2013 Hyundai Sonata Gls on 2040-cars

6000 S 36th St, Fort Smith, Arkansas, United States

Engine:2.4L I4 16V GDI DOHC

Transmission:6-Speed Automatic

VIN (Vehicle Identification Number): 5NPEB4AC6DH624605

Stock Num: P4484

Make: Hyundai

Model: Sonata GLS

Year: 2013

Exterior Color: Silver

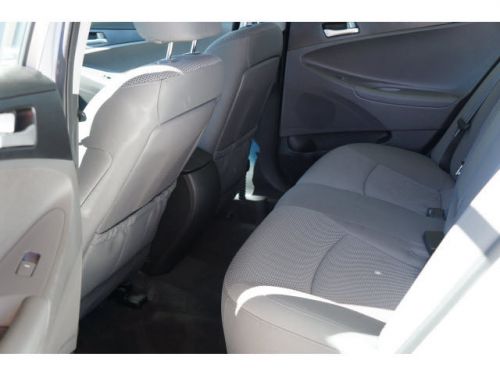

Interior Color: Gray

Options: Drive Type: FWD

Number of Doors: 4 Doors

Mileage: 34676

Shopping with the VIP department gives you VIP Pricing! Haggle-free pricing means a pleasant experience for all of us. Call/text 866-414-7840 to speak with Jackie, Alyssa, James or Jon. We price low and fair, allowing us to focus on your needs. We'll find you the best deal on the perfect pre-owned vehicle. Come experience a unique and enjoyable purchase process!

Hyundai Sonata for Sale

2013 hyundai sonata gls(US $20,000.00)

2013 hyundai sonata gls(US $20,000.00) 2013 hyundai sonata gls(US $18,995.00)

2013 hyundai sonata gls(US $18,995.00) 2011 hyundai sonata limited(US $20,000.00)

2011 hyundai sonata limited(US $20,000.00) 2015 hyundai sonata(US $30,660.00)

2015 hyundai sonata(US $30,660.00) 2011 hyundai sonata se(US $17,850.00)

2011 hyundai sonata se(US $17,850.00) 2011 hyundai sonata limited 2.0t(US $13,984.00)

2011 hyundai sonata limited 2.0t(US $13,984.00)

Auto Services in Arkansas

Wingfoot Commercial Tire ★★★★★

Superior Tire & Express Lube ★★★★★

Steve Jones Chrysler Dodge Jeep ★★★★★

Roberts Auto Repair ★★★★★

Rhodes Auto Brokers ★★★★★

North Arkansas Tire ★★★★★

Auto blog

2016: The year of the autonomous-car promise

Mon, Jan 2 2017About half of the news we covered this year related in some way to The Great Autonomous Future, or at least it seemed that way. If you listen to automakers, by 2020 everyone will be driving (riding?) around in self-driving cars. But what will they look like, how will we make the transition from driven to driverless, and how will laws and infrastructure adapt? We got very few answers to those questions, and instead were handed big promises, vague timelines, and a dose of misdirection by automakers. There has been a lot of talk, but we still don't know that much about these proposed vehicles, which are at least three years off. That's half a development cycle in this industry. We generally only start to get an idea of what a company will build about two years before it goes on sale. So instead of concrete information about autonomous cars, 2016 has brought us a lot of promises, many in the form of concept cars. They have popped up from just about every automaker accompanied by the CEO's pledge to deliver a Level 4 autonomous, all-electric model (usually a crossover) in a few years. It's very easy to say that a static design study sitting on a stage will be able to drive itself while projecting a movie on the windshield, but it's another thing entirely to make good on that promise. With a few exceptions, 2016 has been stuck in the promising stage. It's a strange thing, really; automakers are famous for responding with "we don't discuss future product" whenever we ask about models or variants known to be in the pipeline, yet when it comes to self-driving electric wondermobiles, companies have been falling all over themselves to let us know that theirs is coming soon, it'll be oh so great, and, hey, that makes them a mobility company now, not just an automaker. A lot of this is posturing and marketing, showing the public, shareholders, and the rest of the industry that "we're making one, too, we swear!" It has set off a domino effect – once a few companies make the guarantee, the rest feel forced to throw out a grandiose yet vague plan for an unknown future. And indeed there are usually scant details to go along with such announcements – an imprecise mileage estimate here, or a far-off, percentage-based goal there. Instead of useful discussion of future product, we get demonstrations of test mules, announcements of big R&D budgets and new test centers they'll fund, those futuristic concept cars, and, yeah, more promises.

Driving the GMC Canyon, and pour one out for the Camaro | Autoblog Podcast #812

Fri, Dec 22 2023In this episode of the Autoblog Podcast, Editor-in-Chief Greg Migliore is joined by Road Test Editor Zac Palmer. They start by discussing the the cars they've been driving, including the 2023 GMC Canyon AT4, ECD Jaguar E-Type EV, ECD Land Rover Defender 110 and the Genesis GV60. Next, they hit the news starting with the Chevrolet Camaro production ending. Rumors about the Hyundai N Vision 74 are bandied about, and then the two discuss the latest McLaren iteration named the GTS, which is a refresh of the GT. Lastly, the pair discuss who they think were the most influential leaders in the automotive industry throughout 2023. Send us your questions for the Mailbag and Spend My Money at: Podcast@Autoblog.com. Autoblog Podcast #812 Get The Podcast Apple Podcasts – Subscribe to the Autoblog Podcast in iTunes Spotify – Subscribe to the Autoblog Podcast on Spotify RSS – Add the Autoblog Podcast feed to your RSS aggregator MP3 – Download the MP3 directly Rundown Cars we're driving 2023 GMC Canyon AT4 ECD Jaguar E-Type EV ECD Land Rover Defender 110 2024 Genesis GV60 Performance AWD News Chevrolet Camaro productions ends The Hyundai N Vision 74 might reach production McLaren GTS revealed These were the most influential leaders in the automotive world in 2023 Feedback Email – Podcast@Autoblog.com Review the show on Apple Podcasts Autoblog is now live on your smart speakers and voice assistants with the audio Autoblog Daily Digest. Say “Hey Google, play the news from Autoblog” or "Alexa, open Autoblog" to get your favorite car website in audio form every day. A narrator will take you through the biggest stories or break down one of our comprehensive test drives. Related video: Aftermarket Green Plants/Manufacturing Podcasts Chevrolet Ford Genesis GM GMC Hyundai Jaguar Land Rover McLaren Technology Truck Convertible Coupe Crossover SUV Electric Luxury Off-Road Vehicles Performance Supercars

Hyundai, BMW and Ford win Concept Vehicle of the Year awards

Sat, 06 Jul 2013More than two dozen jurors started with a pool of 23 concept cars introduced at the most recent Los Angeles, Detroit, Chicago, Toronto and New York auto shows, then pared it down to three winners in three categories for the twelfth annual North American Concept Vehicle of the Year Awards. The trophy-bearers are said to be those "vehicles most likely to shape the future of the automobile industry," and lead their classes in the Concept Car, Concept Truck and Production Preview divisions.

Hyundai had two cars as finalists for the Concept Car category, the competition boiled down to the Hyundai HCD-14 Genesis concept, Veloster C3 Roll Top, Honda EV-STER and the Toyota Corolla Furia. It won with the HCD-14 Genesis that was introduced at the Detroit Auto Show, a sharp sedan that sharply divided opinion between those who thought it was too much, those who thought it was too much Audi A7, and those who thought it was perfect. The award panel's judges, however, thought so much of it that it's got two awards in one sitting, not only taking concept car honors, but because it earned the highest overall score in the competition it also takes the crown for Most Significant Concept Vehicle of 2013.

The final selection in the Concept Truck category was down to the Ford Atlas, Kia Cross GT, Nissan Resonance and Volkswagen Cross Blue. The Ford Atlas took the silverware, after also winning the Eyes on Design award - shared with the Nissan Resonance - at the Detroit Auto Show where it was introduced.