1972 Gmc 2500 Custom Pickup Truck on 2040-cars

Lenexa, Kansas, United States

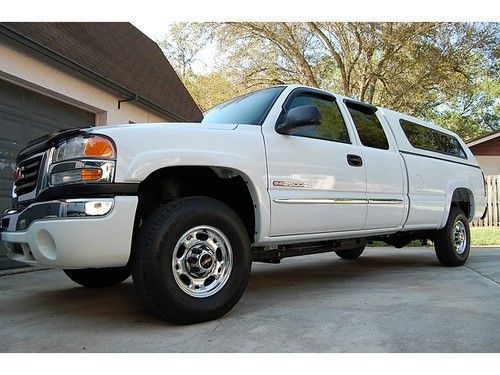

Body Type:Truck

Engine:402 big block

Vehicle Title:Clear

Fuel Type:Gasoline

For Sale By:Private Seller

Number of Cylinders: 8

Make: GMC

Model: Sierra 2500

Trim: Truck

Warranty: Vehicle does NOT have an existing warranty

Drive Type: Two wheel

Power Options: Air Conditioning

Mileage: 72,067

Exterior Color: White

Interior Color: Blue

GMC Sierra 2500 for Sale

Heavy duty! 4 doors! florida truck clean low miles 18,600! show room condition!

Heavy duty! 4 doors! florida truck clean low miles 18,600! show room condition! Crew cab duramax diesel slt 4x4 custom wheels tires leather auto tow low miles

Crew cab duramax diesel slt 4x4 custom wheels tires leather auto tow low miles 02 gmc sierra 2500 hd duramax diesel 4x4 auto crew short bed 2 owner co 80+ pics(US $10,995.00)

02 gmc sierra 2500 hd duramax diesel 4x4 auto crew short bed 2 owner co 80+ pics(US $10,995.00) Gmc 2000 dually 4x4 four door 89k miles 1 owner(US $14,999.00)

Gmc 2000 dually 4x4 four door 89k miles 1 owner(US $14,999.00) 2011 sierra 2500hd diesel 4x4 sle leather rear camera 1 texas owner(US $34,885.00)

2011 sierra 2500hd diesel 4x4 sle leather rear camera 1 texas owner(US $34,885.00) 2005 gmc service truck

2005 gmc service truck

Auto Services in Kansas

Shawnee Kawasaki Honda and Yamaha ★★★★★

S H A D Fleet Services Inc ★★★★★

Petersen`s Small Engine Repair ★★★★★

Parkway Service Center ★★★★★

Lowe Auto ★★★★★

Legacy Auto Center ★★★★★

Auto blog

GM recalls Chevy Express, GMC Savana over rollaway concern

Mon, 21 Jan 2013The National Highway Traffic Safety Administration has issued a recall notice for a small number of General Motors fullsize vans due to possible rollaway concerns. On certain 2013 Chevrolet Express and 2013 GMC Savana models, it is possible to remove the key from the ignition without the shifter being in park.

Only 980 total units are being affected by this recall, and GM is fixing the issue by replacing the ignition cylinder and associated keys. Affected Chevy vans were built during most of November and December while its GMC counterpart was only built for a week in November. The recall goes into effect on January 23, and to find out if your vehicle applies to the recall, the GM and NHTSA contact numbers can be found on the official recall notice, which is posted below.

Frustrated GM investors ask what more Mary Barra can do

Mon, Oct 22 2018DETROIT ó General Motors Co Chief Executive Mary Barra has transformed the No. 1 U.S. automaker in her almost five years in charge, but that is still not enough to satisfy investors. Ahead of third-quarter results due on Oct. 31, GM shares are trading about 6 percent below the $33 per share price at which they launched in 2010 in a post-bankruptcy initial public offering. The Detroit carmaker's stock is down 22 percent since Barra took over in January 2014. After hitting an all-time high of $46.48 on Oct. 24, 2017, the shares have declined 33 percent. In the same period, the Standard & Poor's 500 index has climbed 7.8 percent. Several shareholders contacted by Reuters said GM could face a third major action by activist shareholders in less than four years if the share price does not improve. "I've been expecting it," said John Levin, chairman of Levin Capital Strategies. "It just seems a tempting morsel to somebody." Levin's firm owns more than seven million GM shares. Barra has guided the company through the settlement of a federal criminal probe of a mishandled safety recall, sold off money-losing European operations, and returned $25 billion to shareholders through dividends and stock buybacks from 2012 through 2017. GM declined to comment for this story, but the company's executives privately express frustration with the market's reluctance to see it as anything more than a manufacturer tied mainly to auto market sales cycles. GM's profitable North American truck and SUV business and its money-making China operations are valued at just $14 billion, excluding the value of GM's stake in its $14.6 billion Cruise automated vehicle business and its cash reserves from its $44 billion market capitalization. The recent slump in the Chinese market, GM's largest, and plateauing U.S. demand are ratcheting up the pressure. GM is one of the few global automakers without a founding family or a government to serve as a bulwark against corporate raiders. In 2015, a group led by investor Harry Wilson pressed GM to launch a $5 billion share buyback, and commit to what is now an $18 billion ceiling on the level of cash the company would hold. In 2017, GM fended off a call by hedge fund manager David Einhorn to split its common stock shares into two classes. Einhorn, whose firm still owned more than 21 million shares at the end of June, declined to comment about GM's stock price. Other investors said there were no clear alternatives to Barra's approach.

Chevy Express 1500, GMC Savana 1500 get the axe

Tue, 15 Jul 2014Fans of truck-based, light-duty vans can officially pour one out for the Chevrolet Express 1500 and GMC Savana 1500, as General Motors has officially put its long-serving big/little rigs out to pasture. Things aren't quite as sad as they sound, though. The heavier-duty 2500 and 3500 vans will soldier on, in order to duke it out with the largest members of Ram ProMaster, Ford Transit and Mercedes-Benz Sprinter families.

The move does seem to make a lot of sense. According to GM, customers only purchase the 1500-spec Chevrolet 23 percent of the time, while the GMC captures a mere 7 percent of the Savana family's sales. With numbers like that, it's no shock that GM thinks it can shift some of its buyers into its van family's more capable variants. "We knew we could move a lot of our 1500 customers into 2500-series territory," said GM's Joe Langhauser, the product manager for the company's full-size vans.

It's not just simple sales figures dictating the move, though. The 1500 line is taking up some valuable factory space that will be better spent on an eagerly anticipated new product.