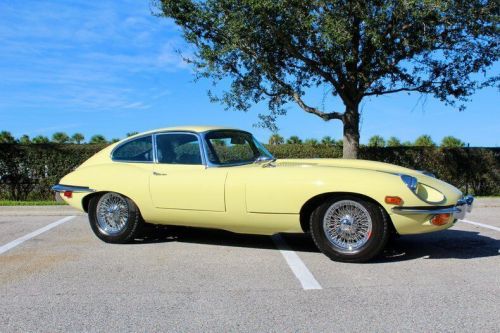

1970 Jaguar E-type on 2040-cars

Engine:4.2 Liter In-Line 6

Fuel Type:Gasoline

Body Type:Convertible

Transmission:Manual

For Sale By:Dealer

VIN (Vehicle Identification Number): 00000000000000000

Mileage: 43921

Make: Jaguar

Drive Type: --

Number of Cylinders: Unspecified

Features: --

Power Options: --

Exterior Color: Pale Primrose

Interior Color: Black

Warranty: Unspecified

Model: E-Type

Jaguar E-Type for Sale

1964 jaguar e-type series i(US $74,500.00)

1964 jaguar e-type series i(US $74,500.00) 1969 jaguar e 2+2(C $80,000.00)

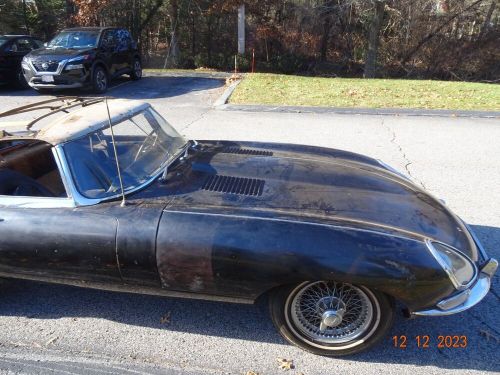

1969 jaguar e 2+2(C $80,000.00) 1970 jaguar e-type(US $1,480.00)

1970 jaguar e-type(US $1,480.00) 1967 jaguar e-type(US $229,000.00)

1967 jaguar e-type(US $229,000.00) 1965 jaguar e-type(US $179,900.00)

1965 jaguar e-type(US $179,900.00) 1968 jaguar e-type(US $150,000.00)

1968 jaguar e-type(US $150,000.00)

Auto blog

Buy a Jaguar E-Type continuation, get a matching wristwatch

Tue, Feb 28 2017From time to time, automakers release special branded watches. Jaguar and Land Rover are no different. The latest from Land Rover isn't particularly remarkable, but one new Jaguar piece is pretty special. Jaguar partnered with British watchmaker Bremont for a line of watches, the most impressive being a 43mm watch that commemorates Jaguar's continuation series of Lightweight E-Types. Like the cars, only six of the watches will be produced, and they will be offered to the owners of those $1.5 million cars. Each watch features a serial number that matches a corresponding car, and the faces have been designed to look like the instruments aboard the E-Types. The same goes for the hands, which look like the gauge needles. The winding crown also has a tire tread pattern that wraps around the sides, with Jaguar's heritage logo on the top. And these timepieces are built with aluminum left over from the continuation E-Types. On the back is the most impressive part, though. Here is where the watch's automatic winding weight is visible. It's shaped like a vintage steering wheel, and the outer rim is made from real wood. The weight keeps the watch and its exclusive Bremont movement wound. If you can't afford this ultra-limited watch, Bremont has a line of other Jaguar watches with many of the same design cues, at prices ranging from less than $5,000 to more than $11,000. The Land Rover watch is a bit disappointing, since it bears little apparent connection to the vehicles. Zenith, the Swiss company that partnered with Land Rover for the piece, claims the design is inspired by the Range Rover. And Land Rover claims a connection in that a British explorer wore the same series watch while completing an expedition with a pair of Range Rovers. There's also the fact that the watch and the SUV are both made of aluminum, but otherwise, the Zenith watch doesn't look particularly automotive. The box sounds pretty cool, though, since it's fashioned from Land Rover wood and upholstery. Related Video:

2013 Jaguar XF Sportbrake

Thu, 28 Feb 2013Editor's Note: Our reporter was anxious to get some time behind the wheel of the XF Sportbrake, even though Jaguar only had a very small window available for us to drive it. As a result, we weren't able to capture our usual original images to go with the Quick Spin story. Please accept our regrets, and Jag's lovely stock photography, instead.

The last wagon attempt from Jaguar was the X-Type, built between 2003 and that model line's unceremonious end in 2009. That X-Type and its legacy represent a real dog of a chapter for Jaguar, and for the Halewood factory where the barker was built. It was the final joke told prior to the brand's proper rebirth phase - a phase we're enjoying the heck out of today.

Current magnanimous Jaguar owner Tata can be thanked for this new wagon, the XF Sportbrake. Like all newness coming from Jag these days, this new wagon also feels lightyears more serious an offering, ready to compete squarely with established premium wagon makers across Europe. A Jaguar wagon in America is a far-off priority for the company, frankly. Still we deserve to know what we're missing for the time being from this (sometimes overly) cherished British firm.

Daily Driver: 2015 Jaguar XJL AWD

Mon, Jun 15 2015Daily Driver videos are micro-reviews of vehicles in the Autoblog press fleet, reviewed by the staffers who drive them every day. Today's Daily Driver features the 2015 Jaguar XJL AWD, reviewed by Seyth Miersma. You can watch the video above or read a transcript below. Watch more Autoblog videos at /videos. VIDEO TRANSCRIPT: [00:00:00] Hey everybody, it's your old pal Seyth here with Autoblog. I am in the 2015 Jaguar XJL. That L is for a long-wheelbase. The engine powering this car is the 3.0-liter supercharged V6. My cameras inside probably didn't pick up a lot of that, but the supercharged 3.0-liter does have a nice little growl to it, especially in sport mode [00:00:30] where I'm staying higher in the rev range. It doesn't have that same big, luxurious, meaty, whoofly V8 sound as the naturally aspirated 5.0-liter used to. At 340 horsepower, 332 lb-ft of torque, this engine has everything that you need. I think that they say the 0 to 60 time is around six seconds. Frankly, the car feels a little bit faster even that that. Again, we're talking about a large long-wheelbase car here. What's particularly interesting and [00:01:00] relevant to the weather that you see behind me right now, is that this car is not rear-wheel drive. It is in fact all-wheel drive. Even going into this, knowing obviously that I was in an all-wheel drive car, the first drive really reveals it to handle a lot like a rear-wheel drive vehicle. That's appropriate. That's what you want in a car of this class. Something very luxurious and that has a reputation built on sporting dynamics as opposed to sort of just comfort and refinement. [00:01:30] Jaguar's goal with an all-wheel drive system like this is to make the car still feel very much like a rear-wheel drive vehicle but give you just enough ability to be able to pull out of a corner smartly when the grip is a little bit lower than you'd expect it to be. Obviously if there's some snow on the ground, that's a helpful thing. Or on a day like today, when I'm coming out of a corner on a slightly slippery road, being able to put the power down is advantageous. To be honest, so far the application has been really seamless. The power seems to be [00:02:00] flowing from the engine just to the rear wheels. I feel like I'm getting a little bit of assist, right now I'm entering a corner at a moderate speed and not really slipping at all. It feels like a rear-wheel drive car. I've always loved this XJ.