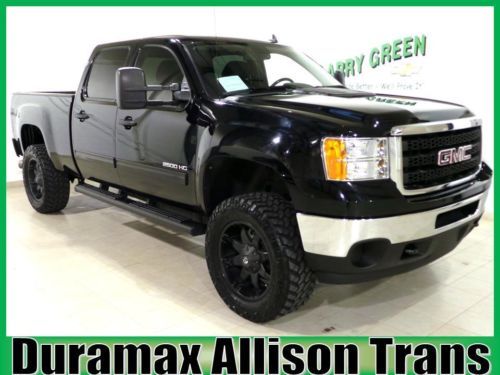

Duramax, Crew Cab , Lt , Leather on 2040-cars

Fremont, Nebraska, United States

Vehicle Title:Clear

Fuel Type:Diesel

Engine:8

For Sale By:Dealer

Transmission:Automatic

Year: 2006

Make: GMC

Model: Sierra 2500

Mileage: 99,359

Disability Equipped: No

Sub Model: SLT

Doors: 4

Exterior Color: Silver

Cab Type: Crew Cab

Interior Color: Gray

Drivetrain: Four Wheel Drive

GMC Sierra 2500 for Sale

White 1 owner crew cab duramax allison warranty financing leather new tires nice(US $36,900.00)

White 1 owner crew cab duramax allison warranty financing leather new tires nice(US $36,900.00) 2011 denali used 6l v8 16v automatic 4wd bose onstar

2011 denali used 6l v8 16v automatic 4wd bose onstar 04 gmc sierra k2500 slt crew cab short bed 6.0l 4x4(US $11,900.00)

04 gmc sierra k2500 slt crew cab short bed 6.0l 4x4(US $11,900.00) 1 owner crew cab warranty financing low miles new tires extras 6.0l bargain nice(US $25,900.00)

1 owner crew cab warranty financing low miles new tires extras 6.0l bargain nice(US $25,900.00) Duramax turbo diesel 6.6l v8 4x4 allison trans terra grappler tires air ride

Duramax turbo diesel 6.6l v8 4x4 allison trans terra grappler tires air ride 04 sierra 2500 slt 4wd crewcab loaded prolift v8 xnice(US $15,995.00)

04 sierra 2500 slt 4wd crewcab loaded prolift v8 xnice(US $15,995.00)

Auto Services in Nebraska

Russwood Auto Center ★★★★★

Kearney Motors & Classic Muscle ★★★★★

Heartland Auto & Truck Repair ★★★★★

Anderson Auto Body ★★★★★

A & B Motors ★★★★★

Vern`s Auto Tech ★★★★

Auto blog

2020 GMC Acadia refresh brings a new engine, AT4 trim level

Mon, Feb 18 2019It's mid-cycle refresh time for the GMC Acadia, and the updated 2020 model kicks off its changes with a new face. It has a square-jawed grille seemingly pulled straight off the Sierra full-size pickup, and the size is amplified by the slender new LED headlights on either side. At the rear, the LED taillights are taller and more chiseled. A new AT4 trim level adds more visual distinction with black trim and wheels, plus all-terrain tires to make it a little more capable off road. The AT4 also boasts standard all-wheel drive. Under the revised skin, the Acadia hides one of two carryover engines, or a new turbocharged 2.0-liter inline-4. This new engine makes 230 horsepower and 258 pound-feet of torque with the help of a twin-scroll turbocharger. To make it more frugal, it's able to deactivate two of its four cylinders. The turbo engine is standard issue on the SLT and Denali trim levels. The carryover engines include a naturally aspirated 2.5-liter 4-cylinder making 193 horsepower and 188 pound-feet of torque, and a naturally aspirated 3.6-liter V6 making 310 horsepower and 271 pound-feet of torque. The V6 is standard equipment on the AT4 trim. No matter the engine, all 2020 Acadias get a 9-speed automatic transmission. The new transmission also ditches the current Acadia's mechanical shift lever in favor of an electronic shifter with the Terrain's mix of buttons and triggers. It does free up space between the seats, but the button arrangement is still as strange as it was when we first saw it in the smaller crossover. There are a handful of other little upgrades to mention. The suspension has been revised for greater comfort; the infotainment has been revised with a bigger screen, USB-C inputs and customizable profiles; and wireless phone charging is now an option. The updated Acadia goes on sale this fall, and pricing will probably be announced close to launch.

2014 Chevy Silverado High Country spied wearing trappings of new luxury trim

Wed, 03 Apr 2013Spy photographers have spotted the new Chevrolet Silverado High Country and GMC Sierra Denali out on public streets for a little testing. From the looks of things, the Silverado will receive a much-differentiated front fascia along with special badges and those honking 20-inch chrome wheels. Expect to find a more posh interior as well. Likewise, the Sierra Denali will wear a tweaked nose with the familiar Denali bling. The one of the GMC trucks spotted here rolls on 21-inch gunmetal wheels instead of the 20-inch chrome pieces of the High Country.

Word has it both trucks will go on sale after the Texas State Fair this summer. While General Motors hasn't said for certain what we can expect to find under the hood, we'd be surprised to see anything outside of the range of engines found in the standard Silverado and Sierra models. That means buyers should be able to get their hands on the efficient, 23-miles per gallon 5.3-liter V8.

GM program sees dealers taking on way more loaner cars

Wed, Dec 17 2014Given the volume of vehicles we're talking about, this is a significant development for GM's bottom line. Bring your car into the dealership for service, and you may need a loaner car in exchange. And with so many recalls being carried out, that means a lot of loaners – especially at General Motors dealerships. That could be one of the reasons why GM is massively expanding its loaner fleet program. While many Chevrolet and Buick-GMC dealerships have an on-site rental car location operated by a third party like Enterprise (which may or may not provide a GM vehicle), others manage their own loaner fleets. But while the range of dealerships operating such fleets was once small, reports Automotive News, the number has been growing rapidly: from the locations responsible for only 20 percent of those brands' sales two years ago to about 90 percent today. The impetus for that growth comes down to a massive expansion of GM's Courtesy Transportation Program. The initiative encourages dealers to ramp up their loaner fleet to a maximum size determined by GM, with a mix determined by the dealer itself, so that a showroom in Texas can be bolstered with a fleet of pickup trucks and a dealer in California can employ more Volt and Camaro Convertible loaners. The dealership gets a $500 credit for each vehicle its puts in its fleet, and can use those vehicles as loaners for service customers, as multi-day test drivers or to rent out separately. The vehicles remain in the dealer's fleet for 90 days or 7,500 miles, then they can be sold as used, but with new-car incentives. The dealer gets a fleet of loaners, customers get to use the loaners, try out a new car overnight or buy a barely used car with attractive incentives, and GM gets to clock more sales. But therein lies the kicker: the automaker counts the dispatch of the loaner new vehicle to the dealership as a new-car sale, which could end up distorting its sales figures. Counting loaner vehicles as sold vehicles is something of an industry-standard practice, but given the volume of vehicles we're talking about, this is a significant development for GM's bottom line. One dealership - Paddock Chevrolet in Kenmore, NY, for example - had no loaner fleet two years ago, but now runs a fleet of 50 vehicles. Multiply that by the 4,000 or so dealers GM has across America and you're talking about the potential for hundreds of thousands of these sorts of sales.

2040Cars.com © 2012-2025. All Rights Reserved.

Designated trademarks and brands are the property of their respective owners.

Use of this Web site constitutes acceptance of the 2040Cars User Agreement and Privacy Policy.

0.052 s, 7841 u