 2001 jaguar s-type - 4k - collectible condition(US $18,900.00)

2001 jaguar s-type - 4k - collectible condition(US $18,900.00) 2006 jaguar s-type r sedan 4-door 4.2l(US $18,999.00)

2006 jaguar s-type r sedan 4-door 4.2l(US $18,999.00) 2000 jaguar s type*florida car*54k*gas saver*heated seats*sunroof*warranty*mint*(US $6,995.00)

2000 jaguar s type*florida car*54k*gas saver*heated seats*sunroof*warranty*mint*(US $6,995.00) 2003 jaguar s-type base sedan 4-door 4.2l

2003 jaguar s-type base sedan 4-door 4.2l

Auto Services in Maryland

Wes Greenway`s Waldorf VW ★★★★★

star auto sales ★★★★★

Singer Auto Center ★★★★★

Prestige Hi Tech Auto Service Center ★★★★★

Pallone Chevrolet Inc ★★★★★

On The Spot Mobile Detailing ★★★★★

Auto blog

Chris Harris finds the Jaguar F-Type R Coupe rather drifty

Wed, 26 Mar 2014Our own Matt Davis may have called the new Jaguar F-Type R Coupe "one heady rascal," but our review was disappointingly short on drifting, tire smoke and general, English shenanigans. You know, the sort of things that Chris Harris from Drive excels at.

Actually, relative to Harris' other reviews, this one is rather serious. There's a good recap of the F-Type on the road, with Harris referencing the car's "great bottom" and "amazing ass," quite frequently. Surprisingly, Harris says the more powerful F-Type R is just "incrementally" faster than the 495-horsepower F-Type V8 S Convertible. Following the on-road portion, it's off to the track. You can probably predict what goes on there. Overall, aside from some quibbles, Harris has nothing but praise for the newest cat.

We've got the entire video available below. Scroll down, have a look and let us know what you think in Comments.

Jaguar Land Rover and Chery investing in Chinese plant

Sat, 24 Nov 2012While the European auto market for Jaguar and Land Rover is waning, Chinese car buyers can't get enough of the British marques. To meet that demand, Tata Motors, parent company of Jag and Land Rover, is partnering with Chinese automaker Chery Automobile Co.

The two announced plans to invest $1.75 billion to build a new plant and create a new, China-focused brand. 2014 is the target for completion of the factory. Jaguars and Land Rovers built at the facility will be the first ever produced outside the UK according to the Associated Press. The JV will be called Chery Jaguar Land Rover Automotive Company Ltd.

The announcement comes less than a month after JLR announced it would open a design studio in China. It's not clear from the reports whether the two announcements are part of the same JV or two separate plans.

Rising aluminum costs cut into Ford's profit

Wed, Jan 24 2018When Ford reports fourth-quarter results on Wednesday afternoon, it is expected to fret that rising metals costs have cut into profits, even as rivals say they have the problem under control. Aluminum prices have risen 20 percent in the last year and nearly 11 percent since Dec. 11. Steel prices have risen just over 9 percent in the last year. Ford uses more aluminum in its vehicles than its rivals. Aluminum is lighter but far more expensive than steel, closing at $2,229 per tonne on Tuesday. U.S. steel futures closed at $677 per ton (0.91 metric tonnes). Republican U.S. President Donald Trump's administration is weighing whether to impose tariffs on imported steel and aluminum, which could push prices even higher. Ford gave a disappointing earnings estimate for 2017 and 2018 last week, saying the higher costs for steel, aluminum and other metals, as well as currency volatility, could cost the company $1.6 billion in 2018. Ford shares took a dive after the announcement. Ford Chief Financial Officer Bob Shanks told analysts at a conference in Detroit last week that while the company benefited from low commodity prices in 2016, rising steel prices were now the main cause of higher costs, followed by aluminum. Shanks said the automaker at times relies on foreign currencies as a "natural hedge" for some commodities but those are now going in the opposite direction, so they are not working. A Ford spokesman added that the automaker also uses a mix of contracts, hedges and indexed buying. Industry analysts point to the spike in aluminum versus steel prices as a plausible reason for Ford's problems, especially since it uses far more of the expensive metal than other major automakers. "When you look at Ford in the context of the other automakers, aluminum drives a lot of their volume and I think that is the cause" of their rising costs, said Jeff Schuster, senior vice president of forecasting at auto consultancy LMC Automotive. Other major automakers say rising commodity costs are not much of a problem. At last week's Detroit auto show, Fiat Chrysler Automobiles NV's Chief Executive Officer Sergio Marchionne reiterated its earnings guidance for 2018 and held forth on a number of topics, but did not mention metals prices. General Motors Co gave a well-received profit outlook last week and did not mention the subject. "We view changes in raw material costs as something that is manageable," a GM spokesman said in an email.