1972 Gmc Sierra Grande 1/2t Truck Factory - V8, Auto, A/c, Posi, Tilt Wheel on 2040-cars

Elk Creek, California, United States

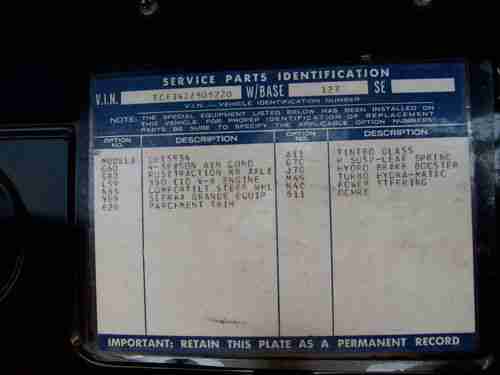

Engine:350

Vehicle Title:Clear

Fuel Type:Gasoline

For Sale By:Private Seller

Interior Color: Parchment

Model: Sierra 1500

Number of Cylinders: 8

Year: 1972

Trim: Sierra Grande

Warranty: Vehicle does NOT have an existing warranty

Drive Type: 2x

Power Options: Air Conditioning

Mileage: 99,999

Exterior Color: Ochra

GMC Sierra 1500 for Sale

Sle1 ethanol - ffv 5.3l full cab 4x4(US $25,999.00)

Sle1 ethanol - ffv 5.3l full cab 4x4(US $25,999.00) 2012 gmc sierra 1500 sle crew cab pickup 4-door 5.3l(US $33,900.00)

2012 gmc sierra 1500 sle crew cab pickup 4-door 5.3l(US $33,900.00) 2002 gmc sierra 1500 reg cab 119.0" wb tachometer

2002 gmc sierra 1500 reg cab 119.0" wb tachometer 2004 5.3l auto burgundy

2004 5.3l auto burgundy 4x4 alarm system anti-lock brakes driver airbag passenger airbag tachometer

4x4 alarm system anti-lock brakes driver airbag passenger airbag tachometer 2007 gmc sierra 1500 4wd crew cab 143.5 sle1

2007 gmc sierra 1500 4wd crew cab 143.5 sle1

Auto Services in California

Zube`s Import Auto Sales ★★★★★

Yosemite Machine ★★★★★

Woodland Smog ★★★★★

Woodland Motors Chevrolet Buick Cadillac GMC ★★★★★

Willy`s Auto Service ★★★★★

Western Brake & Tire ★★★★★

Auto blog

GM recalling 118K Colorado, Canyon pickups over missing hood latches

Thu, 20 Dec 2012General Motors has announced a recall of 118,800 Chevrolet Colorado and GMC Canyon pickup trucks due to the possibility of secondary hood latches not being installed at the time of manufacture. The affected vehicles are from the 2010, 2011 and 2012 model years, all of which were built between November 9, 2009 and August 28, 2012.

According to the official National Highway Traffic Safety Administration report, these trucks fail to "comply with the requirements of Federal Motor Vehicle Safety Standard No. 113, 'Hood Latch System.' The hood may be missing the secondary hood latch." In other words, owners of these trucks could find their vehicles' hoods opening unexpectedly while driving.

The official recall campaign is expected to begin on January 17, 2013. Dealers will inspect the affected pickups and if a secondary hood latch is not present, one will be installed free of charge. Scroll down to read the official NHTSA report.

GM's fullsize SUVs boost highway mileage by nearly 10 percent

Wed, 26 Feb 2014We met the redesigned 2015 versions of the Chevrolet Suburban and Tahoe, and the GMC Yukon and Yukon XL at the 2013 LA Auto Show. Improved gas mileage numbers have been announced to go along with the improved exteriors and interiors, with city mileage improving by seven percent and highway mileage going up by nearly ten percent; you'll now get 16 miles per gallon in the city and 23 on the highway.

The only applies to models with the 5.3-liter engine, though, not the premium Yukon Denali and Yukon XL Denali SUVs with the 6.2-liter motor. Still, the 5.3 gets you more power than previously, with 355 horsepower and 383 pound-feet of torque underfoot, on top of the improved fuel economy numbers. The 6.2-liter sticks with official mpg ratings of 15 highway, 21 city. There's a brief press release below with words straight from the horse's mouth.

GM to squeeze out more production capacity for midsize trucks

Tue, May 26 2015General Motors was predicting a strong showing for the Chevrolet Colorado and GMC Canyon before they debuted, and demand among dealers for the midsize trucks even exceeded company's expectations. The positive situation has left GM with a problem, though: finding ways to increase capacity for the pickups at the Wentzville Assembly plant in Missiouri. With a third shift already running, GM has continued to look for ways to build just a few more of the trucks at the plant. The company has plans to hire as many as 1,000 more workers for the Saturday and Sunday shifts to construct an additional 2,000 pickups a month, according to unnamed insiders at the factory speaking to Automotive News. The little adjustments even extend to getting rid of an unpaid break to add 18 minute of assembly time over the course of a day, which equals about 3,500 more vehicles a year. All of this effort comes because the trucks are in such high demand. According to GM's figures, the company has delivered a combined 35,720 units of the Colorado and Canyon from January through April 2015, and the Chevy was the fastest-selling truck in the US for the previous three months. In May, it spent an average of just 12 days in showrooms before being snapped up. And even better for the company, 43 percent of these buyers came from other brands. According to Automotive News, the most popular trade-ins have included the Ford F-150, Toyota Tacoma, and Dodge Dakota. Related Video: