2014 Gmc Terrain Sle on 2040-cars

Sandy, Utah, United States

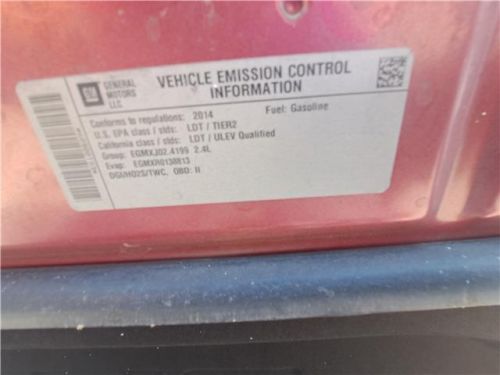

Engine:4 Cylinder Engine

Fuel Type:Gasoline

Body Type:Sport Utility

Transmission:Automatic

For Sale By:Dealer

VIN (Vehicle Identification Number): 2GKALMEK3E6100609

Mileage: 44679

Make: GMC

Trim: SLE

Drive Type: FWD

Horsepower Value: 182

Horsepower RPM: 6700

Net Torque Value: 172

Net Torque RPM: 4900

Style ID: 361543

Features: ENGINE, 2.4L DOHC 4-CYLINDER SIDI (SPARK IGNITI...

Power Options: Steering, power, variable electric assist

Exterior Color: Red

Interior Color: --

Warranty: Unspecified

Model: Terrain

GMC Terrain for Sale

2019 gmc terrain slt(US $21,500.00)

2019 gmc terrain slt(US $21,500.00) 2020 gmc terrain sle(US $21,300.00)

2020 gmc terrain sle(US $21,300.00) 2016 gmc terrain sle-2(US $11,600.00)

2016 gmc terrain sle-2(US $11,600.00) 2024 gmc terrain sle(US $26,920.00)

2024 gmc terrain sle(US $26,920.00) 2014 gmc terrain sle(US $9,756.00)

2014 gmc terrain sle(US $9,756.00) 2015 gmc terrain slt(US $15,399.00)

2015 gmc terrain slt(US $15,399.00)

Auto Services in Utah

Whitlock`s Collision Repair Center ★★★★★

Tunex of South Ogden ★★★★★

The Car Guys ★★★★★

Terrace Muffler & Auto Repair ★★★★★

Stevens Electric Motor Shop ★★★★★

Rocky Mountain Collision of West Valley City ★★★★★

Auto blog

Inevitable GMC Canyon Denali spotted testing

Mon, Feb 16 2015Practically every other model in the GMC lineup already offers a more luxurious Denali option, so why not extend that to the Canyon midsize pickup? It's hardly a surprise to see the brand doing just that, especially since the standard model seems to be proving quite a success. This Canyon was recently spied testing wearing camouflage over its front end. The truck still needs to breathe, though, and the opening in the obfuscation makes it quite easy to spot the Denali's chrome mesh grille, rather than the horizontal slats of the standard model. Also, just peeking out of the bottom part of the masking is the lower air intake, which appears to be completely lined in chrome now. At the sides and rear, the styling is identical to the current look of the pickup, at least for this prototype. While our spies didn't snap any shots of the interior, it seems safe to anticipate the usual Denali upgrades there, including better materials and additional tech features. Of course, expect a bump in price at the same time to pay for the improvements.

Mixed sales results, but automaker stocks rise on need for cars in Houston

Fri, Sep 1 2017DETROIT — The Big Three Detroit automakers on Friday reported better-than-expected August sales and issued optimistic outlooks for demand as residents of the Houston area replace flood-damaged cars and trucks after Hurricane Harvey, sending their stocks higher. General Motors, Ford and Fiat Chrysler posted mixed August U.S. sales, with GM up 7.5 percent and Ford and Fiat Chrysler down. Japanese automaker Toyota improved sales by nearly 7 percent, while Honda fell 2.4 percent. Still, analysts focused on the potential for Detroit automakers to cut inventories and stabilize used vehicle prices as residents of Houston, the fourth largest city in the United States, are forced to replace tens of thousands, perhaps hundreds of thousands, of vehicles after the devastation from Hurricane Harvey. Mark LaNeve, Ford's U.S. sales chief, told analysts on Friday that following Hurricane Katrina in 2005 "we saw a very dramatic snapback" in demand. That said, Ford sales fell 2.1 percent in August. It sold 209,897 vehicles in the United States, compared with 214,482 a year earlier. Sales were down 1.9 percent in the Ford division and off 5.8 percent at Lincoln. Demand was down for cars, crossovers and SUVs. It was not clear how many vehicles in the Houston area will be scrapped, LaNeve said, saying he had seen estimates ranging from 200,000 to 400,000 to 1 million. Ford's Houston dealers may have lost fewer than 5,000 vehicles in inventory, he said. Ford is the No. 1 automaker in the Houston market, with 18 percent share, according to IHS Markit. The company plans to ship used vehicles to Houston dealers and has "every indication we would have to add some production" of new vehicles to meet demand, LaNeve said. Investor concerns about inventories of unsold vehicles and falling used car prices have weighed on Detroit automakers' shares most of this year. Now, automakers can anticipate a jolt of demand from a big market that is a stronghold for Detroit brand trucks and SUVs. "It's got to be a positive for the industry," LaNeve said. Investors appeared to agree. GM shares rose as much as 3.3 percent to their highest since early March. Ford increased 2.8 percent at $11.34, and Fiat Chrysler's U.S.-traded shares were up 5.2 percent $15.91, hitting their highest in more than five years. GM reported a 7.5 percent increase in U.S. auto sales in August, helped by robust sales of crossovers across its four brands.

Best cars for snow and ice in 2023 and 2024

Tue, Jan 23 2024What's the best car for snow? The real answer is "the one with winter tires." What do we mean by that? You could have the finest, most advanced all-wheel-drive system or four-wheel drive in the world, but if you're running all-seasons (the spork of tires), your fancy four-wheeler won't matter much. The odds are, any vehicle on the road running good winter tires will probably perform adequately in slippery, slushy and/or snowy road conditions. (Here's a more complete explanation of why winter tires are totally worth it). In other words, you don't really need any of the cars on this list. With a set of winter tires, countless others will do the job, and even these will be at their best with proper rubber. You can find a variety of winter tires for your car here at Tire Rack. Keep in mind that you will need a full set of four snow tires for safety and performance, no matter what you're driving. The days of your dad putting just two snows on the family truckster to get it moving in a straight line are long gone. Don't get us wrong, getting a car that performs well in snow and ice is still a worthy criteria for car buyers. According to the U.S. Transportation Department, 70% of Americans live in places that get snow and ice. And much of the country has been blasted with arctic air for much of the new year. So let's look at the cars. First, we're highlighting choices for a variety of buyers and price points. Second, we're not just considering snow; we're considering general wintery conditions people will experience driving to work or school. As such, these are all choices with advanced all-wheel-drive systems, usually with "torque-vectoring" systems that not only automatically shunt power front and back, but side to side between the rear axles. Most have extra ground clearance for getting through deep snow, and we prefer those vehicles with more responsive steering, throttles and transmissions that provide a greater sense of vehicle control in slippery conditions.  Acura RDX Read our Acura RDX Review Acura's Super-Handling All-Wheel Drive system was one of the first to offer torque-vectoring, and besides often being touted for its ability to greatly enhanced dry-road handling, its benefits in the slick stuff can be profound. It's actually surprising that Acura hasn't leaned into this capability further by offering more rugged versions of its vehicles.