2003 Hummer H2 Base Sport Utility 4-door 6.0l on 2040-cars

Columbus, Ohio, United States

Vehicle Title:Clear

Transmission:Automatic

Body Type:Sport Utility

For Sale By:Private Seller

Fuel Type:GAS

Mileage: 100,000

Make: Hummer

Exterior Color: White

Model: H2

Interior Color: Tan

Trim: Base Sport Utility 4-Door

Warranty: Vehicle does NOT have an existing warranty

Drive Type: 4WD

Options: Sunroof, 4-Wheel Drive, Leather Seats, CD Player

Number of Cylinders: 8

Safety Features: Anti-Lock Brakes, Driver Airbag, Passenger Airbag, Side Airbags

Power Options: Air Conditioning, Cruise Control, Power Locks, Power Windows, Power Seats

SUPER CLEAN 2003 H2 HUMMER,RUNS AND DRIVES GREAT.

Hummer H2 for Sale

2005 hummer h2 supercharged 6l v8 16v automatic 4wd suv tv dvd sunroof leather(US $21,900.00)

2005 hummer h2 supercharged 6l v8 16v automatic 4wd suv tv dvd sunroof leather(US $21,900.00) 2007 hummer h2 sut custom(US $44,000.00)

2007 hummer h2 sut custom(US $44,000.00) 2008 hummer h2 ultra marine limited edition luxury package loaded(US $43,995.00)

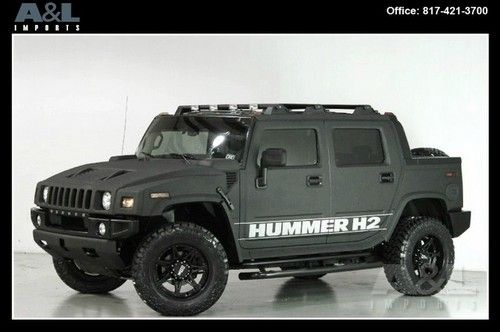

2008 hummer h2 ultra marine limited edition luxury package loaded(US $43,995.00) Kevlar edition! one-of-a-kind. loaded(US $63,990.00)

Kevlar edition! one-of-a-kind. loaded(US $63,990.00) 2005 hummer h2 sut

2005 hummer h2 sut One owner sunset orange tan leather vortec 6.0l bose audio onstar tires like new

One owner sunset orange tan leather vortec 6.0l bose audio onstar tires like new

Auto Services in Ohio

Xenia Radiator & Auto Service ★★★★★

West Main Auto Repair ★★★★★

Top Knotch Automotive ★★★★★

Tom Hatem Automotive ★★★★★

Stanford Allen Chevrolet Cadillac ★★★★★

Soft Touch Car Wash Systems ★★★★★

Auto blog

Out With A Bang: Hummer dealer giving away free shotgun with every new vehicle purchase

Mon, 15 Mar 2010Lynch Hummer dealership in Chesterfield, Missouri - Click above for image gallery

You've heard of art imitating life? Well how about life imitating war? That's another story entirely, but not so far fetched when it comes to the Hummer. The sport-'ute that met the public eye during Operation Desert Storm has all but completely gone through its entire life cycle in the intervening years: first as a military-only vehicle, the original model became available to the public, then GM bought the rights and started churning out pickup-based H2s and H3s, the U.S. armed forces went back Iraq, the original H1 was discontinued and now GM is preparing to wind down the brand entirely. But not before one last pistol-shootin' hoorah, courtesy of the one dealership that arguably sees the truck for what it is more than any other: Lynch Hummer.

The St. Louis-area franchise made headlines last year when they started filling their emptying showroom with gun racks, selling firearms to make up for dwindling sales in the gigantic SUVs. Now the dealership is connecting the dots with a one-of-a-kind promotion: Buy a Hummer, get a free shotgun.

Automakers tussle over owners of 'orphan' makes

Thu, 10 May 2012When General Motors put down several of its brands in recent years, it also let loose thousands of brand-loyal customers who will eventually need another car.

R.L. Polk Associates estimates there are more than 18 million cars from 16 discontinued makes on the road today. Those "orphan owners" have sales-hungry competitors seeing dollar signs. GM is offering Saturn owners $1,000 cash toward a Chevy Cruze, Cadillac CTS or a GMC Acadia. Ford is giving its Mercury lease customers a chance to get out of their contracts with no early-termination penalty and offering to waive six remaining payments if they drive off in a Ford or Lincoln.

Edmunds.com research shows the efforts are paying off somewhat for GM, with 39 percent of Pontiac owners, 37 percent of Hummer owners and 31 percent of Saturn owners taking delivery of another GM-branded vehicle. But that leaves as much as 69 percent of owners going elsewhere. Ford, Honda and Toyota seem to be attracting many former GM owners.

My year in EVs: 8 electrics that are changing the car industry

Wed, Dec 1 2021The year 2021 will go down as an inflection point in the auto industryís transition to electric vehicles. It's when many much-anticipated models became reality. No longer sketches or sketchy prototypes, electric vehicles appeared from all corners with everything from the Lucid Air to Ford Mustang Mach-E changing how we think about transportation. I managed to drive a lot of them, and as I went through my notes, I realized I¬íve got a mini memoir of the seminal EVs of 2021. Here¬ís my take on eight of them. Hummer EV Easily the most over-the-top EV I tested this year. The 1,000-hp super truck lived up to the hype with its domineering presence, stupendous power and simply being a reincarnated Hummer. I took it for a short spin on- and off-road at the General Motors Proving Grounds in Milford, Mich., and was impressed with the airy cabin, removable sky panels and expansive touchscreens. Yes, I crab walked, which felt like steering a pontoon boat, though I can see why it would be useful. Lucid Air Dream Performance The most beautiful sedan I tested all year, EV or otherwise. Unlike the futuristic Mercedes EQS ¬ó which is quite attractive ¬ó Lucid¬ís car is a blend of mid-century modern interior aesthetics and classic European exterior styling. When I walked up for my test drive, someone who I¬ím pretty sure was comedian Jon Lovitz was sitting inside and taking it all in. As it sat in the valet of a hotel in a wealthy suburban enclave north of Detroit, the Lucid drew more attention than any of the Mercedes, Cadillacs or Lexus models passing by. The driving experience was enveloping. Starting at $169,000 for the Performance model (reservations are closed), the Lucid I sampled packed 1,111 hp and 471 miles of range. From the precise steering to the comfortable suspension, the dynamics were spot-on. It's a formidable product, and all the more impressive given it¬ís Lucid¬ís first. Chevy Bolt EV The Bolt was the most pleasant surprise for me. It handled well, offered low-to-the-ground hot hatch dynamics and the steering was dialed-in. Adding a crossover variant for the new generation was a smart play. On a summer morning where I went to a first drive of the Ford Bronco at an off-road course, my hour-long commute in the Bolt was an enjoyable appetizer.¬† The Bolt was also my biggest disappointment due to its extensive recalls for fire risk. Ironically, I had the Bolt in my driveway when the initial recall went out for the previous generation (2017-19).