2016 Gmc Sierra 1500 K1500 Denali on 2040-cars

Lubbock, Texas, United States

Fuel Type:Gasoline

For Sale By:Private Seller

Vehicle Title:Clean

Engine:5.3L Gas V8

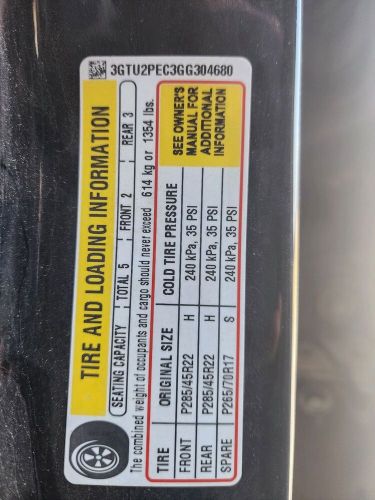

VIN (Vehicle Identification Number): 3GTU2PEC3GG304680

Mileage: 109000

Trim: K1500 DENALI

Number of Cylinders: 8

Make: GMC

Drive Type: 4WD

Model: Sierra 1500

Exterior Color: Black

GMC Sierra 1500 for Sale

1981 gmc sierra 1500(US $7,500.00)

1981 gmc sierra 1500(US $7,500.00) 1990 gmc sierra 1500 1500 restomod(US $39,995.00)

1990 gmc sierra 1500 1500 restomod(US $39,995.00) 2024 gmc sierra 1500 elevation(US $68,274.00)

2024 gmc sierra 1500 elevation(US $68,274.00) 2022 gmc sierra 1500 at4(US $60,900.00)

2022 gmc sierra 1500 at4(US $60,900.00) 2021 gmc sierra 1500 sle(US $33,563.00)

2021 gmc sierra 1500 sle(US $33,563.00) 2024 gmc sierra 1500 at4x(US $76,187.00)

2024 gmc sierra 1500 at4x(US $76,187.00)

Auto Services in Texas

Xtreme Customs Body and Paint ★★★★★

Woodard Paint & Body ★★★★★

Whitlock Auto Kare & Sale ★★★★★

Wesley Chitty Garage-Body Shop ★★★★★

Weathersbee Electric Co ★★★★★

Wayside Radiator Inc ★★★★★

Auto blog

GM to unveil new SUVs at the State Fair of Texas?

Wed, 07 Aug 2013With General Motors just having rolled out its new fullsize truck twins - the Chevrolet Silverado and GMC Sierra - for 2014, now it seems to be time to focus on its big SUVs. The Truth About Cars is reporting that the 2015 Chevy Tahoe/Suburban and 2015 GMC Yukon lineup will be making their debuts later next month at the State Fair of Texas, which kicks off on September 27.

To date, we've only seen spy shots of the new Chevy and GMC SUVs (shown above in Yukon XL guise). Based on those spies both trucks seem to be taking a different styling direction than their pickup truck counterparts - just check out the Ford-looking headlight design on the next-gen Chevys.

We reached out to GM for comment and heard back simply that there is no official announcement about the new Tahoe, Suburban and Yukon. Still, the report definitely makes a solid leap of logic, as Texas is a top market for GM's fullsize SUV lineup. It also appears that GM is still planning a separate launch for the next-gen Cadillac Escalade.

GMC Hummer EV revealed as a 1,000-hp, 350-mile, fast-charging beast

Wed, Oct 21 2020The 2022 GMC Hummer EV has finally been revealed, and it certainly looks the part. It has chunky, squared-off styling, big tires pushed to the edges, and a towering fascia. But itís not a case of form over function. On the contrary, the Hummer EV is has some pretty wicked technology and gear under the skin. The first version of the Hummer EV that will be available is the tricked-out Edition 1. It features three electric motors, which allows for torque vectoring. These motors make 1,000 horsepower, though GMC still hasn¬ít given real-world torque numbers. The motors are fed by a 24-module Ultium battery pack. The pack can provide an estimated 350 miles or more of range. Not only that, but it supports 800-volt fast charging up to 350 kW. That¬ís comparable to Porsche¬ís charging system, and GMC says it can add an extra 100 miles of range in just 10 minutes. Later, a two-motor Hummer EV and a three-motor version without torque vectoring. The Hummer EV rides on fully independent suspension with adaptive air shocks. They can provide continuous damping adjustments for comfort, and have a height adjustment range of 6 inches. When set in its max-height off-road mode, it has two additional inches of ground clearance, and the "Extract Mode" will lift it six inches higher than default. The Edition 1 model also comes with standard 35-inch mud terrain tires, and combined with the suspension, the Hummer EV has a fording depth of 2 feet and the capability to climb over an 18-inch vertical obstacle. Owners will be able to easily add more clearance since GMC made the wheel arches large enough to accommodate aftermarket 37-inch tires. Additional off-road goodies include skid plates along the chassis, rock sliders, the previously covered four-wheel steering with Crab Mode diagonal driving, and 18 camera views including angles under the truck for getting over rocks. Those cameras feature sprayers, too to keep them clean. Detailed information on torque output, torque vectoring, tire pressure, vehicle angles and more are also displayed on the infotainment screen. Speaking of that infotainment screen, it¬ís a massive 13.4 inches and is paired with a 12.3-inch instrument display. They feature proudly in a squared-off, rugged-looking interior. The Hummer EV will get the latest version of Super Cruise, complete with automatic lane-changing. The Edition 1 gets the removable roof panels as standard, and those roof panels are clear, so you can still get some sun with them in place.

Bronco, Yukon, Hummer and a CES recap | Autoblog Podcast #610

Fri, Jan 17 2020In this week's Autoblog Podcast, Editor-in-Chief Greg Migliore is joined by Consumer Editor Jeremy Korzeniewski and Assistant Editor Zac Palmer. They kick things off by talking about recent news, including the revival of the Hummer name as an electric pickup, revealing Ford Bronco spy shots and the unveiling of the 2021 GMC Yukon. Then Zac tells about his time in Las Vegas attending CES 2020. They talk about the cars they've been driving: a JCW-tuned Mini Clubman, the long-term Subaru Forester with its new gold wheels, a Volvo S60 PHEV that's been added to the long-term fleet, and a Camry Hybrid. Last, but not least, they help a listener decide how to spend his money on a sports car. Autoblog Podcast #610 Get The Podcast iTunes Ė Subscribe to the Autoblog Podcast in iTunes RSS ¬Ė Add the Autoblog Podcast feed to your RSS aggregator MP3 ¬Ė Download the MP3 directly Rundown Hummer returning as an electric GMC pickup The latest on the Ford Bronco 2021 GMC Yukon CES 2020 recap Cars we're driving:2020 John Cooper Works Mini Clubman 2020 Subaru Forester long-termer (now with gold wheels!) 2020 Volvo S60 T8 Inscription 2019 Toyota Camry Hybrid XLE Spend My Money Feedback Email ¬Ė Podcast@Autoblog.com Review the show on iTunes Related Video: This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings.