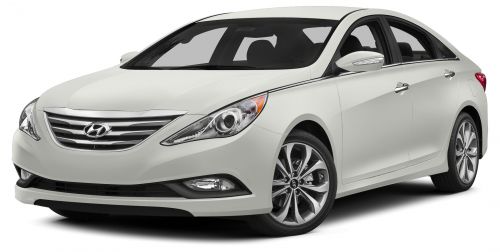

2014 Hyundai Sonata Gls on 2040-cars

4727 U.S. 19, New Port Richey, Florida, United States

Engine:2.4L I4 16V GDI DOHC

Transmission:6-Speed Automatic

VIN (Vehicle Identification Number): 5NPEB4AC9EH919490

Stock Num: 143140

Make: Hyundai

Model: Sonata GLS

Year: 2014

Exterior Color: Harbor Gray Metallic

Interior Color: Gray

Options: Drive Type: FWD

Number of Doors: 4 Doors

Mileage: 9

Thank you for viewing our vehicle here at Hyundai of New Port Richey! Please email us if you have any questions about the vehicle. We have a dedicated internet team waiting to assist you in your search for a vehicle. You can also call us today at: 888-442-8407 or come see us at 3936 US HIGHWAY 19, NEW PORT RICHEY.

Hyundai Sonata for Sale

2014 hyundai sonata gls(US $23,735.00)

2014 hyundai sonata gls(US $23,735.00) 2014 hyundai sonata gls(US $23,735.00)

2014 hyundai sonata gls(US $23,735.00) 2014 hyundai sonata gls(US $23,735.00)

2014 hyundai sonata gls(US $23,735.00) 2014 hyundai sonata gls(US $23,790.00)

2014 hyundai sonata gls(US $23,790.00) 2014 hyundai sonata gls(US $23,810.00)

2014 hyundai sonata gls(US $23,810.00) 2014 hyundai sonata gls(US $23,810.00)

2014 hyundai sonata gls(US $23,810.00)

Auto Services in Florida

Yogi`s Tire Shop Inc ★★★★★

Window Graphics ★★★★★

West Palm Beach Kia ★★★★★

Wekiva Auto Body ★★★★★

Value Tire Royal Palm Beach ★★★★★

Valu Auto Care Center ★★★★★

Auto blog

Hyundai Santa Cruz, Kona N and Elantra Hybrid | Autoblog Podcast #691

Fri, Aug 13 2021In this episode of the Autoblog Podcast, Editor-in-Chief Greg Migliore is joined by West Coast Editor, James Riswick. They've been driving a lot of new cars, including the 2022 Hyundai Santa Cruz pickup, 2022 Hyundai Kona N, 2021 Hyundai Elantra Hybrid, 2021 Acura TLX Type S and 2022 Hyundai Genesis G70. Lamborghini revealed a modern interpretation of the Countach, for better or worse. Finally, they heelp a listener replace a 2013 Ford Edge in this week's "Spend My Money" segment. Send us your questions for the Mailbag and Spend My Money at: Podcast@Autoblog.com. Autoblog Podcast #691 Get The Podcast Apple Podcasts – Subscribe to the Autoblog Podcast in iTunes Spotify – Subscribe to the Autoblog Podcast on Spotify RSS – Add the Autoblog Podcast feed to your RSS aggregator MP3 – Download the MP3 directly Rundown Cars we're driving: 2022 Hyundai Santa Cruz 2022 Hyundai Kona N 2021 Hyundai Elantra Hybrid 2021 Acura TLX Type S 2022 Hyundai Genesis G70 Lamborghini Countach LPI 800-4 revealed Spend My Money Feedback Email – Podcast@Autoblog.com Review the show on Apple Podcasts Autoblog is now live on your smart speakers and voice assistants with the audio Autoblog Daily Digest. Say “Hey Google, play the news from Autoblog” or "Alexa, open Autoblog" to get your favorite car website in audio form every day. A narrator will take you through the biggest stories or break down one of our comprehensive test drives. Related Video:

Hyundai puts its hydrogen development program on hiatus

Wed, Dec 29 2021UPDATE: According to Pulse news in South Korea, Hyundai denies that it has paused development of hydrogen fuel cells. Instead, the report suggests the team was reshuffled as technological hurdles have slowed down progress. Time will tell which version of the report is factual. Hydrogen technology has reportedly lost one of its biggest and most vocal proponents, at least for now. Citing a long list of hurdles, Hyundai has allegedly stopped developing the hydrogen-electric powertrain it planned to put in several of its cars (including Genesis models) in the coming years. Anonymous sources told South Korean publication Chosunbiz that executives pulled the emergency brake after analyzing the results of a feasibility study. Nothing is official at this point, and the report stresses that the pause is temporary. However, the issues reportedly found are relatively serious: they include unspecified technical problems and a lack of marketability due in part to cost-related concerns. The news comes as a surprise because Hyundai has invested a tremendous amount of resources into making hydrogen a viable alternative to gasoline without many of the inconveniences associated with EVs, like long charging times and limited driving range. It's one of the few carmakers in the world that sells a hydrogen-electric car (the Nexo; pictured), and it announced plans to build about 130,000 hydrogen-powered cars annually by 2025. And yet, the Nexo is a tough sell, even in hydrogen-friendly markets like South Korea; 8,206 units were sold there through November 2021. The 671-horsepower Vision FK concept unveiled earlier in 2021 will seemingly remain at the prototype stage. Interestingly, a separate unverified report claims that Hyundai has also shuttered its engine development division. If both are accurate, it means that the Hyundai group (which includes Kia and Genesis) will exclusively develop electric powertrains starting in the near future. Several car companies have tried to pelt hydrogen-powered cars into the mainstream over the past decade and most have failed. Some of the issues facing the technology include the lack of a charging infrastructure and governments with a single-minded focus on EVs. There are 48 hydrogen charging stations in America, according to the United States Department of Energy, and 47 of those are located in California. While that's great news for Californians, it makes the Nexo completely useless for someone driving from Salt Lake City to Seattle.

2015 Hyundai Azera appears refreshed in Miami

Sun, 09 Nov 2014Hyundai has taken the unusual approach of debuting a newly refreshed model - the refreshed 2015 Hyundai Azera - at the Miami International Auto Show instead of one of the larger usual suspects (the LA Auto Show is just around the corner). According to Hyundai, Florida is a large market for the Azera sedan, which surely had something to do with the decision to debut in Miami.

There aren't many big changes to the Azera for 2015, but what has been updated is meaningful, starting with redesigned front and rear fascias, standard 18-inch alloy wheels and LED fog lights on Limited models. Inside, an eight-inch display - all the better to work with Hyundai's latest Blue Link system - joins a new center stack design as notable improvements. On the safety front, Blind Spot Detection with Rear Cross Traffic alert and Lane Change Assist are now standard.

Power still comes from the well-regarded 3.3-liter V6 with 293 horsepower and 255 pound-feet of torque. While none of the changes for 2015 are likely to make the Azera into a best seller in the highly competitive large-car market, where models like the Chevy Impala, Toyota Avalon and Buick LaCrosse live, not to mention Hyundai's sibling from Kia, the Cadenza, we're sure Azera buyers will be happy with the updates all the same.